Renewables on the Verge of Overtaking Coal Globally As Demand Surges: IEA

Wind and solar are projected to generate 5,000 TWh in 2025 and approach 6,000 TWh by 2026

August 7, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

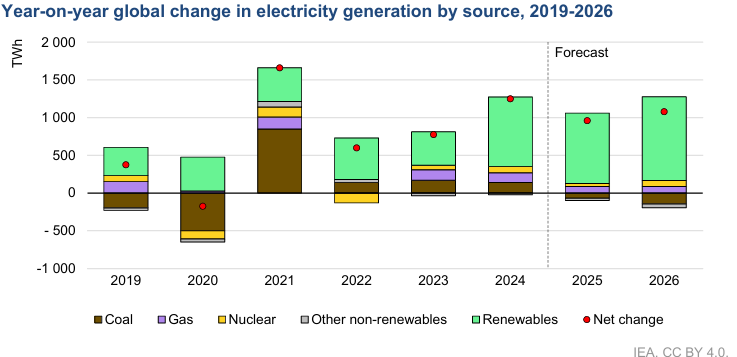

Renewable energy is set to achieve a historic milestone by overtaking coal-fired generation either in 2025 or by 2026 at the latest, according to the International Energy Agency’s (IEA) Electricity Mid-Year Update 2025.

Solar and wind power are leading this transformation, together expected to meet over 90% of the net increase in global electricity demand in 2025.

Combined output from these two technologies exceeded 4,000 TWh in 2024, is projected to surpass 5,000 TWh in 2025 and approach 6,000 TWh by 2026. Their share of total electricity generation is expected to rise from 15% in 2024 to 17% in 2025 and almost 20% in 2026, compared with just 4% a decade earlier.

Hydropower, which remains the largest single renewable source with a global share of 14 %, will likely remain stable in 2025 before growing by more than 2% in 2026, assuming normal rainfall patterns.

Coal-fired generation, after expanding by 1.3 % in 2024, is expected to decline slightly in 2025 as growth in India, the U.S., and parts of Asia is outweighed by reductions in China and Europe. The global decline will accelerate in 2026 to about 1.3 % as renewable capacity growth continues and coal-to-gas switching increases.

Gas-fired generation is expected to increase by 1.3% in 2025, driven by Middle Eastern oil-to-gas transitions and continued growth in Asia, before rising by the same rate in 2026.

Nuclear generation is on track to reach a record high in 2025 due to new reactor startups in China, India, Korea, and other countries, plant restarts in Japan, and sustained strong output from the U.S. and France. Nuclear output is projected to grow by about 2 % annually, reaching close to 3,000 TWh in 2026.

Electricity Demand

The IEA forecasts global electricity consumption to increase by 3.3% in 2025 and 3.7% in 2026, moderating from the exceptionally high 4.4% recorded in 2024 but still among the fastest rates seen in the past decade.

This expansion is occurring despite downgraded global GDP growth expectations, with demand driven by rising industrial activity, continued electrification of transport and heating, the expansion of air conditioning in response to recurring heatwaves, and the rapid growth of electricity-intensive data centers. By 2026, electricity demand will grow more than twice as fast as total energy demand, pushing global consumption above 29,000 TWh.

China remains the single largest driver of global electricity growth. After surging by 7% in 2024, demand in China is expected to rise by 5% in 2025, a slowdown linked to weaker industrial development and the impact of tariffs on exports. Nevertheless, the country will account for around half of the world’s total increase in electricity use this year. The growth rate is projected to accelerate to 5.7 % in 2026 as industrial activity recovers.

India follows a similar pattern, with demand growth slowing to 4% in 2025 from 6% the previous year due to a cooler summer and subdued industrial activity, before rebounding to 6.6% in 2026.

In the U.S., electricity consumption is projected to expand by 2.3% in 2025 and 2.2% in 2026, supported by new high-tech manufacturing facilities, continued electrification, and the rapid scaling of data center capacity, which consumed around 180 TWh in 2024 and is projected to rise sharply in the coming years.

The EU is still in a phase of gradual recovery, with demand expected to grow by 1.1% in 2025 and 1.5% in 2026, following a rebound of 1.6% in 2024 after two years of contraction.

Global investments in the energy sector are set to reach a record $3.3 trillion in 2025, a 2% increase from 2024. Approximately $2.2 trillion is being invested collectively in renewables, nuclear energy, grids, storage, low-emission fuels, efficiency, and electrification. This investment is twice the $1.1 trillion allocated to oil, natural gas, and coal.

Prices and Electricity System Security

Electricity prices have shown sharply diverging regional trends in 2025. Wholesale prices in the European Union and the U.S. rose by between 30 and 40 % in the first half of the year due to higher natural gas prices, lower wind and hydropower output, and increased reliance on fossil-fired generation.

By contrast, India and Australia experienced price declines of between 5 and 15%, supported by lower fuel costs, new capacity additions, and strong seasonal renewable generation.

Negative wholesale prices, a symptom of high renewable penetration and inflexible demand, have become more frequent in European markets such as Germany, the Netherlands, and Spain, where they accounted for 8 to 9% of total hours in the first half of 2025, up from 4 to 5% the year before.

The IEA warns that recent large-scale blackouts underline the need for greater investment in electricity system security. In February 2025, a transmission failure left 99% of Chile without power for 17 hours, while in April, a cascade of events caused a blackout across Spain and Portugal, affecting tens of millions of people for more than 10 hours.

As electrification spreads across industries, transport, and heating, ensuring a reliable supply will require not only expanding generation capacity but also strengthening grid infrastructure, enhancing operational flexibility, and updating regulatory frameworks.

Carbon Emissions

The shift toward low-emission sources is helping to curb carbon dioxide emissions from electricity generation. After rising by 1.2% in 2024, emissions are expected to plateau in 2025 and decline slightly in 2026. This is despite continued global temperature records and associated increases in cooling demand.

The carbon intensity of global electricity generation is projected to fall from 445 grams of CO₂/kWh in 2024 to 415 grams by 2026, a reduction of nearly 7% in just two years. The European Union is expected to see the steepest drop, from 175 grams to 140 grams/kWh, while China is projected to achieve a reduction from 565 grams to 505 grams over the same period.