Suzlon Posts 538% YoY Profit Surge in Q2 FY26, Wind Turbine Sales Up 115%

The quarter recorded the highest deliveries of wind turbine generators of any Q2

November 5, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

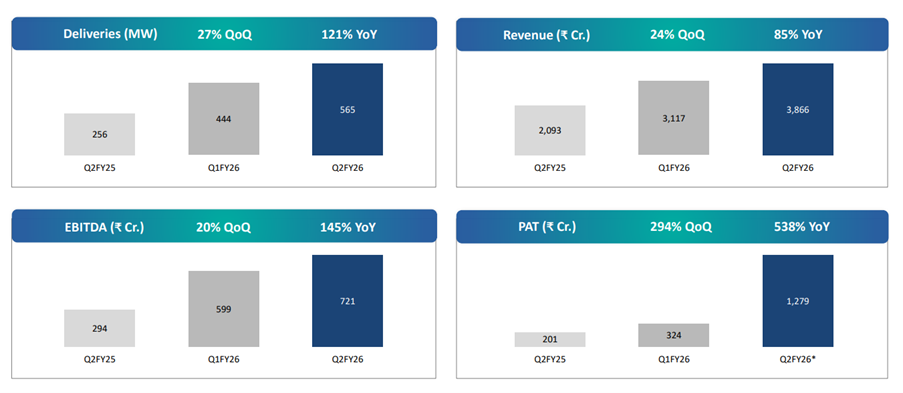

Wind turbine manufacturer Suzlon Energy recorded a 538% year-over-year (YoY) increase in profit after tax (PAT) of ₹12.79 billion (~$144 million) in the second quarter (Q2) of the financial year (FY) 2026, increasing from ₹2.01 billion (~$22.6 million).

The company has attributed the rise in profit to an increase in sales of wind turbine generators. It reported a 115% jump in sales of wind turbine generators valued at 32.41 billion (~$365 million) in Q2 FY26 from ₹15.07 billion (~$169.7 million) in the same quarter of the previous year.

Suzlon’s revenue during the quarter stood at ₹38.66 billion (~$435.5 million), an 85% jump from₹20.93 billion (~$235.7 million) in Q2 FY25.

The earnings before interest, taxes, depreciation, and amortization (EBITDA) also significantly increased to ₹7.21 billion (~$81 million) in Q2 FY 2026, a 145% YoY increase from ₹2.94 billion (~$33 million).

Suzlon’s earnings per share (EPS) came in at ₹0.93 (~$0.01), compared to ₹0.15(~$0.001) from the same quarter in the preceding year.

1H Results

In the first half (1H) of FY 2026, Suzlon reported revenue of ₹69.83 billion (~$786.7 million), representing a 70% year-over-year increase from ₹41.09 billion (~$462.9 million).

PAT stood at ₹16.04 billion (~$180.7 million) in 1H FY 2026, a 219% YoY increase from ₹5.03 billion (~$56.6 million).

The EBITDA also increased by 99% YoY to ₹13.2 billion (~$148.7 million) from ₹6.64 billion (~$74.8 million).

The earnings per share (EPS) increased to ₹1.17 (~$0.013) compared to ₹0.37 (~$0.004) in 1H FY25.

Business Highlights

In Q2 FY 2026, Suzlon delivered 565 MW of wind turbines, a 121% YoY increase from 256 MW. The company’s deliveries in the quarter were the highest ever in Q2.

The company delivered more than 1 GW of wind turbines in the first half of FY26, representing a 90% YoY increase from 530 MW.

The company has a domestic wind manufacturing capacity of 4.5 GW.

As of September 2025, it has over 15.4 GW of cumulative wind installations across India. It has also delivered more than 10,000 wind turbines and has assets under management amounting to $10 billion.

It also has more than 21 GW of wind energy capacity installed worldwide and claims to hold a cumulative 29% share in the global wind market.

The company had a record order book of 6.2 GW as of September 2025, comprising 51% of projects from the commercial and industrial sector, 14% from public sector undertakings, and 35% of projects in the bidding stage.

Outlook

Suzlon has identified potential for more than 23 GW of renewable installations, and development for more than 7 GW is underway.

It also has an execution pipeline of 1,865 MW of wind projects.

Recently, Suzlon Energy secured a wind turbine order with a capacity of 838 MW from Tata Power Renewable Energy. The project is part of Tata Power’s FDRE initiative and represents Suzlon’s second-largest order ever, following the 1,544 MW order from NTPC Green Energy.

In Q1 of FY 2026, Suzlon Energy recorded a net profit of ₹3.24 billion (~$37.01 million), increasing 7.3% YoY from ₹3.02 billion (~$34.5 million).