AI Surge, Funding Gaps, and Geopolitics Delay Net Zero to 2060: Report

Global Net Zero by 2050 Unlikely, G7 Nations Falling Behind Targets

November 3, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

The global energy transition is falling behind as the world drifts further from its climate goals, according to Wood Mackenzie’s Energy Transition Outlook 2025–26. It warned that net zero target achievements are unlikely before 2060.

Ten years after the Paris Agreement, no G7 nation is on track to meet its 2030 emission targets, and the world is now headed for 2.6°C of warming, up from last year’s 2.5°C projection.

The report attributes the slowdown to surging AI-driven power demand, geopolitical tensions, and chronic underinvestment. It cautions that with weak 2035 commitments and little accountability, fossil fuels remain dominant even as renewables have quadrupled over the past decade.

Achieving a 2°C pathway would require a 30% rise in annual global energy investment to about $4.3 trillion through 2060, roughly 2–4.5% of global gross domestic product (GDP).

In 2023, the International Energy Agency indicated that limiting global temperature rise to 1.5 °C above pre-industrial levels requires a rapid and profound transformation of the global energy system and significant mitigation actions in other sectors, such as land use and industry.

Slowing Progress, Rising Risks

Despite rapid growth in renewable capacity, from 5% to 20% of global power generation between 2015 and 2025, new low-carbon energy sources have largely met incremental demand rather than replacing hydrocarbons.

The report warns that governments are prioritizing affordability and energy security over emissions reduction as inflation, trade wars, and conflicts in Ukraine and Gaza reshape the global economy.

Policy reversals in major economies, including the withdrawal of U.S. and European banks from the Net Zero Banking Alliance, are slowing progress. The combined effect is a 0.1°C deterioration in the global base-case forecast from last year’s 2.5°C pathway.

Global Energy Future

Wood Mackenzie models four emission scenarios—delayed transition, base case (energy evolution), country pledges (energy resilience), and net zero (energy innovation).

Under the delayed transition, weak policies, trade fragmentation, and limited grid capacity keep fossil fuels dominant well into the 2030s, resulting in a 3.1°C warming outcome.

The base case, which the report considers most realistic, projects a continued rise in global energy demand driven by industrialization and population growth, with renewables expanding but failing to displace hydrocarbons at scale. This pathway results in 2.6°C warming.

The country pledges, based on the government meeting its existing targets, achieves a 2°C outcome by 2060 through accelerated clean investment, carbon pricing, and coal phase-outs.

Net zero (Energy Innovation) envisions a complete system rewiring through electrification, renewables, carbon capture, and hydrogen deployment, limiting warming to 1.5°C.

However, Wood Mackenzie underscores that this final pathway is “extraordinary in ambition and improbable under current policy conditions.”

AI Power Surge and Electricity Crisis

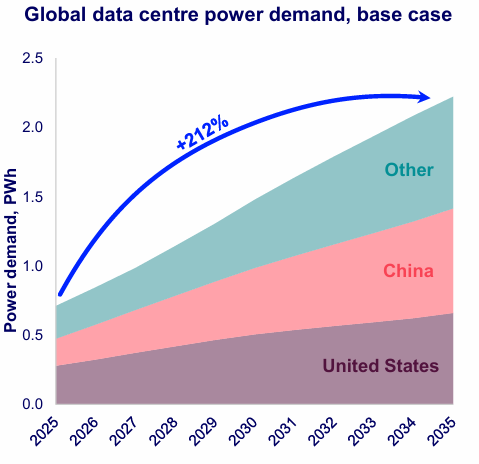

Artificial intelligence has emerged as both a disruptor and a potential savior of the energy system. The report identifies more than 250 GW of data center projects worldwide, over triple last year’s total, with 42 GW expected to be operational by 2027.

Global data center electricity consumption is projected to reach 700 TWh in 2025, already surpassing that of electric vehicles, and could exceed 3,500 TWh by 2050, equivalent to the current combined power demand of India and the Middle East.

This growth could trigger electricity shortages and price spikes as grids strain to accommodate new loads. Tech companies are increasingly turning into energy producers to supply their own operations.

Nuclear power, offering 24/7 zero-carbon generation, is regaining importance, with global capacity expected to double or even quadruple from 400 GW to between 800 GW and 1,600 GW by 2060.

The report notes that AI’s computational capabilities could also accelerate breakthroughs in materials science, energy optimization, and, potentially, the commercialization of fusion energy in the 2050s.

Renewables and Grid Constraints

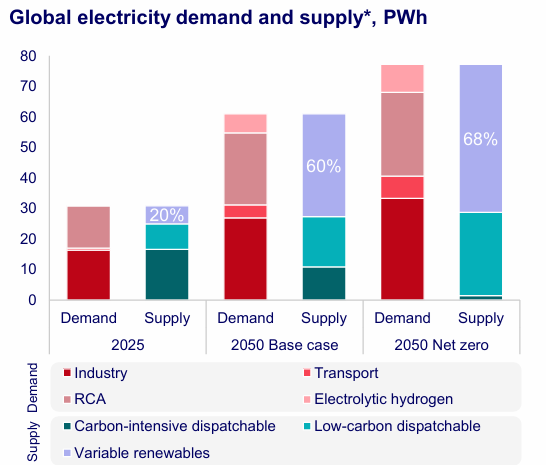

Electricity’s share of total energy use is projected to rise from 20% today to more than 50% by 2050 under net-zero scenarios, driven by widespread electrification, hydrogen production, and data demand.

Variable renewables, mainly solar and wind, will grow from 20% to 60% of global power generation by 2050, with solar output doubling by 2030 and overtaking coal by 2034.

However, Wood Mackenzie cautions that even under optimistic projections, renewables will reach a “practical ceiling” of 68% of generation due to grid and storage constraints.

Coal will continue powering developing economies, while gas-fired turbines provide balancing capacity in regions where grids cannot handle intermittent renewable loads.

By 2042, gas-fired power will reach its peak as renewables supply half of the world’s electricity. Total solar and wind capacity is expected to rise from 3.4 TW in 2025 to 12.6 TW by 2040.

Critical Minerals

The transition’s pace now hinges on critical minerals such as lithium, nickel, cobalt, copper, and rare earths. Clean technologies, including EV batteries, solar panels, and wind turbines, are heavily dependent on these inputs.

Demand for critical minerals is outpacing supply chain adaptation, creating new vulnerabilities. China dominates the refining of lithium and rare earth elements, the Democratic Republic of Congo controls most cobalt production, and Indonesia leads in nickel.

The report identifies rare earth elements as a strategic chokepoint: 50% are used in EV and wind turbine magnets, 16% in industrial catalysts.

In 2025, China accounts for 65% of global rare earth energy production, followed by Asia-Pacific (excluding China) at 20%, North America at 14%, and others at 7%. Supply concentration is amplifying geopolitical leverage, prompting importing nations to diversify offtake agreements, stockpile resources, and invest in local refining.

The report stresses that without expanded investment in mining and refining, mineral scarcity could erode the cost advantage of renewable technologies.

Fossil Fuels

Oil demand, previously forecast to peak in 2030, is now expected to reach its high point in 2032 at around 108 million barrels per day. Gas remains resilient through the 2040s, serving as a transition fuel, while coal continues to decline slowly but persists in developing markets. China’s oil demand, currently about 16 million barrels per day, is projected to fall by 35% by 2060 as electric vehicle adoption expands.

The report finds that structural inertia, capital costs, and energy security concerns make the decline in fossil fuels gradual and uneven. Many governments continue to rely on hydrocarbons for affordability and reliability, particularly where renewables deployment is limited by finance or grid capacity.

At the COP28 Summit in Dubai in 2023, world leaders settled on a weaker text that spoke of ‘transitioning away’ from fossil fuels rather than a more definitive ‘phase-out’.

Hydrogen and Carbon Capture

Hydrogen, carbon capture, and bioenergy technologies will contribute between 20% and 30% of total emissions reductions required for net zero, according to Wood Mackenzie. Currently announced capacities stand at 152 million tons per annum for hydrogen and two gigatons per annum for carbon capture, utilization, and storage (CCUS).

Small modular nuclear reactors (SMRs) have a combined global pipeline of 47 GW, of which 18 GW is intended for data center applications.

The report identifies three main barriers to these technologies: high capital costs, insufficient infrastructure, and inconsistent policy frameworks. Hydrogen is expected to play a critical role in decarbonizing heavy industry, shipping, and aviation, while CCUS remains vital for hard-to-abate sectors like cement, chemicals, and gas processing. Bioenergy, meanwhile, faces constraints on feedstock and sustainability.

Financial returns vary significantly: the report projects internal rates of return for 2035 at 15–25% for upstream oil and gas, 10–15% for renewables, 8–10% for hydrogen, and below 8% for CCUS.

Capital Flows and Investment Gaps

Cumulative investment needs to reach between $130 trillion and $175 trillion by 2060 to align with a 2°C scenario. Electrification, grids, EV charging networks, and clean infrastructure account for roughly half of this capital requirement. The report estimates that global energy investment intensity will rise to between 2% and 4.5% of GDP.

The report also highlights that a faster transition requires higher upfront expenditure, while delayed action increases long-term economic and climate risks. A slower transition reduces immediate costs but locks economies into carbon-intensive infrastructure, increasing exposure to fossil-fuel volatility and climate-related damage.

Conversely, a rapid transition compresses decades of investment into a short timeframe, straining capital markets and supply chains but avoiding future losses.

Renewables Outlook

The report notes that variable renewables such as solar and wind will account for about 60% of power supply by mid-century, rising to 68% under a net zero scenario. In contrast, carbon-intensive and dispatchable sources are expected to shrink significantly, with low-carbon options such as nuclear, hydro, and electrolytic hydrogen replacing them.

In 2025, total electricity demand is around 30 petawatt-hour (PWh), while supply is close to 35 PWh, with renewables accounting for roughly 20%. By 2050, supply nearly doubles, and the share of renewables surges, signaling a structural transformation in the global energy mix.

Overall, the analysis underscores a defining shift: solar generation is expected to double by 2030, overtaking gas by 2033 and coal by 2034. Dispatchable gas generation will likely peak in 2041, marking the point when variable renewables are projected to supply half of the world’s power.