First Solar Plans New 3.7 GW Module Plant, Revenue Up in Q3

The company’s net profit rose 46% YoY

November 3, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

U.S.-based solar module manufacturer First Solar’s revenue rose 79.6% year-over-year (YoY) to $1.59 billion in the third quarter (Q3) of 2025 from $887.67 million.

First Solar attributed the rise in revenue to an increase in volume of modules sold to third parties and to more backlog deliveries fulfilled in Q3.

The company beat analysts’ revenue expectations by $23.84 million.

Net profit stood at $455.94 million, a 45.6% jump from $312.96 million in the same quarter of the previous year.

The earnings per share (EPS) came in at $4.24, compared to $2.91 in the same quarter a year ago, beating analysts’ expectations by $0.33.

9M Results

In the first nine months (9M) of 2025, revenue rose by 31% YoY to $3.54 billion from $2.69 billion.

Net profit jumped 12% from $898.93 million to $1.01 billion.

EPS came in at $9.37 compared to an EPS of $8.36 during the same period of last year.

Business Highlights

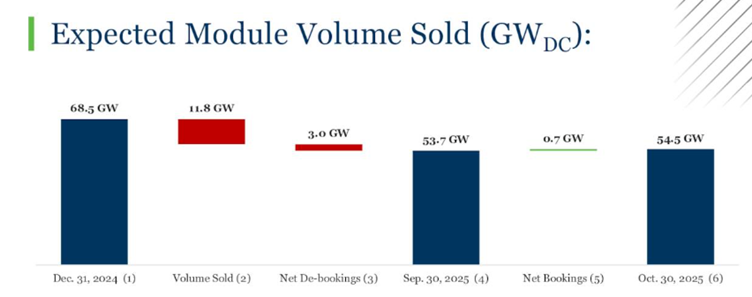

First Solar delivered 5.3 GW of modules in Q3 2025. Its expected contracted backlog stands at 54.5 GW through 2030.

The company manufactured 3.6 GW of modules in Q3 2025, with 2.5 GW coming from its U.S. facilities and 1.1 GW from its international facilities.

It sold 11.8 GW of modules during the quarter.

However, due to lower module demand in the quarter, production in Malaysia and Vietnam decreased.

During the earnings call, Mark Widmar, CEO and Director at First Solar, stated that the company is working to expand its domestic manufacturing capacity at its Louisiana facility.

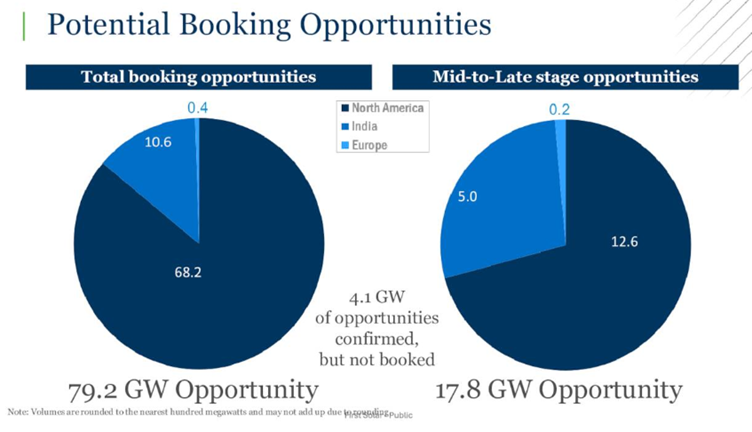

First Solar secured a 0.6 GW order for 2027 delivery at an ASP of $0.316/W. It stated that the ASP may increase, with a potential incremental rise of $ 0.046/W, contingent upon achieving specific milestones within its technology roadmap.

In Q3 2025, First Solar reported gross bookings of approximately 2.7 GW at a base of ASP of $0.309/W, including 0.4 GW of Series 7 modules, which were impacted by an ASP of $0.29/W.

It terminated 6.6 GW of bookings under multiyear agreements defaulted on by affiliates of BP, a European oil and gas major, at a base ASP of $0.294/W.

The company plans to commission its fifth module manufacturing facility in the U.S. with a planned capacity of 3.7 GW. The facility is expected to be commissioned by the end of 2026 and ramp up through the first half of 2027.

Widmar stated that the industry is awaiting the results of the administration’s investigation into polysilicon and derivatives, including the potential for incremental tariffs that could impact the crystalline silicon supply chain. “From a policy perspective, the industry also awaits guidance from the administration related to project impacts from foreign entity of concern procurement, which may be delayed as a result of the ongoing government shutdown.”

First Solar said that it continues to see mounting headwinds for U.S. developers associated with procurement dependent on the Chinese crystalline silicon supply chain.

It noted that while First Solar’s cells were included in India’s Approved List of Models and Manufacturers (ALMM). Wafers are also expected to be included in the ALMM. The company is confident that its wafers would qualify under the ALMM’s expanded scope.

Outlook

First Solar’s revenue guidance for 2025 has been increased from $4.9 billion-$5.7 billion to $4.95 billion-$5.2 billion.

The company said that the guidance has been adjusted to account for reduced international volumes sold due to customer terminations, partially offset by termination payments.

The guidance was also impacted by a 0.5 GW reduction in assumed domestic India sales following the mid-year redirection of Indian products from the U.S. market to the domestic book-and-bill market, driven by the high U.S. import tariff.

Additionally, sales of U.S.-manufactured modules are expected to decrease by 0.2 GW at the end of 2025 due to Q3 glass supply constraints at its Alabama facility. The decrease in module sales was partially offset by the expected increase in supply from First Solar’s Louisiana factory.

Widmar said that with respect to planned future module production, the market for these modules may be constrained by U.S., Indian, and European policies. He added that the situation in the U.S. has further exacerbated, with its traditional utility-scale customers experiencing transmission and permitting-related challenges.

He explained that the scenario for future module production in the U.S. is worsening, largely due to constraints outlined in the Department of the Interior’s memo on renewable project development, the ongoing government shutdown, and the impact of tariffs.

First Solar’s revenue reached $1.1 billion, an 8.6% YoY increase from $1.01 billion in Q2.