Underbidding in Battery Energy Storage Auctions Raises Questions Over Project Viability

Only 50% of standalone BESS projects were found to be economically viable

January 30, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

In recent standalone battery energy storage system (BESS) auctions, several companies have won projects at tariffs below the levelized cost of storage (LCOS), signaling an increasingly aggressive bidding environment.

At such low tariffs, there is a fear that projects may become unviable.

Industry insiders say some bidders have secured projects by hedging against a future decline in BESS prices, betting that projects will become viable at lower tariffs over time. This trend of underbidding has become more pronounced, with tariffs in a free fall.

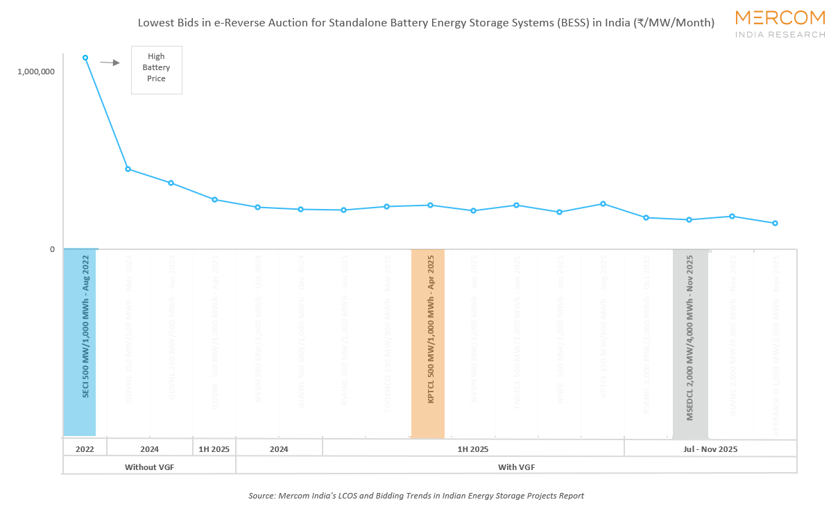

In 2025, the lowest tariff for standalone BESS projects declined to ₹148,000 (~$1,611)/MW/month, a 35% drop from ₹225,985 (~$2,460)/MW/month in the previous year.

According to Mercom India Research’s LCOS and Bidding Trends in Indian Energy Storage Projects report, only 50% of the standalone BESS projects evaluated in a recent industry survey demonstrated positive project economics and viability under modeled assumptions.

LCOS represents a BESS project’s lifetime costs relative to the total energy discharged over its operational life.

Why LCOS Matters

With aggressive underbidding shaping the BESS market, LCOS offers critical clarity for developers assessing project viability. Industry watchers note that such underbidding is typical of an early-stage market, a pattern previously observed in India’s solar sector a decade ago.

According to Anil Rajanna, CEO and Co-founder at Elektron RE, LCOS can help developers evaluate capital expenditures, operational expenditures, and the overall project life.

Unlike the now-mature solar market, the BESS sector remains highly volatile, making it difficult to assess project economics based solely on auction tariffs. While tariffs often reflect forward-looking assumptions and risk-taking, LCOS provides a more comprehensive and realistic assessment of project fundamentals.

It is worth noting that a significant number of recent BESS auction winners came from non-BESS or non–power-generation sectors, highlighting broader interest among companies seeking to diversify into energy storage.

Industry players attribute this rising interest to two key factors: relatively lower lithium battery and energy storage prices observed a quarter ago, and the fact that capital expenditure accounts for nearly 60–65% of a standalone BESS project’s total cost.

However, they caution that such aggressive bidding could distort project economics, particularly for companies entering the energy storage sector without prior experience.

Pramod MJ, Assistant General Manager (BESS) at a BESS solutions company, believes that while LCOS is a more accurate viability indicator for standalone BESS projects at the project level, investors continue to focus on metrics such as internal rate of return and net present value.

Why Underbidding?

Developers largely attribute the underbidding trend to the sharp decline in BESS prices witnessed last year.

Explaining the pricing trajectory, Pramod said battery prices remained stable till May 2025 before falling from around $60/kWh–$63/kWh to nearly $50/kWh, with some transactions reportedly as low as $53/kWh.

He added that developers took forward-looking bets, factoring in declining battery prices and the typical 18-month project execution window.

Ishan Nagpal, AVP (Regulatory, Bidding and Commercial) at Sunsure Energy, cited low entry barriers as another key reason for underbidding. “Recent BESS auctions allowed micro, small, and medium enterprises to participate without requiring bank guarantees.”

He warned that such tariffs could undermine the tendering process, adding that some projects may never reach execution.

Pramod also highlighted that the rental model adopted for standalone BESS projects offers limited scope for independent power producers (IPPs) to create value, which helps explain the absence of established BESS players among recent auction winners.

However, developers do not expect underbidding to continue indefinitely. They say BESS prices have begun trending upward, posing challenges for IPPs that secured projects at aggressively low tariffs. Some developers anticipate a waiting period for battery prices to stabilize, which could delay project execution timelines.

Explaining the recent reversal in battery price trends, Rajanna said that until last quarter, China had been subsidizing battery original equipment manufacturers through nearly 9% rebates for both domestic consumption and exports. The rebate has since been reduced to 6%, effective April 1, 2026, and is expected to be phased out entirely by January 2027.

He also pointed out that lithium prices have surged by over 100% in the last eight weeks, while supply-demand imbalances have further contributed to a bullish outlook for BESS prices.

Calls for Market Correction

Industry experts are urging tendering agencies to ensure that tariffs determined through auctions remain feasible and reflect underlying costs.

Nagpal called for stricter quality criteria in BESS tenders to ensure participation is limited to serious and capable players, warning that unchecked underbidding could jeopardize the sector’s long-term credibility.