Global Energy R&D Grows, but Venture Capital Slows: IEA

Investment in solar technology tripled from $140 billion in 2015 to $440 billion in 2025

February 19, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

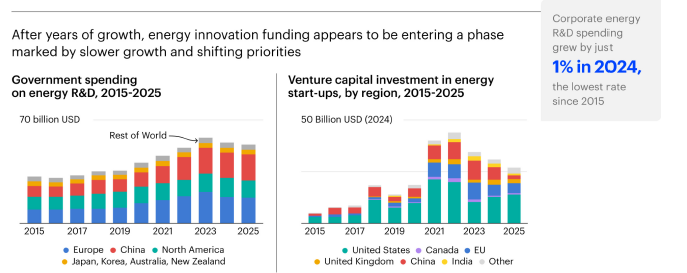

Energy innovation in 2026 is being shaped by competitiveness, energy security, and supply chain resilience. After several years of strong growth, innovation funding is entering a more uncertain phase, with venture capital (VC) declining but public and corporate R&D remaining stable, according to the International Energy Agency’s (IEA) report, ‘The State of Energy Innovation 2026.’

Energy now accounts for the bulk of global patenting activity, and more than 320 new energy start-ups raised first-time funding in 2025.

According to the report, China’s pursuit of innovation-led growth is evident in its funding, patenting, and technological innovations. They now account for 60% of corporate R&D for the energy supply and infrastructure sectors.

The U.S. continues to be a global leader in energy innovation, even as it resets its energy R&D priorities.

Unlike many other countries, U.S. energy innovation funding is balanced across public funding, corporate R&D, and venture capital.

In 2025, nearly half of the global venture capital invested in energy start-ups went to U.S.-based companies.

At the same time, overall venture capital funding for energy-related startups declined for the third consecutive year. Investment fell by 10% to ₹27 billion in 2025, marking the lowest level of activity since 2020.

Solar Technology

Solar has been the surprise of 2025. No other technology received as much support and investment in 2025 as solar.

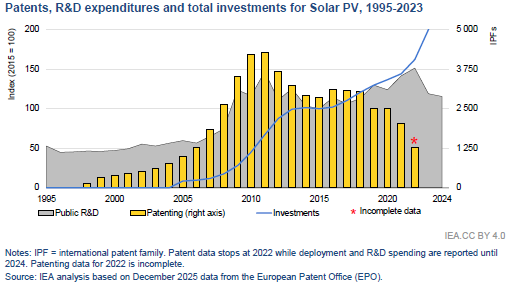

Solar has become a major source of power generation, with investment tripling from $140 billion in 2015 to $440 billion in 2025. This growth is driven by technological innovation and several decades of R&D.

The VC for solar accounted for 3% of total energy VC in 2025.

Changes in solar innovation after 2011 have been mostly in the patenting of solar cell technologies. Before solar was widely adopted, there was significant diversity of designs being patented in the hope of scaling them up for market returns.

Crystalline silicon now accounts for 98% of all solar PV modules sold worldwide.

The report states that since 2011, the race in solar innovation has tilted toward perovskites. Perovskites offer the potential for higher efficiencies while requiring less space than traditional crystalline silicon modules.

Energy Storage and Wind Technology

Korea has the most specializations in energy storage and electric mobility, though its patenting is lower than that of China and Japan, which together submitted nearly 35,000 storage-related patents from 2020 to 2023.

In terms of wind energy, the countries with the highest technological specialization are those that adopted wind energy earliest. Denmark had a 50% share of wind energy in its electricity mix by 2015 and is now around 60%.

Despite becoming a major wind turbine manufacturer recently, China had a relatively low share of 4% wind electricity in 2015, which has grown gradually.

Lithium-ion Batteries

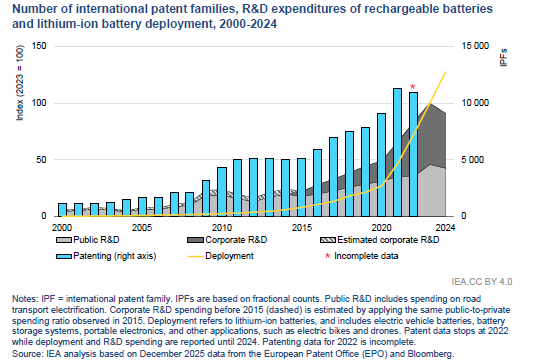

Lithium-ion batteries now dominate deployment in electric vehicles (EVs) and battery storage systems, while also leading in patenting activity. Patents related to lithium-ion batteries and designs have accounted for nearly 60% of all battery patents submitted annually since 2000, with an additional 40% linked to battery manufacturing, largely focused on lithium-ion production.

The rapid adoption of lithium iron phosphate (LFP) cathode chemistries since 2020 has boosted innovation, elevating it to second place among cathode chemistries in terms of patenting activity in 2022. LFP deployment has grown rapidly as well.

In 2024, LFP accounted for about half of EVs sold globally, largely driven by deployment in China, and over 90% of stationary storage installations.

China, Korea, and Japan remain the leading sources of lithium-ion battery patents.

Opportunities for Innovation in Manufacturing

According to the IEA, several emerging manufacturing technologies, including dry electrode coating, roll-to-roll perovskite production, solid-state batteries, and solid-state cooling, have reached the demonstration phase and could soon be commercialized.

Dry electrode coating is an emerging, not yet commercial, technology that eliminates solvents and the drying stage in battery cell manufacturing. It could reduce energy use in the coating step by up to 20% and lower total cell manufacturing costs by around 5%.

In wind power manufacturing, robots that automate layering, trimming, and finishing could significantly reduce labour requirements. Labour accounts for around 25% of the levelized cost of producing wind turbine blades in advanced economies. Automation of the finishing steps could reduce costs by up to 60%.

Technology Innovation for Grid Stability

Maintaining grid stability and power quality relies on components of power plants, such as turbines, which spin at 50 Hz or 60 Hz and provide inertia to the system, so that dips in frequency can be quickly stabilised.

In the coming years, the share of synchronous generators on many more grids is expected to decline as grids expand and inverter-based generators are more widely deployed.

However, for some grids shifting toward non-synchronous generators, such as wind, solar, and batteries, continuing to rely on synchronous generators is no longer the most cost-effective way to ensure stability.

High-Potential Technologies for Grid Stability

One-way HVDC point-to-point links are increasingly becoming common for efficient long-distance transmission. The next technology upgrade is multi-terminal systems, including offshore systems, and grid-forming voltage-sourced converters. They would allow multiple high-capacity connections in remote locations, such as offshore or onshore wind or ocean energy.

The report notes that historically, inverters that convert DC power from solar and batteries to AC were used in the grid, meaning they could not influence frequency as they fed electricity into it.

A technical upgrade enables them to set voltage magnitude and frequency, provide virtual inertia, and offer ‘black-start’ capabilities when connected to an available power source.

Unlike conventional transformers that rely on magnetic cores, solid-state transformers use semiconductor devices and advanced power electronics, enabling highly controllable operation.

Beyond simply stepping voltage up or down, they can perform functions similar to STATCOMs or grid-forming inverters and actively manage voltage fluctuations in the grid.

Their ability to manage both AC and DC power, along with bidirectional power flow, makes them well-suited for integrating large, dynamic loads such as fast-charging stations, hydrogen electrolysers, and data centres.

While patent activity, R&D investment, and upcoming projects continue to rise, financial volatility and shifting policy priorities are introducing greater uncertainty.

According to IEA’s recently published Electricity 2026 report, global electricity demand is entering a period of structural acceleration, with consumption projected to grow at an average annual rate of 3.6% between 2026 and 2030.