Global Power Demand to Grow 3.6% Annually Through 2030: IEA

Renewables and nuclear power to hit 50% share

February 18, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Global electricity demand is entering a period of structural acceleration, with consumption projected to grow at an average annual rate of 3.6% between 2026 and 2030, according to the International Energy Agency’s (IEA) Electricity 2026 report.

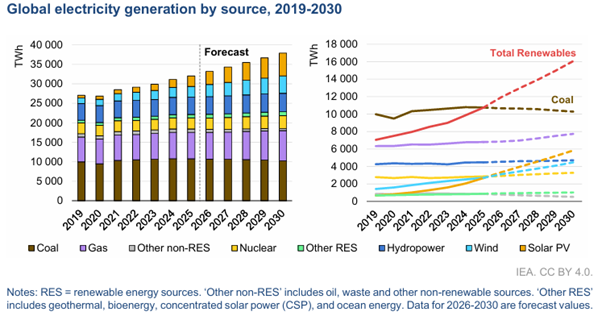

The report, Electricity 2026, states that rising electricity consumption will reshape global energy markets, with renewables and nuclear power together expected to generate 50% of global electricity by the end of the decade, up from 42% today.

Demand Growth Accelerates

Electricity demand is forecast to grow at least 2.5 times faster than overall energy demand through 2030, marking a structural shift toward electrification. In 2024, electricity demand outpaced global GDP growth for the first time in three decades outside crisis periods, highlighting the increasing role of electricity in economic activity.

Emerging and developing economies will account for about 80% of additional demand through 2030, while advanced economies are also seeing rising consumption after nearly 15 years of stagnation, contributing about one-fifth of total demand growth.

Demand growth is driven by industrial electrification, expanding electric vehicle adoption, rising air conditioning use, and increasing electricity consumption from data centers and artificial intelligence infrastructure.

Electricity’s share in total final energy consumption is projected to rise from 21% in 2025 to 24% by 2030.

In transport, electric vehicles will more than double their contribution to electricity demand growth compared to the previous five-year period. Buildings are also a major driver, with cooling needs contributing significantly, especially in emerging markets.

Renewables and Nuclear Expand Rapidly

Renewables are now overtaking coal as the largest source of electricity generation, having nearly drawn level with it in 2025. Solar capacity is expanding rapidly, adding more than 600 terawatt-hours of generation annually through 2030, making it the fastest-growing electricity source globally.

Solar is expected to overtake wind and nuclear by 2026 and hydropower by 2029 in annual electricity generation additions. Renewables surpassed one-third of total global electricity generation in 2025 and will continue to expand alongside nuclear power, which set a new generation record in 2025 and is projected to grow steadily through 2030.

Coal-fired electricity generation, however, is projected to decline globally, with its share falling from 34% in 2025 to 27% by 2030, although coal will remain the single largest source of power generation by the end of the decade.

Grid Investment and Bottlenecks

The report highlights that expansion and modernization of electricity grids will be essential to support rising demand and integrate variable renewable energy sources. Annual investment in electricity grids must increase by about 50% from the current level of approximately $400 billion to ensure reliability and accommodate new capacity.

More than 2,500 GW of generation, storage, and large-load projects, including data centers, are currently stalled in grid connection queues worldwide.

The IEA estimates that deploying grid-enhancing technologies and implementing regulatory reforms could unlock between 1,200 GW and 1,600 GW of these stalled projects in the near term.

Utility-scale battery storage installations have increased sharply, providing critical short-term system flexibility and supporting the integration of renewables. Major markets such as California, Germany, Texas, South Australia, and the United Kingdom have seen significant growth in utility-scale battery deployment.

Transmission investment plans are also expanding, including Spain’s €13.6 billion (~$16.14 billion) program to expand the transmission network and improve grid capacity and reliability.

China, India to Spur Demand

China will remain the largest contributor to global electricity demand growth, accounting for approximately 50% of the increase through 2030, with electricity consumption rising at an annual rate of about 4.9%.

Electricity demand in India is projected to grow even faster, at 6.4% annually, adding more than 570 terawatt-hours over five years, with cooling alone accounting for over 20% of this increase. Agriculture and industrial electrification are also major contributors in India.

In 2025, IEA had forecast that India’s electricity demand would grow at 6.3% annually over three years.

Electricity demand in the U.S. is projected to grow at around 2% annually through 2030, with data centers accounting for nearly half of this growth.

In Europe, demand is expected to grow at approximately 2% annually, but consumption is not expected to return to 2021 levels before 2028 due to structural efficiency improvements and economic factors.

Solar and natural gas will drive supply growth across the Americas, while coal use declines significantly in Europe and the Americas, partially offset by continued coal use in parts of Asia.

Industrial electricity consumption is increasing globally, especially in the light industry. Cooling demand in buildings is another major driver, with electricity demand from buildings accounting for more than 70% of growth in some markets in recent years.

Affordability a Concern

Despite increasing supply from renewables and nuclear, electricity affordability remains a concern. Household electricity prices in many countries have risen faster than incomes since 2019, placing pressure on consumers and industries.

Policymakers are focusing on regulatory reforms, market design improvements, and investment strategies to ensure system flexibility, affordability, and efficiency.

The report also identifies risks related to ageing infrastructure, extreme weather events, cyber threats, and physical disruptions to power systems. Modernizing grid operations, strengthening infrastructure security, and expanding system flexibility will be critical to maintaining reliability.

Overall, the global electricity systems are undergoing structural transformation, with renewables, nuclear power, electrification, and grid investment reshaping supply and demand patterns through 2030.

In November 2025, the World Energy Outlook 2025, published by the IEA, highlighted how new vulnerabilities in electricity systems and mineral supply chains now complement traditional risks associated with oil and gas.