Solar Open Access Capacity Additions in India Slump 48% QoQ in Q1

Of the open access solar projects installed in Q1 2025, 67% were standalone solar and 32% wind-solar hybrid energy projects

June 4, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

India’s solar open access capacity additions dropped 47% year-over-year (YoY) to 1.1 GW in the first quarter (Q1) of 2025 from over 2 GW, according to Mercom India’s Q1 2025 Solar Open Access Market Report.

Solar open access capacity additions also dropped 48% quarter-over-quarter (QoQ) from 2.1 GW in Q4 2024.

According to Priya Sanjay, Managing Director of Mercom India, the numbers appear down, especially since the comparative quarters recorded high-capacity additions last year due to different reasons.

“In Q1 of last year, developers were importing modules and commissioning projects due to the suspension of the Approved List of Models and Manufacturers regulation until Q2. In Q4 of 2024, project developers had a window to import as open access projects applying for approvals before October 1, 2022, were exempted from buying domestic modules under the ALMM,” said Sanjay.

However, due to the year-end commissioning rush driven by the close of the financial year, there was a shortage of domestic modules, resulting in a slowdown in installation activity. The lack of transmission infrastructure, combined with delays in the connectivity approval process and uncertainty surrounding the inter-state transmission system waiver, slowed the commissioning of solar open access projects during Q1 2025.

Solar open access projects accounted for 19.8% of the total large-scale solar installations during the quarter.

Of the open access projects installed in Q1 2025, 67.4% were standalone solar, 32% wind-solar hybrid energy projects, and 0.6% floating solar.

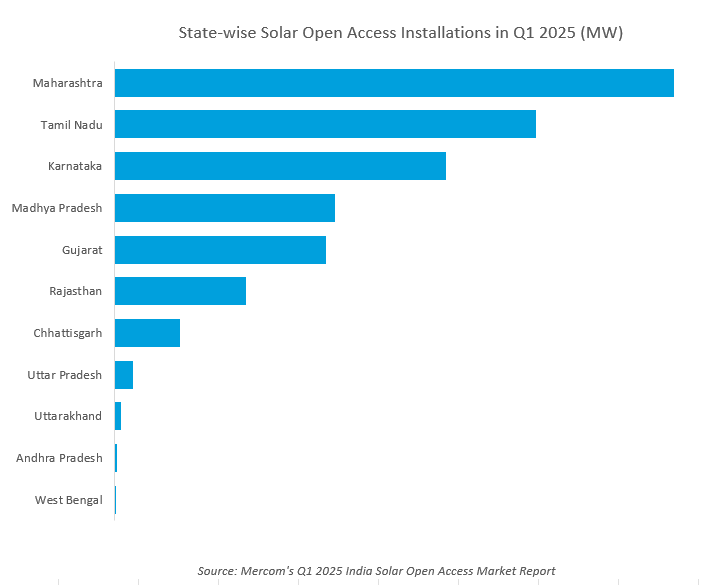

Maharashtra led solar open access capacity additions, accounting for nearly 29% of installations.

The top five states accounted for over 89% of installations during the quarter.

“Maharashtra has the maximum number of C&I units in the country, and it has the highest electricity tariffs. The high DISCOM tariffs create a conducive environment for solar open access in the state. The market has picked up due to clarity on policies surrounding open access in the state,” she said.

As of March 2025, India’s cumulative installed solar open access capacity was 21.5 GW.

Karnataka remained the leading state in cumulative installations, accounting for approximately 24% of solar open access capacity at the end of Q1 2025. Maharashtra and Tamil Nadu ranked second and third, contributing almost 17% and over 12% of cumulative installations, respectively.

The pipeline of solar open access projects under development and in the pre-construction phase was over 31 GW at the end of March 2025. The top five states collectively contributed nearly 87% of pipeline projects.

“Lack of synergy between state and central policy, evacuation infrastructure, availability of land, and shortage of substations continues to be a problem. There are supply chain issues across all solar power projects. However, open access projects have the advantage of relatively higher power purchase tariffs that can accommodate the high module costs,” Sanjay said.

The cleared volume of renewable energy certificates traded on the Indian Energy Exchange rose 155% QoQ in Q1 2025.

In Q4 2024, Adani Green was the leading seller in the green day-ahead market (G-DAM), accounting for over 41% of the electricity sold.

Maharashtra was the leading procurer from G-DAM, accounting for 17% of the electricity purchased through Q4 2024.

The volume traded in the green term ahead market on IEX increased by approximately 72% QoQ in Q4 2024.

The Q1 2025 Solar Open Access Market Report offers a comprehensive analysis of the solar open access market, including retail electricity tariffs, power purchase agreement prices, and open access charges and costs for fifteen states.

The Q1 2025 Solar Open Access Market Report by Mercom India is 69 pages long and covers vital information and data on the market. For the complete report, visit: https://www.mercomindia.com/product/q1-2025-mercom-india-solar-open-access-market-report