State of Solar PV Manufacturing in India 1H 2025 – India Added 44.2 GW of New Solar Modules & 7.5 GW of Cell Manufacturing Capacity in 1H 2025

In the first half (1H) of 2025, 44.2 gigawatts (GW) of solar modules and 7.5 GW of solar cell manufacturing capacity were added in India, according to the recently released research report, State of Solar PV Manufacturing in India 1H 2025, by Mercom India.

Manufacturing capacity additions in 1H 2025 were primarily driven by the 186 GW large-scale solar project pipeline scheduled between 2025 and 2027, the 2030 solar installation targets, and strong policy-driven domestic demand for ALMM modules.

As of the release of this report, the cumulative capacity of modules under the ALMM List-I stood at 109.5 GW, and the cumulative cell capacity of ALMM List-II stood at nearly 17.9 GW.

As of June 2025, 91.5 GW of module production capacity across various technologies had received ALMM certification. Of the cumulative installed cell production capacity, 13.1 GW was listed under ALMM List-II, as per the MNRE’s order issued on July 31, 2025. ALMM-certified capacities provide a more accurate reflection of supply, although wattage breakdowns are not disclosed in the ALMM list.

The top 10 manufacturers accounted for 49.9% of module and 99.2% of cell capacity.

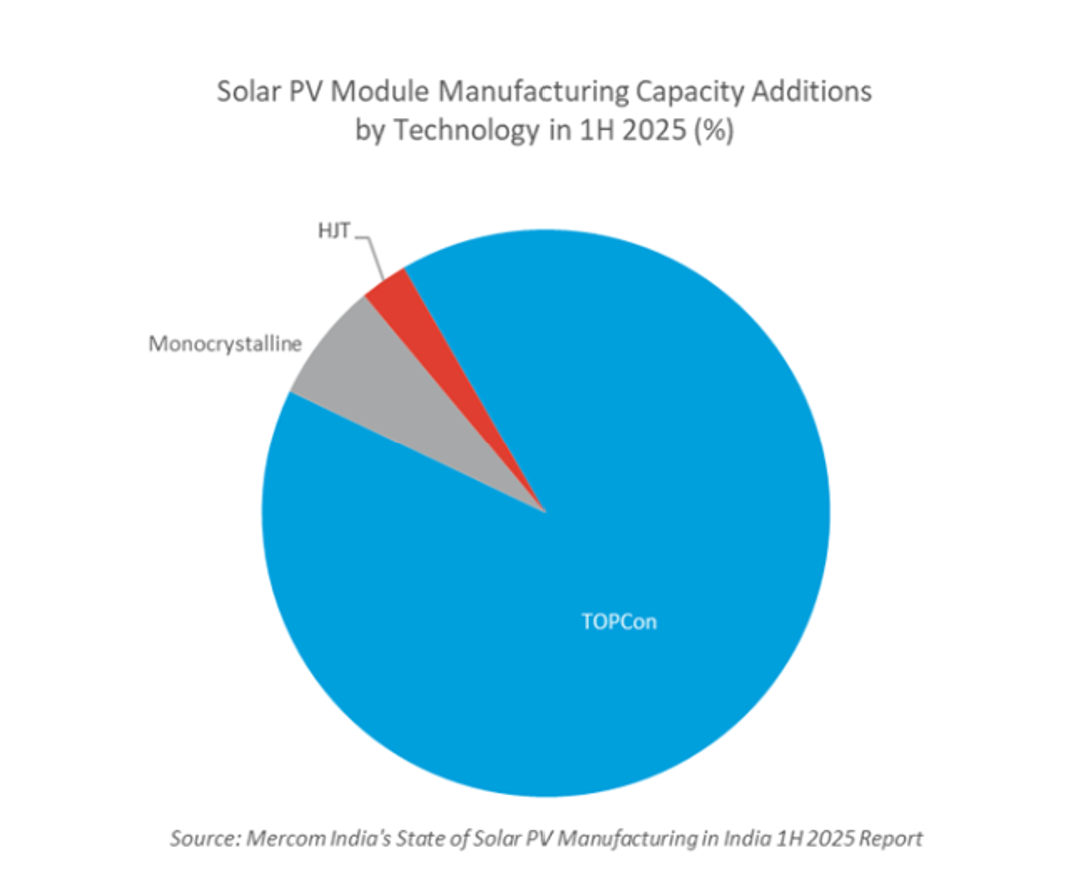

TOPCon led module manufacturing capacity additions in 1H 2025, accounting for over 90%, followed by monocrystalline modules with almost 7%. For the first time, HJT module capacity was added in the country, contributing nearly 3%. No additions were made to integrated solar wafer/ingot or polysilicon capacity during the first half of the year.

As of June 2025, monocrystalline technology accounted for 54.5% of total cell capacity, followed by TOPCon with 41.5% and polycrystalline with 4%.

Indian manufacturers currently have nearly 182 GW of module and over 86 GW of cell capacity under construction, expected to be commissioned by 2027. In addition, 97 GW of module and about 85 GW of cell capacity have been announced, and are projected to come online by 2030 or earlier.

Gujarat stood out as the preferred destination for module manufacturing production, accounting for 41.6% of capacity as of June 2025. Rajasthan and Uttar Pradesh followed with module production capacities of 12.8 GW and 11.5 GW.

Gujarat also held the largest annual solar cell production capacity at 47.3%. Tamil Nadu and Karnataka were other top states, with capacities of 4.3 GW and 3.6 GW, respectively.

Various public sector and government entities issued tenders totaling 860 MW to procure solar modules in 1H 2025, down 88.7% YoY.

A total of 44.6 GW of solar modules and cells were imported in 1H 2025. Modules accounted for 34% of imports, while cells accounted for 66%.

Domestic manufacturers exported nearly 3 GW of modules and 83 MW of cells in 1H 2025, primarily to the United States.

Key Highlights from Mercom’s State of Solar PV Manufacturing in India 1H 2025 Report

- India added 44.2 GW of solar module and 7.5 GW of cell capacity in 1H 2025

- The top three states for module manufacturing were Gujarat, Rajasthan, and Uttar Pradesh

- Gujarat, Tamil Nadu and Karnataka were the leading states for solar cell manufacturing

- In 1H 2025, various public sector and government entities issued 860 MW of tenders to procure solar modules

- India’s solar PV module and cell imports were up over 34% and 66%, respectively

Contact Mercom for pricing: reports@mercomindia.com or call us at +91-80-41211148.

MERCOM INDIA RESEARCH

Mercom India Research is a leading research and consulting firm at the forefront of India’s clean energy transformation delivering timely, relevant market intelligence and advisory for India’s energy markets.

RELATED NEWS

CUSTOM RESEARCH & CONSULTING

Do you need more tailored research that cannot be answered by any of Mercom’s popular reports?

Our custom research services may be the answer.

We provide data and analysis to help companies understand information specific to their particular segment so they can make sound strategic decisions relating to new market entry, product introductions, or to simply help them understand how they or their customers are positioned within the market.

Mercom’s custom research and advisory services provide clients data and analysis tailored to meet their unique needs. Call us today to learn more: research@mercomindia.com