India’s Cumulative Wind Capacity to Touch 63 GW in the Next Four Years: Report

India has an onshore wind energy potential of approximately 214 GW

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

India is likely to have a cumulative wind energy capacity of 63.6 GW, with a potential range spanning from 59.3 GW to 68.1 GW, by 2027, which is currently 41.9 GW, according to a Global Wind Energy Council (GWEC) report.

The India Wind Energy Market Outlook 2023-27 emphasizes the considerable onshore wind energy potential of approximately 214 GW, with a capacity utilization factor (CUF) of over 30%. Leveraging this potential becomes imperative to advance climate mitigation, bolster energy security, and achieve clean energy goals.

In March 2023, the government announced a bidding trajectory until the fiscal year 2028, targeting at least 10 GW of wind tenders to be issued annually.

Wind Tenders and Auctions

As of June 2023, India had a project pipeline totaling 12.9 GW, including both standalone wind projects and wind components of hybrid projects. Central tenders accounted for 10.7 GW, and state tenders for 2.2 GW.

The year 2022 saw a surge in tenders issued for standalone wind and hybrid projects, reaching 10.4 GW, surpassing the 9.2 GW recorded by December 2021. Notably, 4.7 GW of this combined tender volume was successfully awarded.

Central auctions for hybrid projects saw a surge of interest from developers. In all, 5.7 GW of hybrid tenders were announced, of which 1.2 GW were awarded.

Drivers of Wind Growth

According to the GWEC, the following factors are the drivers for the growth of wind energy growth:

- Cost competitiveness of wind in the overall mix.

- Dedicated grid infrastructure for integration.

- Compliance of wind renewable purchase obligation (RPO) targets by states.

- Acceleration in commercial & industrial (C&I) sector demand.

Cost Competitiveness of Wind Energy

Between the years 2020 and 2022, India witnessed a substantial increase of around 10-12% in the generation costs of wind projects, leading to a corresponding rise in the Levelized Cost of Energy (LCOE) from ₹2.8 (~$0.034)/kWh-₹3.3 (~$0.039)/kWh in 2020 to ₹3.2 (~$0.038)/kWh-₹4.1 (~$0.049)/kWh in 2022.

This cost surge was driven by heightened expenses for raw materials in the supply chain, particularly steel (which constitutes over 70% of the raw materials used in turbines) and aluminum.

The solar industry encountered similar challenges in 2022, primarily stemming from an escalation in polysilicon costs after 2020 due to manufacturing constraints in China.

The report points out that the decline in wind energy costs is predicted to be less pronounced than solar up to 2028. A significant reduction in the cost of steel and aluminum is not expected in the immediate future. As a result, wind energy costs are projected to hover around ₹3.4 (~$0.041)/kWh by 2028.

Grid Infrastructure for Wind Power

By April 2023, there were 6.4 GW of available capacity within interstate transmission system (ISTS) substations for facilitating new grid connections.

In conjunction with this pre-existing capacity, the government has outlined a strategy for enhancing the capacity further in relation to wind power projects. This augmentation plan can be divided into three distinct segments:

- In 2018, the Ministry of New and Renewable Energy (MNRE) devised a comprehensive strategy to integrate 66.5 GW of renewable energy capacity into the ISTS grid infrastructure. By December 2022, 58 GW of the originally planned grid capacity is in different phases of construction and awaits further enhancement. Within this capacity, 34 GW applies to wind projects.

- The subsequent aspect of grid strategizing pertains to the expansion of renewable energy parks and the allocation of zones, with a targeted increase of 55 GW in capacity. Within this program, 12.6 GW of capacity originating from Gujarat’s Khavda Zone and the Leh Renewable Energy parks hold significance for wind energy.

- The ‘Transmission System for over 500 GW Renewable Energy Capacity by 2030’ report by the Central Electricity Authority outlines a plan for 58 GW of grid capacity to facilitate wind power evacuation by 2030. This capacity distribution is divided into segments of 24 GW by 2025, 17 GW by 2027, and a further 17 GW by 2030.

Wind RPO as a Demand Driver

The cumulative wind power installations in India amount to 41.9 GW, encompassing approximately 9 GW from C&I installations.

The yearly growth pace over recent years has demonstrated a relatively gradual trajectory, with an average of 1.74 GW added between 2018 and 2022.

As outlined by the RPO targets set by individual states, there is a prospective augmentation of 17 GW in capacity within the upcoming four years. This projection effectively more than doubles the yearly rate of installations to 4.25 GW.

Demand for Wind Power in the C&I Market

Approximately 300 MW of wind power capacity was installed within the C&I sector, which marked a significant increase compared to around 100 MW installed in 2021. According to MEC Intelligence (MEC+), solar capacity installation was much higher over the same timeframe, with 3.4 GW added in 2022 and about 700 MW in 2021.

The market has a substantial pipeline of hybrid projects totaling approximately 2.3 GW, of which it wind project pipeline is expected to be about 700 MW to 1 GW tailored explicitly for the C&I sector.

Offshore Wind Development

There is currently an increasing interest both domestically and internationally to access India’s substantial offshore wind potential.

Outlining a strategic direction, a paper published by the Ministry of New and Renewable Energy (MNRE) in July 2022 unveiled a plan to allocate tenders for offshore wind projects amounting to 37 GW by 2030, focusing on the states of Gujarat and Tamil Nadu.

Onshore Wind Outlook

Wind installations in India between 2023 and 2027 are forecast in three different scenarios:

- Ambitious case: In a scenario characterized by rapid progress, a cumulative installation capacity of 26.2 GW is observed. This acceleration is propelled by the synchronization of state RPOs with the targets set by the Ministry of Power, leading to a broader demand for wind energy.

- Base case: In a scenario characterized by regular progression, there is a total installation capacity of 21.7 GW. This is primarily motivated by the utilization of the existing project pipeline and the ongoing trend of awarding tenders for new capacities at a rate of 3-4 GW annually.

- Conservative case: In a scenario characterized by gradual progress, the projection is for installations totaling 17.4 GW. In this case, the market requires a period of adjustment to acclimatize to the novel bidding mechanism, which consequently impacts the demand for wind energy due to the elevated prices discovered in tender processes.

Indian Wind Supply Chain

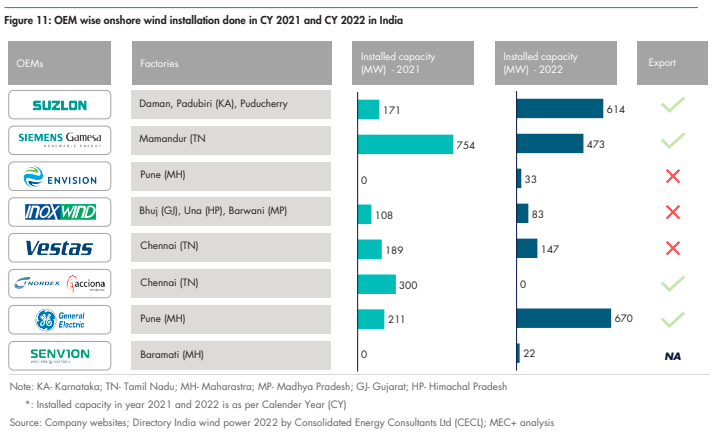

India has a nacelle manufacturing capacity of 11.5 GW, strategically situated across Karnataka, Maharashtra, Gujarat, and Tamil Nadu.

In 2016, India established an objective of achieving a total renewable energy capacity of 175 GW by 2022, including a wind power component of 60 GW. This implied an annual augmentation of 5 GW, prompting the anticipation of domestic manufacturing investments by original equipment manufacturers (OEMs). However, the market’s momentum waned after 2017 with the discontinuation of the Feed-in Tariff (FiT) framework.

Source: GWEC

According to the report, a significant portion of the manufacturing capacity remained underutilized, primarily due to reduced domestic market demand and relatively limited exports of nacelles from India.

Technology Alignment of Indian Turbines

Wind turbines with capacities ranging from 2 MW to 3.6 MW are manufactured in India, aligning with the country’s prevailing domestic deployment requirements.

The central hurdle lies in the progression of technology within wind turbine development, which can be evaluated based on three key parameters: nameplate capacity, hub height, and rotor diameter.

An examination of the leading ten nations in terms of wind installations until 2027 reveals that India exhibits a shortfall in nameplate capacity, displays a somewhat lesser lag concerning rotor diameter, and performs commendably with regard to hub height.

Cost competitiveness and convergence

While India has a competitive advantage in relatively low labor costs, it still lags behind other countries regarding manufacturing efficiency and cost competitiveness. The major challenge is the significant difference in the manufacturing cost of turbines in India versus China.

Source: GWEC

The wind industry in China has made substantial investments in manufacturing technology, and domestically sourced raw materials come at a more economical rate than other regions.

Consequently, China has achieved economies of scale that enable the production of turbines within the price bracket of ₹34 million (~$411.444)/MW-₹38 million (~$459,849)/MW, which is nearly 30% less than the cost of domestically assembled turbines in India, falling within the range of ₹46 million (~$556,660)/MW-₹48 million (~$580,862)/MW. However, turbines primarily manufactured within India incur the highest costs, falling within the range of ₹56 million (~$677,673)/MW-₹63 million (~$762,382)/MW.

Supportive tax regime

One more pivotal obstacle confronting India is the absence of a favorable taxation structure and incentives. Noteworthy distinctions are apparent within the tax systems of India and China, factors that could potentially influence India’s positioning within the worldwide wind supply chain. These disparities comprise:

- Inconsistency in the Indian tax system and policies leading to increasing difficulty in compliance for both domestic and foreign investors.

- India has a relatively higher number and higher rates of taxes than China, which ultimately increases the cost of goods.

- China has a ‘refund upon levy’ policy applicable on their standard VAT, where a refund of 50% is applicable on the payable amount, leading to a low cost of goods compared to India.

- China receives an export tax rebate in the range of 9-13%, along with a corporate income tax rate of 15%, which is favorable compared to India’s 33.8%.

Last month, the Ministry of Power introduced new guidelines for the tariff-based competitive bidding process for procurement power from grid-connected wind power projects to boost renewable capacity and meet the distribution licensee’s RPO.

According to a report published by GWEC last December, Tamil Nadu could add 25 GW of new wind power capacity by 2030.