India Added 3.8 GW of Solar Open Access Capacity in 1H 2025

These additions were 4% less than those in 1H 2024

September 9, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

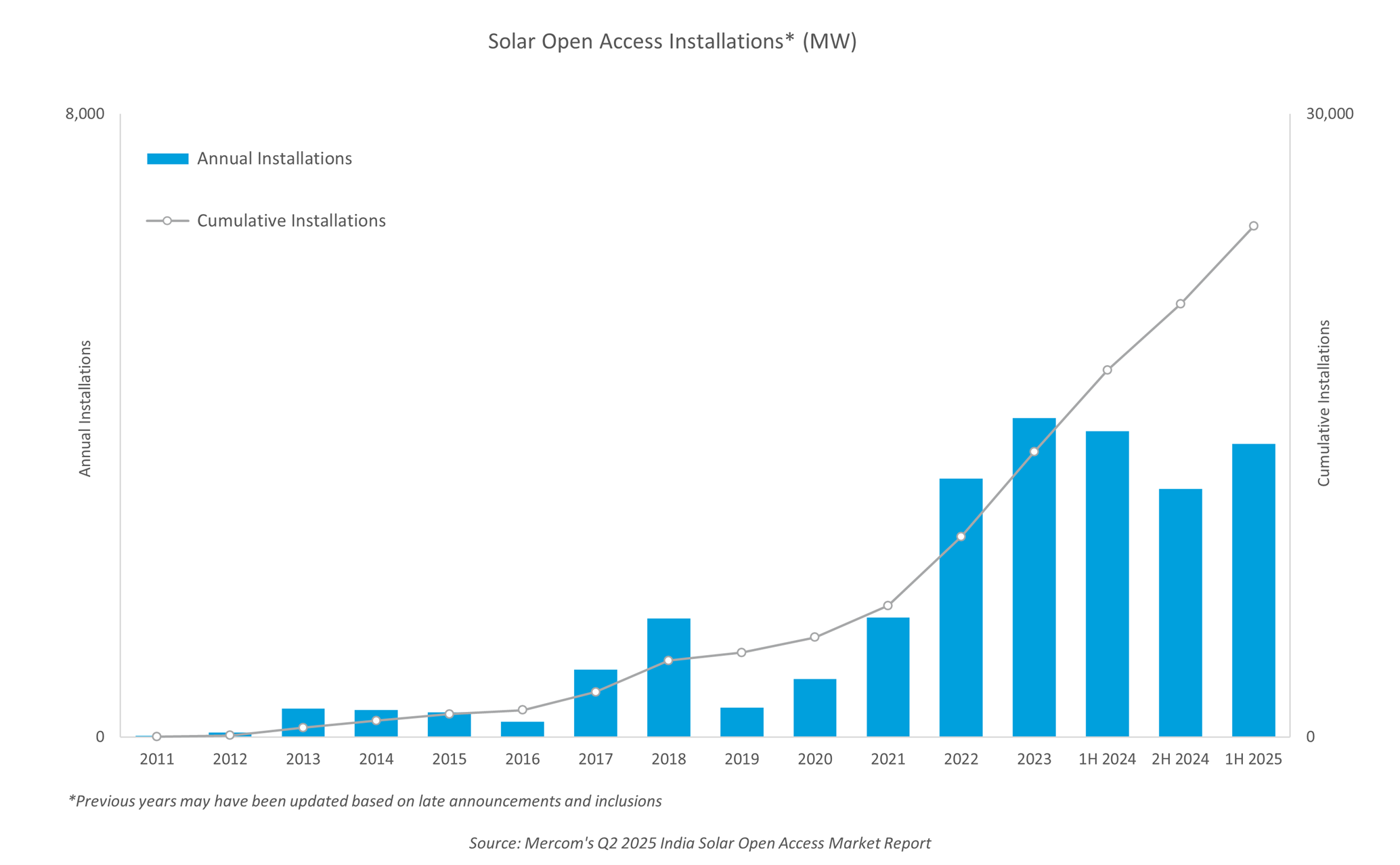

India added nearly 3.8 GW of solar open access capacity in the first half (1H) of 2025, an over 4% decrease from 3.9 GW installed in the same period of 2024, according to Mercom India’s Q2 2025 Solar Open Access Market Report.

Installations in 1H 2024 were higher as many open access developers expedited project commissioning before the reimposition of the Approved List of Models and Manufacturers. However, installations for 1H 2025 saw a slight dip, mainly due to delays in connectivity approvals and the limited availability of transmission infrastructure in Q1.

Priya Sanjay, Managing Director at Mercom India, stated, “The main challenge is not on the demand side. There is strong awareness and appetite for procuring green energy via open access, given its cost savings and profitability. Instead, the constraints lie in policy hurdles, evacuation infrastructure, and supply chain bottlenecks.”

Open access installations rebounded sharply in Q2 2025, with 2.7 GW of capacity added. This represented a quarter-over-quarter (QoQ) increase of more than 143% and a year-over-year rise of over 60%.

The growth was largely driven by developers rushing to commission projects before the expiry of the Interstate Transmission System (ISTS) charges waiver in June 2025. In several cases, developers opted for partial commissioning to secure eligibility under the waiver.

Battery storage remains viable primarily for addressing energy banking restrictions or meeting specific green energy mandates, such as those of 24/7-demand data centers.

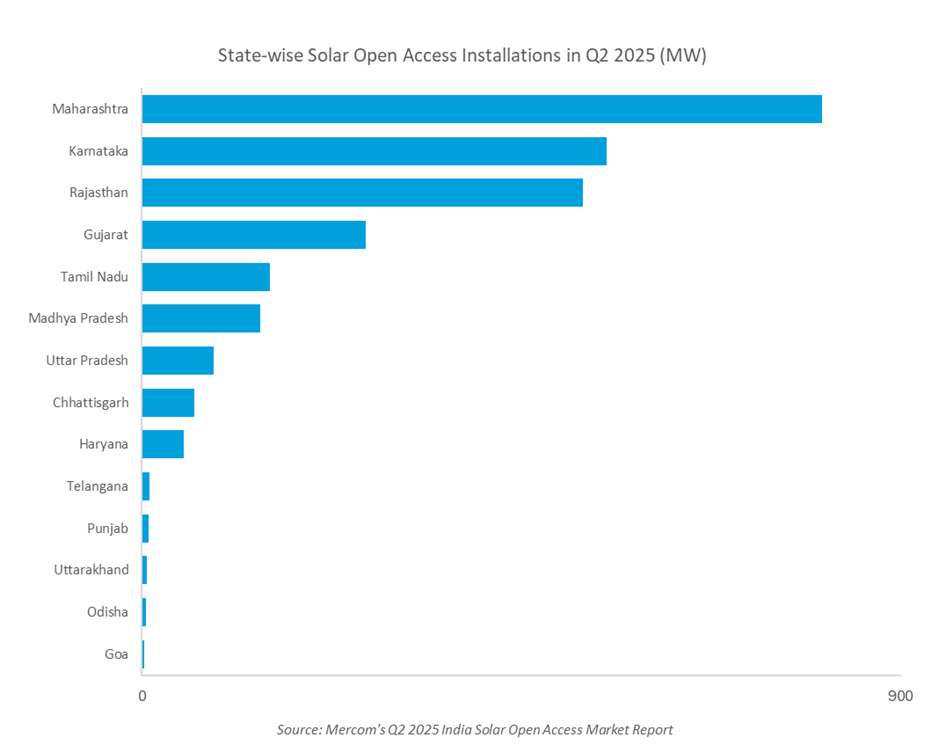

In Q2 2025, Maharashtra emerged as the leading state for solar open access capacity additions, contributing over 30% of the total installations. The top five states together accounted for more than 86% of all installations during the quarter.

Karnataka retained its position as the state with the highest cumulative solar open access capacity, accounting for approximately 24% of the total installed capacity as of June 2025. Maharashtra and Gujarat ranked second and third, contributing more than 18% and approximately 12%, respectively.

Sanjay also highlighted the influence of state-specific factors on project commissioning. “Much of it depends on the state. In Karnataka and Maharashtra, approvals are fairly streamlined, so we expect steady progress. However, in Rajasthan, curtailment remains a risk, which could affect developer confidence and tariff structures.”

The top five states together accounted for nearly 74% of the cumulative installations at the end of Q2 2025. Overall, as of June 2025, India’s cumulative installed solar open access capacity reached 24.6 GW.

The report also highlights that the pipeline of solar open access projects under development and in the pre-construction stage stood at more than 31 GW as of June 2025.

“The biggest issue is the lack of implementation uniformity across states. For instance, Karnataka may clear approvals in a month, while Tamil Nadu could take three to six months. Each state follows its own rules and timelines, creating uncertainty. A standardized and transparent approval framework would go a long way in supporting developers and investors,” said Sanjay.

Karnataka led the green day-ahead market (G-DAM) in Q1 2025, accounting for approximately 34% of electricity sold. On the procurement side, the Damodar Valley Corporation emerged as the largest buyer, accounting for almost 28% of electricity purchased through G-DAM.

Trading volumes of renewable energy certificates on the Indian Energy Exchange declined more than 22% QoQ in Q2 2025, while the green term-ahead market recorded a drop of around 25% in Q1 2025 over the previous quarter.

Looking ahead, growth in open access will continue to depend heavily on state policies. While the top five states currently account for a major share of the market, Sanjay pointed out that states such as Andhra Pradesh, Telangana, and Chhattisgarh could become significant contributors once favorable policies are implemented.

The Q2 2025 Solar Open Access Market Report by Mercom India is 70 pages long and covers vital information and data on the market.

For the complete report, visit: https://www.mercomindia.com/product/q2-2025-mercom-india-solar-open-access-market-report