New GST Rates on Renewable Energy Goods Likely to Reduce Costs and Tariffs

Developers say renewable energy tariffs may decrease in the coming auctions

September 12, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

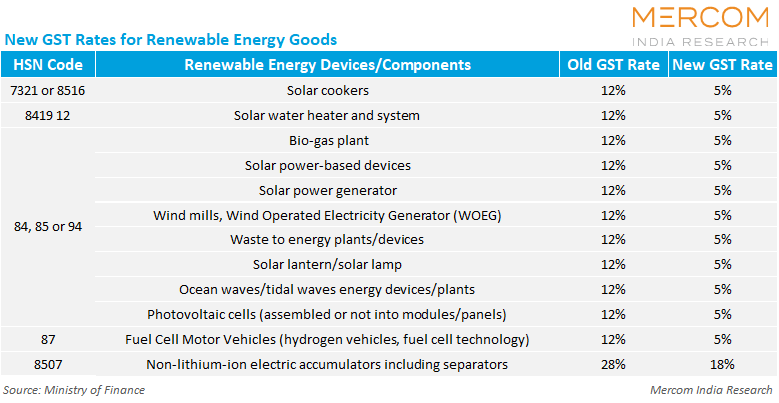

The reduction in Goods and Services Tax (GST) from 12% to 5% on solar cells and other renewable energy devices is likely to lower power costs for consumers while enhancing project viability for developers.

Besides solar cells, windmills, and wind-operated electricity generators, as well as ocean/tidal wave devices, will also benefit from the GST cut.

The tax rate also applies to fuel cells for motor vehicles, including those powered by hydrogen.

The GST on non-lithium batteries was reduced to 18% from 28%.

Engineering, procurement, and construction (EPC) service providers said they expect their costs to come down by 7 to 10%. Earlier, 70% of the project cost (goods) was billed at 12% GST, and 30% of the project cost (services) at 18% GST, resulting in a composite tax rate of approximately 13.8%.

According to Manish Mehta, Co-Founder and Chief Commercial Officer at Sunsure Energy, a savings of about 4.9% can be expected under the new GST regime. He said 70% of the project cost will now be billed at 5% and 30% of the project cost at 18%, which brings the effective rate down to 8.9%. This results in a 4.9% reduction in the total project cost.

Mehta added that the GST rebate will directly benefit independent power producers, and they will be able to pass on the cost savings to the consumer. “For a project of ₹30 million (~$340,692)/MW, we can expect a 5% reduction.”

Developers say that the GST reduction will decrease capital expenditure (CAPEX) on equipment and EPC, and will, in turn, improve the projects’ levelized cost of energy (LCOE) and bankability.

Siddharth Bhatia, Managing Director at Oyster Renewable Energy, stated that developers anticipate a CAPEX relief of up to 7%-10%, which will enable competitive bids and faster financial closure for new projects.

According to Sundeep Gupta, Vice Chairman at Jakson Group, a 7% tax reduction on renewable energy components effectively translates into a 4%–5% decrease in overall project CAPEX.

Nishant Sood, Managing Director at Candi Solar India, stated that the move could be a significant boost for clean energy adoption, as it widens the cost gap between solar and grid tariffs.

Nikhil Nahar, Co-Founder at SolarSquare, said that the net blended GST on the overall solar project will lead to savings for consumers in the utility-scale, housing society, and residential customer segments.

The GST reduction is also likely to have a significant impact on the wind sector.

JP Chalasani, CEO at Suzlon Group, noted that in wind energy, lower taxation on turbines, nacelles, blades, and balance-of-plant components will cut capital intensity and the LCOE. “It will enable faster commissioning, stronger investor returns, and greater capacity additions.”

Electric vehicle (EV) segment players are also optimistic about the impact after the reduction in GST rates for non-lithium batteries.

Uday Narang, Founder of Omega Seiki, said the reduction in GST on internal combustion engine vehicles will create new competition, as EVs still enjoy a significant tax advantage compared to their petrol and diesel counterparts. “The reductions will help the EV sector continue to grow rapidly, attract investments, and accelerate consumer adoption in both urban and semi-urban markets.”

Tariff Reduction

With reduced project costs on the cards, developers and EPC players anticipate aggressive bidding in future auctions and a drop in tariffs.

Mehta of Sunsure Energy stated that, in tariff terms, the approximately 5% drop in project cost translates to a ₹0.1 (~$0.001)/kWh decrease in tariffs.

Nahar of SolarSquare said lower project costs in the utility solar sector will enable developers to lower bids by 4.3%. “For housing society and residential customer segments, the effect is more tangible. A lower upfront investment will directly reduce the CAPEX, thereby optimizing the LCOE to further make solar power cheaper compared to the grid-tariff.”

Gupta of Jakson Group said his company estimates a tariff reduction by ₹0.02 (~$0.0002)/kWh to ₹0.05 (~$0.0005)/kWh in the upcoming auctions.

However, Mehta noted that the benefits of the decrease on non-DCR projects could be offset by other factors, like the Chinese government enforcing the anti-involution policy which is increasing the cost of cells by 30% in the market.

Drop in Module Costs

Cell manufacturers claim that a GST reduction will directly lower the tax on solar cells and modules, bringing down costs and improving profit margins.

Vipin Tiwari, Corporate Strategy Manager at AXITEC Energy, a module manufacturer, said a lower GST could mean that domestic cell suppliers can offer Approved List of Models and Manufacturers (ALMM)-listed products at more competitive prices.

Bhatia of Oyster Renewable Energy noted that the GST cut, combined with better input-credit pass-through at the EPC level, could help in bridging the gap between DCR and non-DCR modules.

However, Avinash Hiranandani, Managing Director at RenewSys, explained that despite the drop in module costs, manufacturers will still be impacted by an inverted duty structure (IDS) under which they will have to claim the accumulated input tax credit.

“Module manufacturers will have to claim a refund for GST. The GST on services accumulates, for which there is no refund mechanism, with inputs taxed at 18% and output taxed at 5%. The GST reduction will aid in reducing module prices, but an inverted duty structure will impact the overall costs and working capital cycle of the manufacturers,” he said.

EPCs also foresee the same problem, but highlighted that it is an issue they have been facing under the previous GST regime as well.

Mehta of Sunsure Energy said that under IDS, EPCs end up blocking their working capital, and they have to wait for the capital to be recovered through profit or refunds.

Sharvil Dave, Founder and CEO at Ataru Renew Power, said that under the new regime, for EPCs executing 3 MW–5 MW projects every quarter, at least ₹1.5 million (~$17,015.5) to $2 million (~$22,687) will be stuck on the GST portal instead of being in their cash flow.

Stakeholders suggest that to address the IDS issue, the Central Board of Indirect Taxes and Customs must align the harmonized system of nomenclature codes for renewables with the updated GST rate for inputs. They also suggest revising the composite supply formula from 70:30 to 80:20 to reflect the current EPC costs.

Better Project Financing

Developers say that with lower GST, the internal rate of return (IRR) for projects and debt service ratios will improve, resulting in domestic banks being more eager to lend.

However, Mehta of Sunsure Energy highlighted that it may not mean more funding from foreign investors, as they are worried about India’s policy and infrastructure readiness.

Sonam Chandwani, Managing Partner at KS Legal & Associates, said that a well-communicated, stable GST regime reduces tax-related ambiguities, which investors often price in as risk premiums.

She noted that capital flows will still hinge on broader macroeconomic factors, including currency stability, off-taker creditworthiness, and long-term policy visibility.

While the new GST regime has raised hopes of better times for the renewable energy sector, stakeholders await further clarity on how the rate cut translates on the ground.

EPCs also foresee the same problem, but highlighted that it’s an issue faced by them earlier as well.0

Mehta said that under IDS, EPCs end up blocking their working capital, and have to wait for the capital to be recovered through profit or refunds.