REC’s Loan Disbursements to Renewables Sector Up 12% YoY in Q1 FY26

Outstanding loans in the transmission sector were ₹452.31 billion or 8% of REC's loan book

July 30, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Public infrastructure finance company REC has reported its highest-ever quarterly net profit of ₹44.51 billion (~$514.09 million) for the first quarter (Q1) of the financial year (FY) 2026, a 29% increase from ₹34.42 billion (~$397.55 million) during the same period in the previous year.

The company also declared a first interim dividend of ₹4.60 (~$0.05)/equity share with a face value of ₹10 (~$0.12) each.

The total income for the quarter stood at ₹147.34 billion (~$1.70 billion), up 13% from ₹130.37 billion (~$1.51 billion) in Q1 FY 2025. Net interest income grew by 17% year-over-year to ₹52.47 billion (~$606.03 million) from ₹44.74 billion (~$516.75 million). Disbursements during the quarter rose by 36% to ₹595.08 billion (~$6.87 billion), up from ₹436.52 billion (~$5.04 billion) in the same period of the preceding year.

The return on net worth improved to 22.63% in Q1 FY 2026, up from 19.51% in Q1 FY 2025, a 312-basis-point increase. The company’s earnings per share on an annualized basis rose 29% to ₹67.60 (~$0.78) as of June 30, 2025, increasing from ₹52.28 (~$0.6) a year earlier.

REC’s loan book grew to ₹5.85 trillion (~$67.73 billion) as of June 30, 2025. The quality of assets also improved, with net credit-impaired assets declining to 0.24% as of December 31, 2024, compared to 0.82% as of June 30, 2024. The provision coverage ratio on non-performing assets (NPA) stood at 77.05%. REC resolved one NPA account during the quarter.

During Q1 FY 2026, REC’s yield on loan assets increased to 10.08% from 9.99% in Q1 FY 2025. The cost of funds rose marginally to 7.12% from 7.05%.

As a result, the interest spread stood at 2.96%, slightly higher than the 2.94% recorded in the corresponding period of the previous year.

The company’s net interest margin increased from 3.64% in Q1 FY 2025 to 3.74% in Q1 FY 2026. Its net worth increased to ₹796.88 billion (~$9.23 billion) as of June 30, 2025, supported by the growth in profitability.

Renewables

REC approved loans of ₹196.59 billion (~$2.26 billion) for renewable energy projects in the Q1 FY26, accounting for 20% of the company’s total approvals. This marked a 49% decline from ₹384.9 billion (~$4.43 billion) in Q1 FY25, when loan approvals for renewable projects were 34% of the total.

Loan disbursements to the renewable energy sector in Q1 FY26 amounted to ₹72.33 billion (~$832 million), a 12% year-over-year (YoY) increase compared to ₹53.51 billion (~$616 million). Large hydropower projects included the growth in loan disbursements for renewables was up by 35% YoY.

The company’s total outstanding loans in the renewable segment reached ₹638.5 billion (~$7.35 billion), 11% of the total. In comparison, the share of total outstanding loans for renewables was 8% in Q1 FY25. Of this, ₹537.44 billion (~$6.19 billion) is extended to the private sector, and ₹101.06 billion (~$1.16 billion) to the state sector.

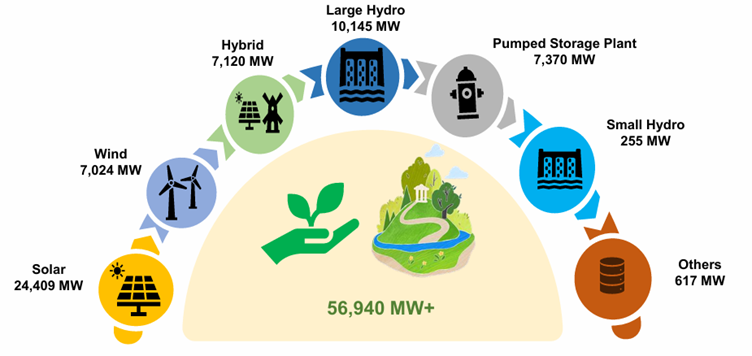

In terms of technology-wise exposure, the loan book includes ₹288.43 billion (~$3.32 billion) for solar (24,409 MW), ₹100.31 billion (~$1.16 billion) for wind (7,024 MW), ₹96.99 billion (~$1.12 billion) for large hydropower projects (10,145 MW), ₹83.45 billion (~$970.35 million) for pumped storage projects (7,370 MW), and ₹47.65 billion (~$553.78 million) for hybrid power projects (7,120 MW).

Transmission

REC approved loans of ₹73.71 billion (~$849.3 million) for transmission projects for Q1 FY26, constituting 7% of the total approvals for the quarter. This is a slight increase from ₹71.69 billion (~$826.1 million) in Q1 FY25.

Loan disbursements towards transmission projects were ₹12.22 billion (~$140.8 million) in Q1 FY26, accounting for 2% of the total. This marked a 15% dip from ₹14.43 billion (~$166.3 million) in Q1 FY25.

REC’s total outstanding loans in the transmission sector were ₹452.31 billion (~$5.45 billion), forming 8% of its overall loan book. This is slightly lower than the ₹476.48 billion (~$5.74 billion) recorded in the previous year.

Of the total loan amount, ₹412.51 billion (~$4.97 billion) (91%) is extended to state sector borrowers, while ₹39.8 billion (~$471.8 million) (9%) is with the private sector.

Recently, REC Limited received approval from the Central Board of Direct Taxes (CBDT) to issue 500,000 zero-coupon bonds aggregating to ₹50 billion (~$582.25 million).

In May this year, the company reported a total income of ₹153.48 billion (~$1.79 billion) for the fourth quarter of the financial year 2025, representing a 21% year-over-year increase.

In April this year, REC Limited raised ₹50 billion (~$586 million) through the issuance of bonds.