Solar Power to Become Cheaper as Government Cuts GST on Cells

Solar cells will attract a GST rate of 5% from the earlier 12%

September 4, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

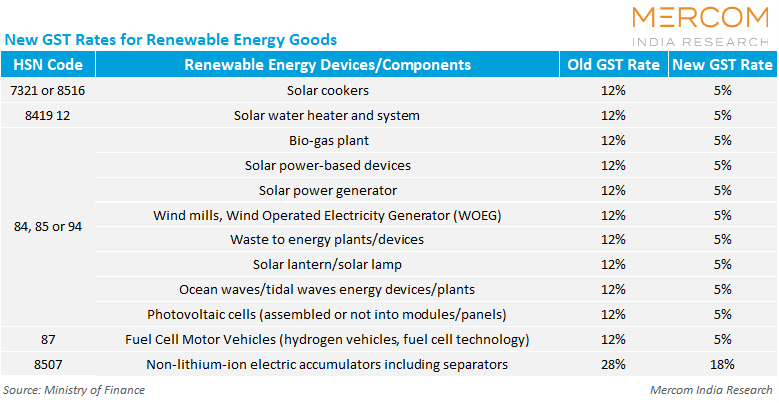

In a big boost to the renewable energy component manufacturing, the Ministry of Finance has reduced the goods and services tax (GST) on solar cells, wind energy generators, and biogas plants from 12% to 5%.

The reduced GST rates were announced at the 56th meeting of the GST Council.

The GST reduction will make solar project development cheaper by about 5%. Solar tariffs may also come down significantly.

Solar cells, regardless of whether they are assembled into modules, will now be subject to a GST of 5%. The same rate of GST will apply to solar lanterns/solar lamps, solar cookers, solar water heaters and systems.

The wind sector was also a beneficiary, with GST for windmills and wind-operated electricity generators slashed to 5%. The tax reduction will also apply to ocean wave/tidal wave devices.

The Finance Ministry also announced a 5% GST for waste-to-energy projects/devices and biogas projects.

The GST applicable to fuel cell motor vehicles, including hydrogen vehicles based on fuel cell technology, has also been reduced to 5%.

The government has reduced GST for non-lithium-ion electric accumulators, including separators, to 18% from 28%.

Solar project development is expected to get cheaper under the new GST regime. Nearly 70% of the contract value comprises the cost of goods, while 30% of the contract value comprises services (installation, commissioning, etc). Under the new tax regime, goods will be taxed at 5% GST and services at 12%.

Under the old tax regime, the total GST applicable was 13.8% and under the new tax regime, it has been reduced to 8.9%. Effectively, the solar projects will see a drop in project costs by 4.9%.

The renewable energy industry widely appreciated the GST relief, saying solar power will become more affordable and enable faster adoption.

Gautam Mohanka, Director at Gautam Solar, stated that the decision by the GST Council marks a pivotal step in accelerating India’s clean energy transition. “This significant reform greatly increases the accessibility of solar installations for households, businesses, and farmers across the country. We believe this tax break will not only boost energy security and encourage new project pipelines but also contribute meaningfully to India’s climate action commitments and its global responsibility to combat climate change.”

The National Solar Energy Federation of India also appreciated the GST Council for accepting its request to reduce the GST rate on renewable energy equipment to 5%.

In the 2025 Union Budget, the Finance Ministry reduced customs duty on solar cells and modules from 25% to 20%, and the duty on solar modules from 40% to 20%.