Maharashtra Sees Surge in Open Access Solar Installations

Solar open access installations rose 161% QoQ and 240% YoY

September 23, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

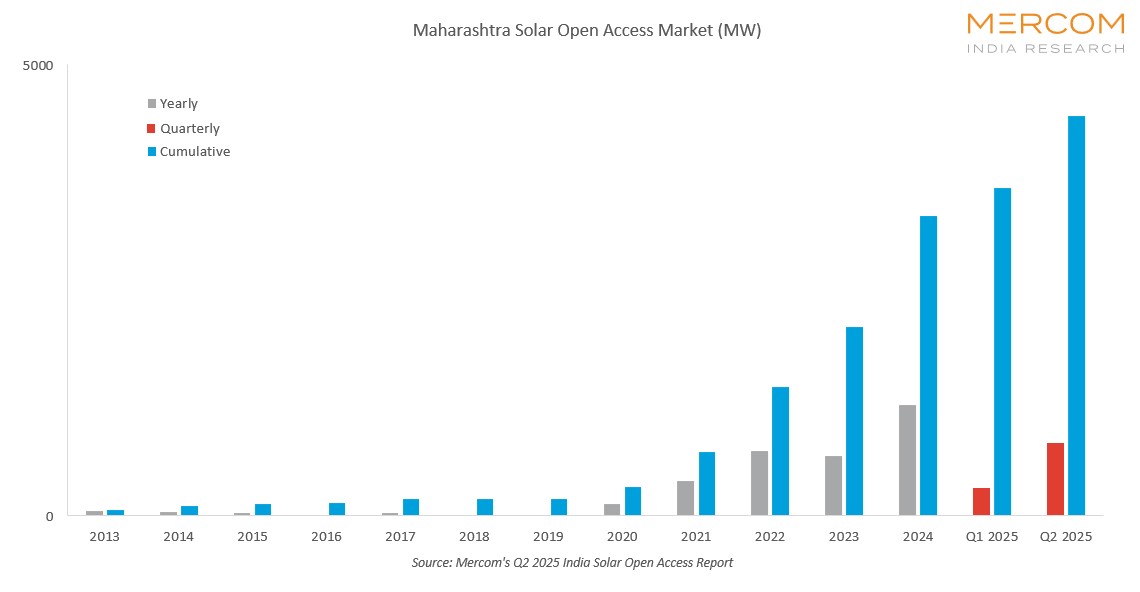

Maharashtra led solar open access installations in the second quarter (Q2) of 2025, accounting for 30% of the country’s capacity additions. Installations in the state rose 161% quarter-over-quarter (QoQ) and 240% year-over-year (YoY), with nearly 59% of the projects delivered by three major developers.

High grid tariffs drove several commercial and industrial consumers to opt for solar open access. The demand primarily came from consumers in sectors such as chemicals, fast-moving consumer goods, and textiles, which benefited from savings in electricity costs by switching to solar energy.

India added 2.6 GW of solar open access capacity in Q2 2025, up 143% from Q1 and 60.1% YoY, according to the Q2 2025 Mercom India Solar Open Access Market report. The surge was driven by developers rushing to secure the interstate transmission system charge waiver before the June 2025 deadline, with several projects commissioned partly to qualify.

Maharashtra also ranked second in cumulative solar open access installations, holding 18% of the country’s share. Open access represented 48% of the state’s cumulative large-scale solar capacity. Of the total capacity added, 94.3% came from standalone solar projects, while wind-solar hybrid and floating solar projects contributed to the remaining cumulative installations.

The Maharashtra Electricity Regulatory Commission amended the distributed open access regulations, allowing consumers with a contracted demand of at least 100 kW, either through single or aggregated connections within a single electricity area, to avail of Green Energy Open Access. Captive consumers benefit from full flexibility, while the revised time-of-day tariff structure encourages industries to align demand with solar generation hours.

Power purchase agreements (PPAs) are offered on long, medium, and short-term terms, providing consumers with flexibility in their procurement. While tariffs have declined from ₹13.21 (~$0.149)/kWh to ₹9.26 (~$0.105)/kWh for the commercial and from ₹8.36 (~$0.095)/kWh to ₹7.48 (~$0.085)/kWh for the industrial sector, they remain among the highest in the country. Open access charges and PPA tariffs increased this quarter; however, significant landed cost savings continue under captive and group captive models.

With timely distribution company approvals, rising corporate demand, falling operating costs, and strong sustainability commitments, Maharashtra’s open access solar market is expected to maintain momentum, supported by a large pipeline of projects.

Mercom’s solar open access tracker provides all vital project details for installed and pipeline captive, group captive, third-party, and projects under solar parks in the country.

For the complete report, visit: https://www.mercomindia.com/product/q2-2025-mercom-india-solar-open-access-market-report.