India’s Solar Exports Up 65% in Q3 2025, Imports Down 15.1%

Modules comprised 97.8% of exports, and cells 2.2%

December 8, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

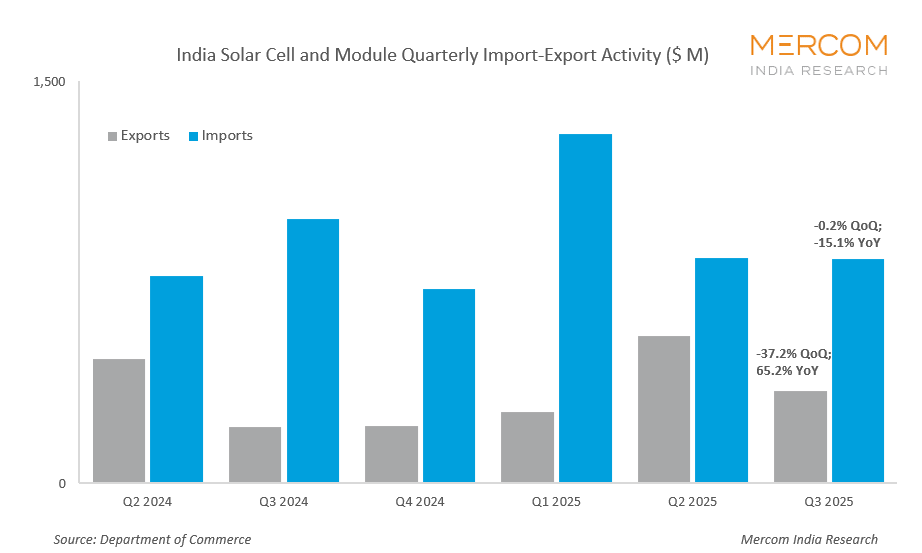

India exported solar cells and modules worth over $344.5 million (~₹30 billion) in the third quarter (Q3) of 2025, a 65.2% year-over-year (YoY) increase from $208.5 million (~₹17.46 billion), according to data from the Department of Commerce.

In a quarter-over-quarter (QoQ) comparison, module and cell exports declined by 37.2% from over $548 million (~₹47 billion).

Modules comprised 97.8% of total shipments, and cells accounted for the remaining 2.2%. Exports of solar cells surged 83.5% QoQ and 14.4% compared to the same quarter the previous year.

Module exports were down 38.1% from the previous quarter’s level but up 66.9% YoY.

The U.S. remained the primary destination for Indian solar cell and module exports, accounting for 97% of the total market share.

On July 31, the U.S. imposed an additional 25% tariffs on imports from India, taking the total levy to 50%, beginning August 27. Though the U.S. has been the largest export market for Indian solar cells and modules, the higher tariff has eroded the price advantage of Indian products and is likely to reduce India’s export competitiveness.

Imports

During Q3 2025, India imported solar cells and modules valued at $837.5 million (₹73.1 billion), a 0.2% QoQ decline. Solar imports decreased by 15.1% YoY.

Solar cells accounted for 82% of the total import value, while modules accounted for the remaining 18% in Q3 2025.

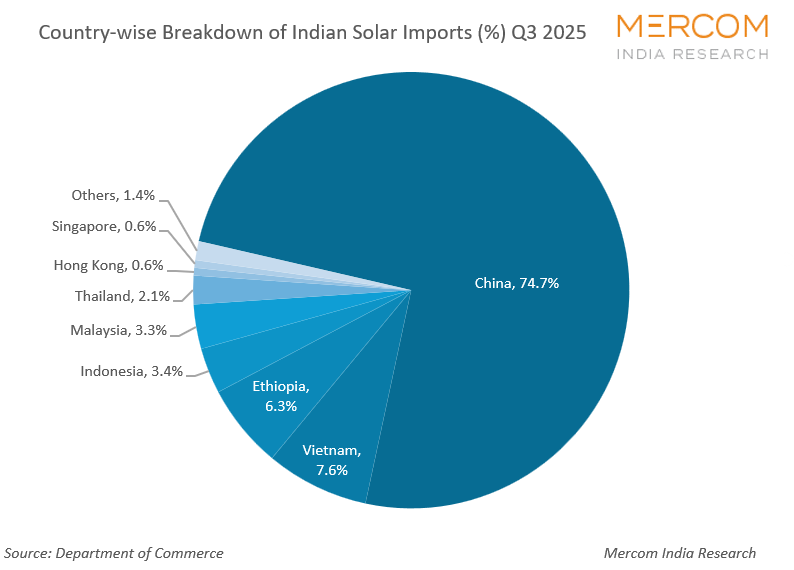

In Q3 2025, 74.7% of solar imports were from China, up 6.4% from the previous quarter.

Solar cell imports rose by 12.4% QoQ, while module imports fell by 33.5 %. In YoY comparison, cell imports were up 75%, whereas module imports declined by 74%.

The Ministry of New and Renewable Energy has mandated the use of solar cells registered under the Approved List of Models and Manufacturers List-II starting June 1, 2026. Following the MNRE’s formal release of the ALMM List-II, developers increased their purchases of solar cells. Projects with bid submissions on or before September 1, 2025, may use non-ALMM-listed cells. Bids submitted after this date must comply with the new rules. To leverage this exemption and avoid future supply pressures or higher costs, developers rushed to secure cells ahead of the deadline.

First Nine Months (9M) 2025

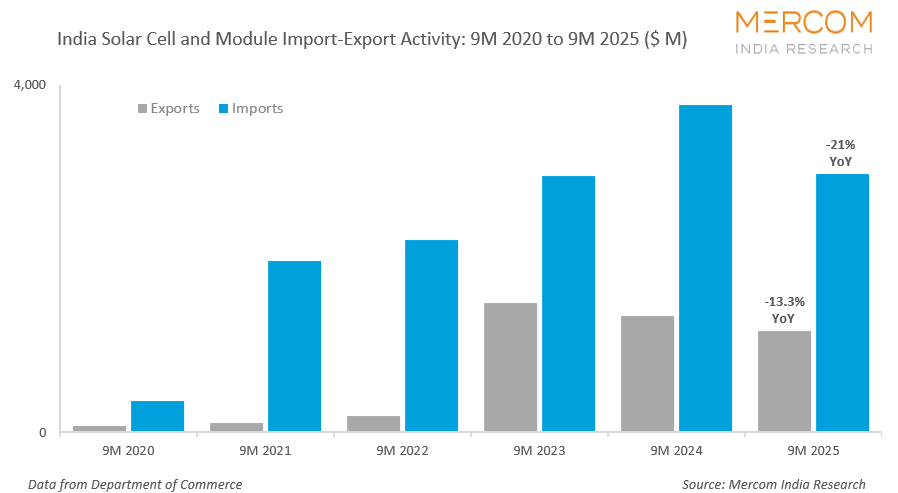

In the first nine months (9M) of 2025, solar cell and module exports dropped 13.3% YoY to $1.1 billion (~₹100.2 billion) from $1.3 million (~₹111.5 billion). Modules accounted for 98.7% of the total exports.

India’s solar cell and module imports fell 21% to $2.9 billion (~₹257 billion) during 9M 2025, from $3.7 billion (~₹314.1 billion) in 9M 2024. Cells accounted for the majority of total solar imports (59.8%).

Export momentum to the U.S. weakened compared to 2024, as these markets imposed stricter certification requirements, extended shipping timelines, and revised tariff structures.

India added 42.2 GW of solar module capacity and 7.5 GW of solar cell capacity in the first half (1H) of 2025, according to Mercom’s State of Solar PV Manufacturing in India 1H 2025 report.

Mercom’s India Solar EXIM Tracker provides detailed solar import and export data by component types, suppliers, manufacturers, and developers.