KUSUM Projects in Maharashtra Delayed as Land Leasing Costs Soar

Developers suggest land banking and a shift to agrivoltaics as a solution

January 6, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

The rapid increase in solar installations under Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyaan (PM-KUSUM) in Maharashtra is leading to developers facing high land-leasing costs and delays in project execution.

The issue of higher land leasing is most prominent in Maharashtra, as the state accounts for the majority of PM-KUSUM projects in the country.

According to KUSUM developers, land costs have risen by 25% to 30% since the program was launched in Maharashtra.

For feeder-level solarization, farmers can lease their land for solar project development at predetermined lease rents. Installations are located on various types of land, including barren, fallow, agricultural, pastureland, and marshland.

Feeder-level solarization projects can receive a central financial assistance of up to 30% of the installation costs, capped at ₹10.5 million (~$116,488)/MW.

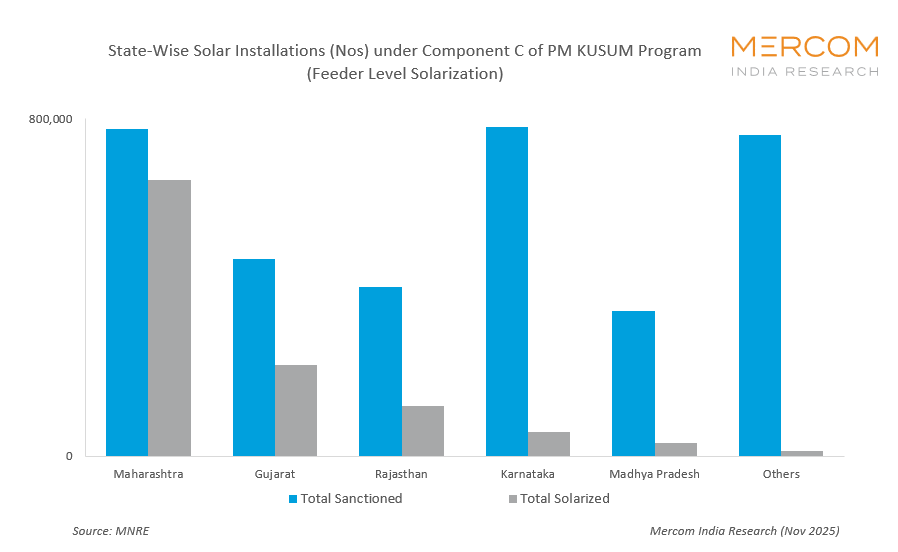

As of November 30, 2025, Maharashtra led feeder-level solarization projects with 775,000 approved and 654,695 installed under Component C of the PM-KUSUM program.

Kushal Shah, Managing Director at B.U. Bhandari Energy, observed that land leasing remains one of the most challenging aspects of implementing the PM-KUSUM program in Maharashtra.

The increasing demand for suitable parcels, particularly those near substations, has created competition, delays, and higher land-lease expectations from landowners.

According to developers, PM-KUSUM has scaled exceptionally well in Maharashtra, particularly in high-demand districts such as Jalna, Beed, Latur, and Aurangabad.

Manish Khare, Co-Founder and MD at Khare Energy, said that it’s a bigger challenge on land parcels where farmers perceive solar as a ‘land locking’ activity.

He added that there are fewer constraints on leasing land parcels for agrivoltaic-based KUSUM models.

Under agrivoltaics-based KUSUM models, the land is used to generate solar power and to grow crops simultaneously.

KUSUM project developers noted that in high-potential regions with good evacuation infrastructure, site costs could be even higher. According to solar developers, this rise in project costs is determined by competition for well-located plots with easy access, stable terrain, and good solar exposure.

Rise in Project Costs

According to estimates, if land is to be purchased by an independent power producer, the cost of land varies between ₹500,000 (~$5,564.9)/acre and ₹1.5 million (~$16,694.7)/acre, and around ₹2.5 million (~$27,824.5)/MW to ₹7.5 million (~$83,473.5)/MW.

Shah highlighted that land-related escalation alone is adding 5–7% to the overall project cost, depending on location and availability of private land versus government lease options.

Project developers noted that a rise in land costs can also significantly affect overall project timelines.

Vivek Gupta, MD at Oswal Pumps, highlighted that delays in finalizing land agreements can also add logistical expenses, extended manpower deployment, and minor redesign costs. On average, these factors together add about 5–8% to the total project cost for grid-connected components of PM-KUSUM.

He added that efficient planning, early stakeholder engagement, and district-level coordination help limit cost escalation and keep installations on track.

Developers also stated that rising land issues and higher project costs have halted many PM-KUSUM projects in Maharashtra.

Ravi Verma, a Member of the Governing Council at the Sustainable Projects Developers Association, said that nearly 300-500 MW of KUSUM projects in Maharashtra are on hold due to land-leasing issues.

Developers say these projects are on hold due to various reasons, such as land parcels not being finalized, boundaries needing to be surveyed, or ownership records needing to be updated.

Khare said that nearly 30-40% of the approved capacity of PM KUSUM projects are likely to be delayed due to land and evacuation challenges.

Substation Connectivity

Apart from land issues, substation connectivity is one of the most significant bottlenecks in implementing PM-KUSUM projects.

Developers cite low and unstable voltage on 11 kV agricultural feeders, the aging and degraded state of substation infrastructure, and the challenge of accommodating new injection points as factors constraining project growth.

Khare explained that insufficient bay capacity, limited technical exposure and training among DISCOM staff, and non-transparent procedures and administrative delays affect bay approvals, current transformer/potential transformer installations, metering, transmission line strengthening, and final synchronization of projects.

Industry experts say that Maharashtra State Electricity Distribution Company and Maharashtra State Electricity Transmission Company (MSEDCL) are working to expand their available substation capacity, but certain substations are already saturated.

Developers say that some of the allotted lands for KUSUM projects are far from substations, which also leads to increased energy losses, right-of-way (RoW) issues, and higher project costs.

Verma suggested that MSEDCL allow developers to relocate the substation to minimize transmission line length and reduce losses.

Developers say that rapid growth in decentralized solar under KUSUM is putting pressure on 33/11 kV infrastructure. “Upgrades are underway, but a more structured and accelerated augmentation plan will be essential to support the long-term KUSUM pipeline,” said Shah.

Resolving Land Issues

One of the ways KUSUM project developers are addressing the land issues is through land banking. Proactively securing land or maintaining pre-screened land banks can shorten development timelines, reduce acquisition risks, and ensure cost predictability.

Land banking can also help developers participate in new tenders without engaging in fresh land acquisitions for the projects.

Gupta pointed out that land banking can also help strengthen farmer engagement, as stakeholders are aware of the potential project locations. “For large-scale agricultural solarization programs, this approach provides greater continuity, minimizes disputes at the last mile, and ensures that installation teams can move seamlessly from one site to another.”

Project developers noted that while the government sets lease rates, leasing is a dynamic process, and farmers finalize negotiations. They added that such land parcels are mostly for government land.

Shah said that in several districts, local authorities communicate indicative lease ranges, but there is no uniform state-wide enforced rate.

However, he added that actual land leases often depend on village-level negotiations, land type, and proximity to grid infrastructure.

Khare stated that the industry can also address land-leasing issues by shifting to the agri-solar model, in which farmers earn dual income, and land is not locked up for the project’s life cycle.

He added that developers and EPC companies can also evaluate hybrid models, such as partial land purchase combined with a long-term lease, to adapt to the changing land-lease scenario in the state.

Government Intervention

To ensure continued growth momentum for KUSUM projects, the central and state governments need to join hands to resolve land issues.

Shah said the government must standardize acquisition norms and land dispute-resolution mechanisms for land parcels. Faster and digitalized substation load-flow approvals must be enabled, and funds earmarked for transmission upgrades in KUSUM clusters. Statutory approvals must be time-bound.

Developers added that the government must continually invest in rural grid upgrades to support higher penetration of KUSUM projects.

Khare said that, in a bid to promote agrivoltaics projects, the government must create a prototype agrivoltaics zone with pre-approved land, crop suitability, and evacuation infrastructure. He also highlighted the need to fast-track substation augmentation, especially 11 kV feeders and 33 kV bays.