Top Five States for Solar Open Access in Q2 2025

Installations in the top five states accounted for a little over 86% of the total capacity

September 19, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

India added 2.6 GW of solar open access capacity in the second quarter (Q2) of 2025, a nearly 143% increase from 1.1 GW in Q1 2025. Installations rose 60.1% year-over-year (YoY) from over 1.7 GW, according to Q2 2025 Mercom India Solar Open Access Market report.

The rise in solar open access installations was due to developers moving swiftly to secure the waiver on the interstate transmission system (ISTS) charges before the June 2025 deadline. Several projects were partly commissioned to qualify for the benefit.

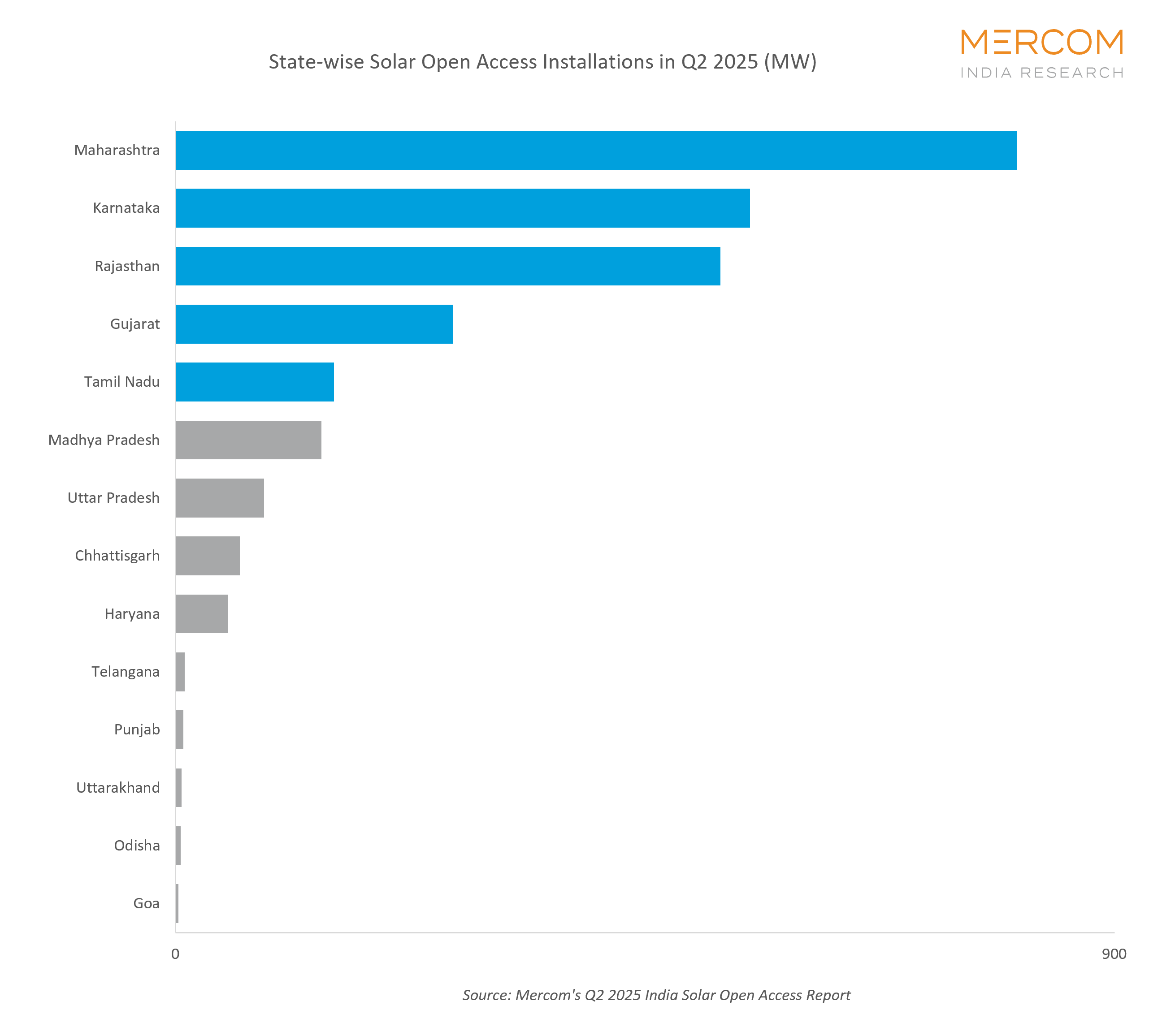

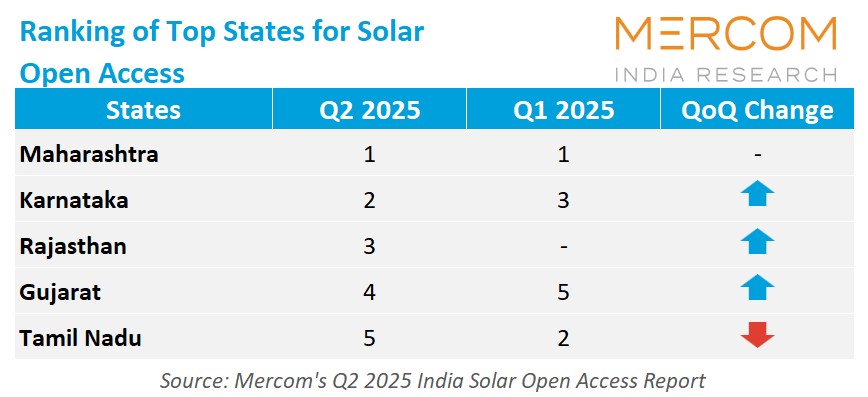

Maharashtra, Karnataka, Rajasthan, Gujarat, and Tamil Nadu led solar open access installations in Q2 2025, contributing to slightly over 86% of the total.

Maharashtra

Maharashtra led solar open access additions in Q2 2025, accounting for 30.3% of the total capacity. During the quarter, 48.1% of Maharashtra’s large-scale solar capacity was added through the open access model.

However, regulatory changes in the state for the financial year 2026 have dampened the appeal of open access. Commercial and industrial (C&I) tariffs have dropped while costs have increased. Cross-subsidy and wheeling charges rose 1.7% and 5.1% YoY, respectively. While revised time-of-day tariffs are favorable, tariffs during the evenings are up, spurring demand for behind-the-meter storage.

Karnataka

Karnataka added the second-highest solar open access capacity in Q2 2025. In the first half of the year, solar installations increased by 3.1% compared to the same period last year, accounting for 20.7% of the quarter’s total additions.

The state’s solar open access installations growth was driven by open access regulations that expanded eligibility and provided greater clarity for consumers. However, banking restrictions, lower C&I tariffs, and growing rooftop adoption are creating risks for developers and limiting demand for open access.

Rajasthan

In Q2 2025, Rajasthan ranked third in the country for solar open access capacity additions, contributing 19.6% of the total installations. During the quarter, 16.1% of the state’s large-scale solar installations were deployed under the open access model.

Rajasthan’s transmission capacity received a major boost in 2024 with the commissioning of key ISTS lines, enabling delayed open access projects to secure connectivity. Installations in the coming quarters are likely to grow, even if new approvals remain stalled until 2030. Storage-linked incentives have been introduced through mandatory BESS for projects above 5 MW.

Gujarat

In Q2 2025, Gujarat ranked fourth among the states for solar open access additions. During the quarter, 10.2% of the state’s large-scale solar capacity was deployed under the open access model.

In Gujarat, rising C&I tariffs and supportive renewable energy policies are driving interest in open access, with the state aiming to achieve 50% renewables in its power mix by 2030. Recent tariff adjustments, including higher wheeling charges but reduced transmission, cross-subsidy, and additional surcharges, along with a draft grid connectivity framework, are keeping open access financially viable and attractive for larger developers and investors.

Tamil Nadu

In Q2 2025, Tamil Nadu accounted for 5.7% of the total solar open access capacity additions, ranking fifth among states. Open access comprised 82.8% of the state’s large-scale solar additions.

Large-scale solar developers in Tamil Nadu continue to face hurdles, including a mandatory lock-in period for selling power to distribution companies. After this period, developers can transition to captive or third-party arrangements, but distribution companies often restrict such moves. Developers also complain of delays exceeding two years for payments. Despite repeated demands from industry groups to facilitate open access, approvals remain limited. The rising demand from data centers and the development of new solar parks are driving interest in both captive and open-access projects.

Mercom’s solar open access tracker provides all vital project details for installed and pipeline captive, group captive, third-party, and projects under solar parks in the country.

For the complete report, visit: https://www.mercomindia.com/product/q2-2025-mercom-india-solar-open-access-market-report.