Landed Costs of Solar Open Access Projects Rise on Higher PPA Tariffs

Five states saw no savings under the third-party solar open access model

September 17, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

The landed costs for third-party solar open access projects increased in 11 of 15 states for high-tension (HT) industrial consumers, primarily driven by higher power purchase agreement (PPA) tariffs, according to Mercom India’s Q2 2025 Solar Open Access Market Report.

In the second quarter (Q2) of calendar year (CY) 2025, India added approximately 2.7 GW of solar open access capacity. This represented a quarter-over-quarter (QoQ) increase of more than 143% and a year-over-year rise of over 60%.

The landed cost of solar open access projects for HT industrial consumers was calculated using the PPA prices, wheeling charges, cross-subsidy surcharge (CSS), and additional surcharges discovered in each state.

Out of the 15 states analyzed, 11 saw landed costs go up from the previous quarter due to higher PPA tariffs. Landed costs in Kerala and Tamil Nadu remained unchanged, while Gujarat and Punjab saw declines because of reduced open access charges.

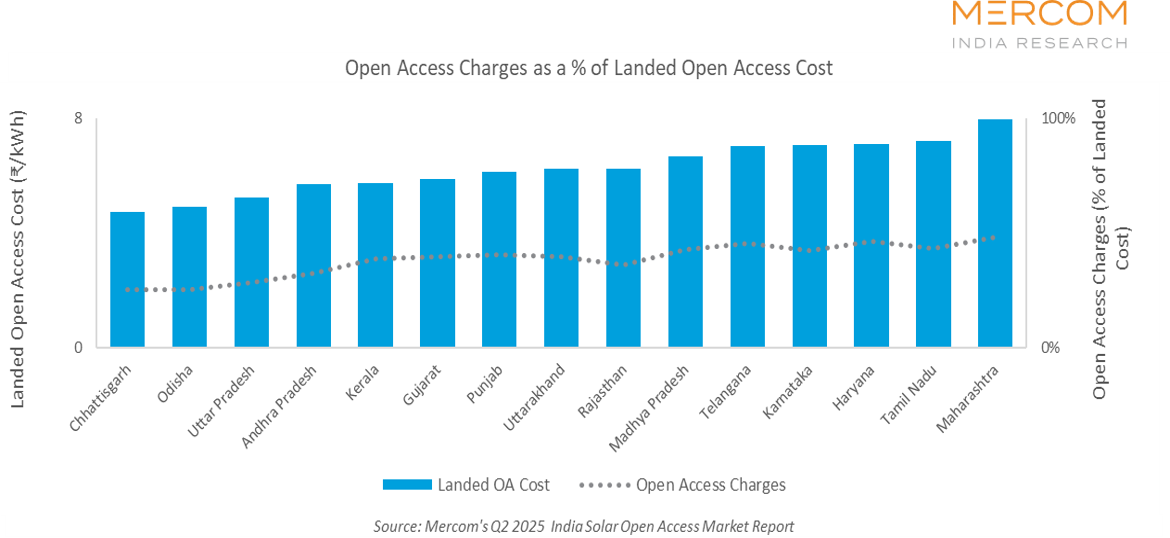

In Q2, the net landed open access cost across states ranged from ₹8 (~$0.091)/kWh to less than ₹5 (~$0.057)/kWh. Maharashtra reported the highest landed cost, followed by Tamil Nadu and Haryana, while the lowest was seen in Chhattisgarh, Odisha, and Uttar Pradesh.

Karnataka, Andhra Pradesh, Chhattisgarh, Uttarakhand, Haryana, Madhya Pradesh, Maharashtra, Rajasthan, Telangana, Uttar Pradesh, and Odisha witnessed a QoQ increase in landed solar open access costs. Together, these states accounted for over 84% of the country’s cumulative installed solar open access capacity as of June 2025.

Karnataka recorded the sharpest QoQ jump in open access costs, due to a 240% increase in cross-subsidy charges along with a rise in PPA tariffs.

In Gujarat, there was a decrease in the additional surcharge and cross-subsidy surcharge. Punjab also experienced a decrease in the additional surcharge, leading to a lower landed cost compared to the previous quarter.

In Andhra Pradesh, wheeling charges increased 660% leading to a QoQ increase in the landed cost by 13%.

Maharashtra and Tamil Nadu had the highest PPA tariffs, while Chhattisgarh accounted for the lowest tariffs.

During Q2, PPA tariffs increased across several states as nearly all solar open access projects were required to use modules included in the Approved List of Models and Manufacturers. These modules are typically more expensive due to limited availability, mandatory compliance with regulations, and higher manufacturing costs.

The share of open access charges declined in most states. The share of open access charges in the landed costs was the lowest in Chhattisgarh, Odisha, and Uttar Pradesh, and the highest in Haryana, Tamil Nadu, and Maharashtra.

Chhattisgarh saw the highest estimated savings under the third-party, captive, and group captive solar open access models, respectively.

The savings under the third-party model were lower than those of the captive and group captive projects due to exemptions from CSS and additional surcharges. State commissions can consider lowering these charges to encourage third-party open access models, given the potential for additional savings.

Recently, Punjab, Tamil Nadu, and Uttarakhand revised their additional surcharges. The additional surcharge decreased by around 81% in Tamil Nadu and 20% in Punjab, while it went up 2% from the previous quarter in Uttarakhand.

In the same quarter, the Karnataka Electricity Regulatory Commission (KERC) issued the Open Access Regulations, 2025, which align with the National Electricity Policy and are designed to simplify application norms and charges in order to encourage participation by all stakeholders, particularly commercial & industrial consumers.

These insights are from the Q2 2025 India Solar Open Access Market Report, which is 70 pages long and covers state-wise open access charges, electricity tariffs, power purchase agreement tariffs, installed and pipeline project capacities, and policy updates, along with other critical information and data on the market.