Data Shows Policy Clarity Plays Critical Role in Industrial Power Demand Expansion

Western and Southern regions lead the race in industrial demand and renewable energy uptake

February 19, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

India’s top states fostering open access power have emerged as the core engines of industrial electricity demand growth, driven by manufacturing clusters, rising captive generation, and accelerating adoption of renewable energy.

Data from successive Central Electricity Authority (CEA) reports over the past few years show that industrial electricity consumption and captive capacity have expanded in tandem, which mandates non-discriminatory open access to transmission and distribution networks.

Open Access Driving Industrial Clusters Growth

Commercial and Industrial (C&I) consumers remain the single largest category of electricity users in India, accounting for nearly 42% of total electricity consumption in recent years.

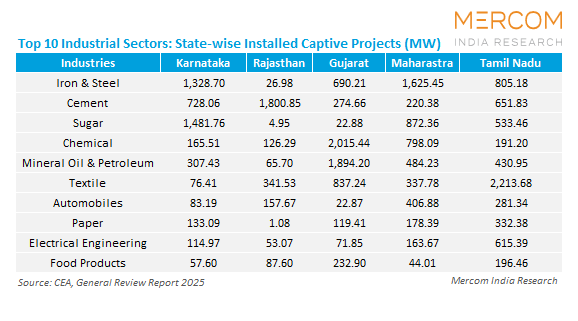

This dominance is most pronounced in open access power-friendly states such as Maharashtra, Gujarat, Tamil Nadu, Karnataka, and Rajasthan, which host large clusters of steel, cement, chemicals, refining, automobiles, textiles, electronics, and pharmaceuticals.

Between the financial years (FY) 2019–20 and FY 2023–24, total electricity consumption rose sharply alongside industrial output, with industrial demand remaining resilient even amid broader economic volatility.

Captive Power: Backbone of Industrial Energy Security

A defining feature of industrial cluster growth in open access power rich states has been the continued expansion of captive power capacity.

Over the past five years, captive installed capacity in industries with demand above 500 kW has steadily increased, reaching 80 GW by FY24, including nearly 9 GW from renewable energy sources.

Heavy industries such as metals, cement, and petrochemicals, and large manufacturing hubs, have relied on captive renewable energy generation to manage power costs and ensure grid reliability.

“Most consumers now prefer hybrid solutions to standalone solar, as they provide round-the-clock savings. Further, as the group captive mechanism is a proven concept, discussions are underway on BESS and even green hydrogen,” said Aditya Malpani, Senior Director and Regional Head, Business Development, at AMPIN Energy Transition.

This reflects a strategic shift by industrial clusters toward top states with favorable open-access regulations that allow direct procurement of renewable energy from third-party generators.

“Buyer preference is group captive open access. Group captive is the workhorse; full captive and third-party are situational. What buyers prioritize is largely a function of the surcharge regime and banking, as well as the ability to hold equity and invest. Group captive open access dominates incremental C&I volume because it blends surcharge advantages with scalable project sizes and professional developer execution. It also fits clusters that want renewable energy without building an in-house generation company,” noted Anil Bhat, Director – Business Development at Hexa Climate.

“Group captive open access is followed by full captive/CAPEX. Full captive is preferred by very large, credit-strong consumers (steel, large chemicals, pharma, hyperscale data centers) when they want maximum control over costs, dispatch, and compliance, and can manage development risk, asset performance, and approvals,” Bhat added.

Renewables Reshape Industrial Power Procurement

Renewable energy has become an integral part of industry clusters in states with supportive open access policies. Over the last decade, and especially in the past five years, renewable installed capacity (excluding large hydro) has expanded at a CAGR of over 15%, while renewable generation has grown at more than 13%.

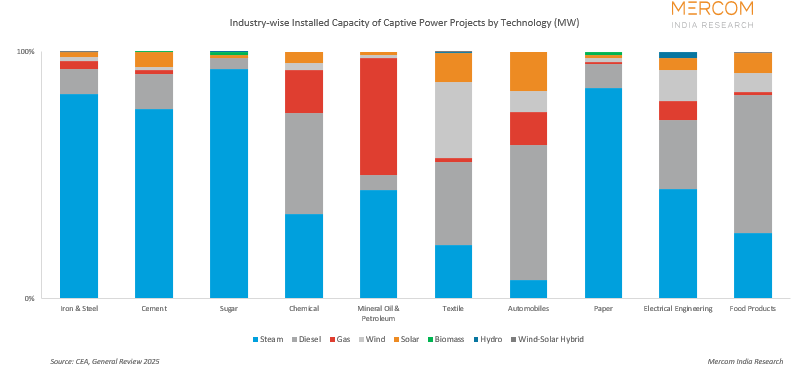

According to CEA data, while steam-based captive power continues to dominate, there is clear, accelerating integration of solar, wind, and hybrid capacities.

Commenting on the growth of the open access model with the rise of renewable capacity in the country, Bhat said renewable growth has pushed industrial open access from ‘single technology’ to ‘portfolio design.’

India added renewables at a record pace in 2025; solar reached ~132.9 GW and wind ~54 GW by November 2025.

Regional Concentration

The growth of industry clusters has been uneven across regions, closely linked to the consistency of open access policy implementation.

Maharashtra and Gujarat in western India, and Tamil Nadu and Karnataka in the South have recorded the strongest growth in industrial demand, captive capacity, and renewable energy uptake.

In the first nine months of 2025, India added 6.1 GW of solar open access capacity, a 13.4% YoY growth from 5.4 GW, according to Mercom India Research. Karnataka, Maharashtra, Rajasthan, Gujarat, and Tamil Nadu, the top five states, contributed 85% of the installations during the period.

“States with strong industrial bases and clear open-access frameworks have seen large volumes of solar and wind capacity tied directly to industrial offtake through open-access and captive arrangements. This has reduced industries’ exposure to grid tariffs and cross-subsidy surcharges, while also supporting national decarbonisation targets,” Bhat said.

In contrast, states with policy uncertainty and frequent changes in open-access charges have experienced slower growth in industrial power demand, despite comparable industrial potential.

“The Western and Southern regions are traditionally active markets for open access power, but many new states in the Eastern and Northern regions are also coming up as attractive investment destinations,” noted Malpani.

States with strong open access policies host energy-intensive sectors, including steel, cement, chemicals, automotive manufacturing, textiles, and refining, keeping industrial demand structurally high.

Overall, industrial clusters in these states are not only expanding but also increasingly adopting renewable and hybrid procurement models, reinforcing their position as the fastest-growing open-access markets in the country.

Industry-Led Demand to Grow

Industrial clusters in states with robust open access frameworks will continue to anchor India’s electricity demand growth. The expansion of green manufacturing and the growing use of storage-backed renewable power are likely to drive the growth of open access power markets.

Emphasizing the growing popularity of energy storage, Malpani stressed that storage will play a significant role, particularly in offsetting firm peak power requirements. Since most states have adopted Time-of-Day (ToD) tariff-based settlements, solar or wind cannot fully meet peak power demand. However, storage can supply firm peak power.

This growth will depend on a balanced approach that includes cross-subsidy surcharges, banking rules, grid integration, and investments in transmission and distribution infrastructure to support industry-led power procurement.

Falling solar and wind tariffs have pushed industrial clusters toward solar-plus-open-access and captive-renewable models. Top open-access states with stable banking and surcharge regulations have captured the bulk of this shift.