LCOS and Bidding Trends in Indian Energy Storage Projects Report

Only 50% of standalone battery energy storage projects analyzed in the report showed positive project economics under the modeled assumptions, according to the LCOS and Bidding Trends in Indian Energy Storage Projects Report by Mercom India Research. These projects were auctioned between July and November 2025.

The report focuses on the cost of energy storage, where the market stands today, and how bidding trends compare with underlying project economics. It evaluates both standalone battery storage and solar-plus-storage projects using levelized cost of storage (LCOS) -based analysis.

Overall, the LCOS results indicate that cell costs, project scale, storage duration, cycling profile, and contract tenure are the dominant drivers of storage-delivered energy costs.

Current market trends indicate that battery storage has moved beyond a supporting role and is now a core component of India’s clean energy mix.

Between July and November 2025, storage tenders were issued for 24 GWh, while 25.6 GWh of projects were auctioned. This includes standalone battery energy systems and solar-plus-storage systems. This surge in tendering activity has led to greater price convergence, with tariffs stabilizing within the range of ₹150,000 (~$1,707)/MW/month to ₹185,000 (~$2,106)/MW/month under Viability Gap Funding (VGF) linked programs.

As of June 2025, cumulative installed battery storage capacity stood at 490 MWh, with solar-plus-storage projects accounting for the majority of deployments. The pipeline continues to expand rapidly, with nearly 74.8 GW of storage-linked capacity under various stages of tendering by mid-2025.

Key Highlights from Mercom India Research’s LCOS and Bidding Trends in Indian Energy Storage Projects Report:

- Between July and November 2025, 24 GWh of storage projects were tendered and 25.6 GWh auctioned

- Only half of the standalone battery energy storage projects analyzed showed positive project economics

- Cell prices, project size, and cycles determine the economic viability of standalone battery energy storage projects

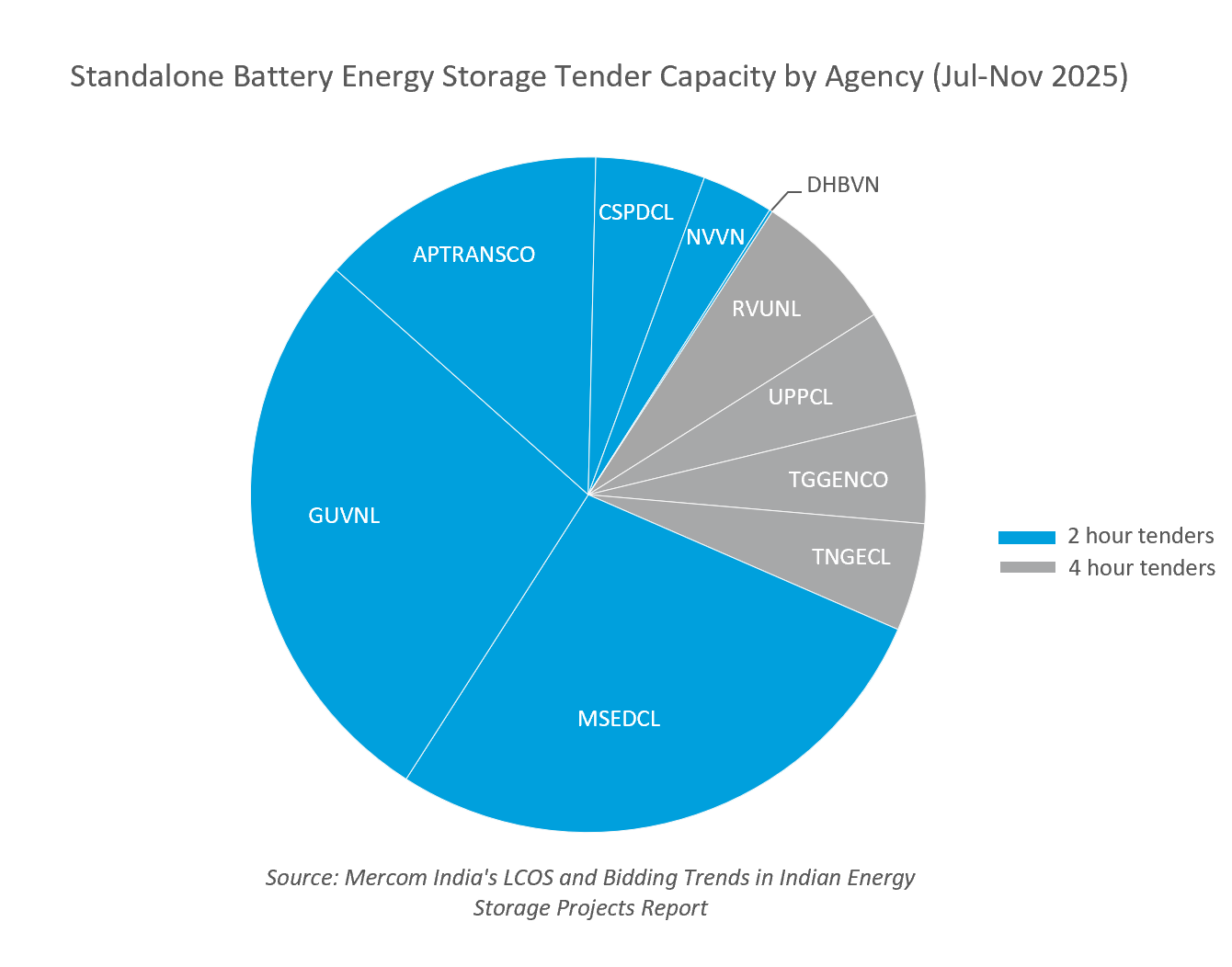

- 60% of tenders issued between July-November 2025 were for 2-hour storage, the remaining were for 4-hour storage.

- Actual LCOS outcomes varied across developers depending on project-specific requirements, cost structures

Contact Mercom for pricing: reports@mercomindia.com or call us at +91-080-41211148 or +91-080-23560436.

MERCOM INDIA RESEARCH

Mercom India Research is a leading research and consulting firm at the forefront of India’s clean energy transformation delivering timely, relevant market intelligence and advisory for India’s energy markets.

RELATED NEWS

CUSTOM RESEARCH & CONSULTING

Do you need more tailored research that cannot be answered by any of Mercom’s popular reports?

Our custom research services may be the answer.

We provide data and analysis to help companies understand information specific to their particular segment so they can make sound strategic decisions relating to new market entry, product introductions, or to simply help them understand how they or their customers are positioned within the market.

Mercom’s custom research and advisory services provide clients data and analysis tailored to meet their unique needs. Call us today to learn more: research@mercomindia.com