India Added 2.8 GW of Rooftop Solar Capacity in 1H 2025

The country added 1,618 MW of rooftop solar systems during Q2 2025

September 2, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

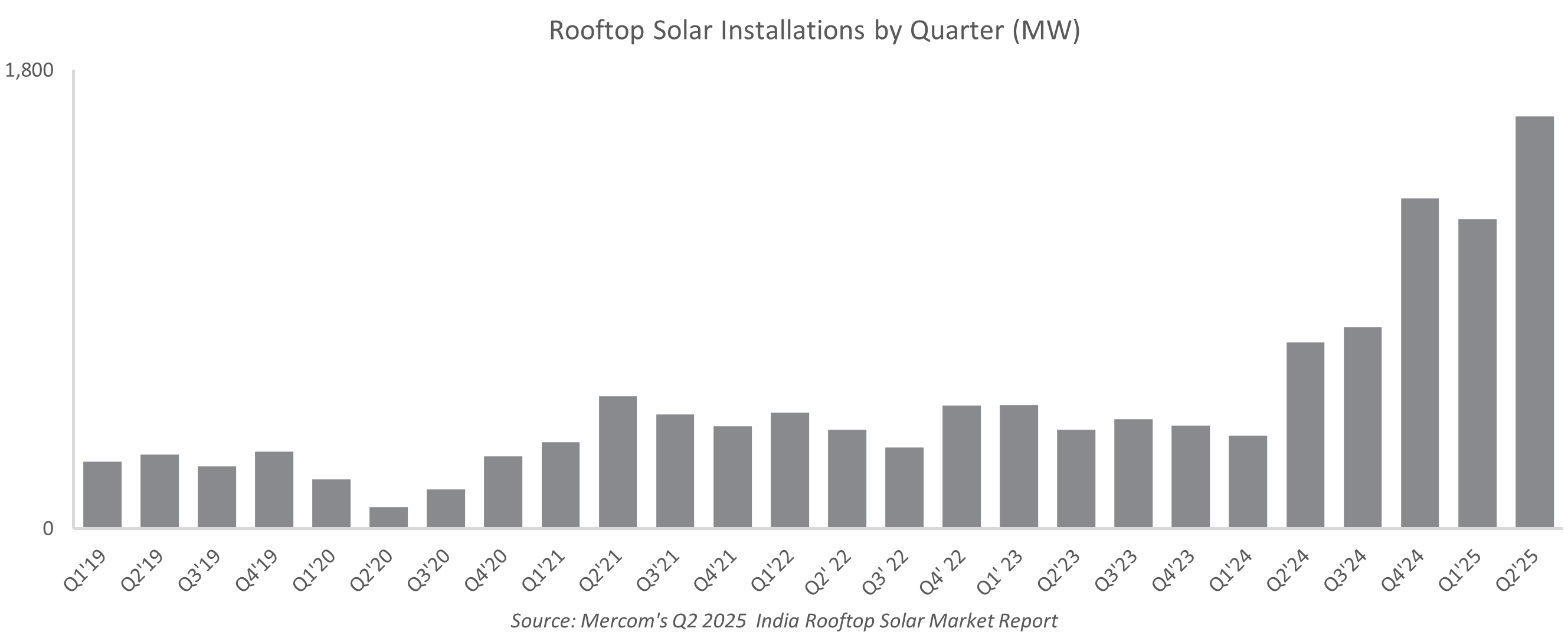

India added 2.8 GW of rooftop solar capacity in the first half (1H) of 2025, according to Mercom India’s newly released Q2 2025 India Rooftop Solar Market Report. The installations grew 158% year-over-year (YoY).

During the second quarter (Q2) of 2025, 1,618 MW of rooftop solar systems were installed, an almost 33% increase from 1,216.6 MW in Q1 2025, and an over 121% increase from the 731 MW installed in Q2 2024.

The installation growth in 1H and Q2 of 2025 was mostly driven by the clearance of delayed registrations under the PM Surya Ghar: Muft Bijli Yojana, the commissioning of new systems, and enhancements to the PM Surya Ghar portal.

“The rooftop solar sector in India is finally taking off, largely due to the Prime Minister’s rooftop solar initiative, which has sparked unprecedented consumer interest. After overcoming initial setbacks, we can anticipate consistently higher installation rates in the residential segment moving forward. Nevertheless, the success of the program could be hindered by domestic module availability, component shortages, and escalating costs if these issues are not resolved,” said Raj Prabhu, CEO of Mercom Capital Group.

Leading Segments

In Q2 2025, rooftop solar capacity additions were led by the residential segment, contributing over 74%, followed by the industrial (19%), commercial (6%), and government (0.5%).

Priya Sanjay, Managing Director at Mercom India, said, “Residential installations, the primary driver is the PM Surya Ghar program, as these installations are currently subsidized and relatively easy to install. Savings are the primary drivers for commercial and industrial (C&I) enterprises to opt for rooftop solar installations.”

Installations under the capital expenditure model accounted for 88% of the quarterly additions. Meanwhile, capacity additions under the operational expenditure or renewable energy service company model accounted for roughly 12% of the installations during the quarter.

Issued rooftop solar tenders in Q2 2025 stood at 1,269 MW, an over 232% quarter-over-quarter growth from 382 MW and a 110% YoY increase from 604 MW.

As of June 2025, India had a cumulative installed rooftop solar capacity of 16.5 GW.

Leading States

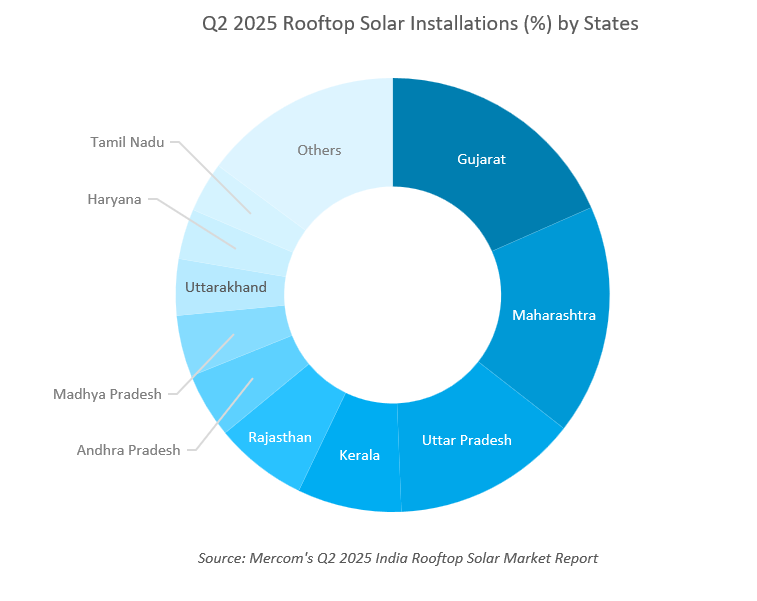

Gujarat, Maharashtra, Uttar Pradesh, Kerala, and Rajasthan led the rooftop solar capacity additions during the quarter. The top five states represented 64% of the total installations.

As of June 2025, the top ten states accounted for over 81% of the cumulative rooftop solar installations. Gujarat, Maharashtra, Kerala, Rajasthan, and Uttar Pradesh continued to lead cumulative installed rooftop solar capacity.

For the first time, Assam reported the highest quarterly compounded growth rate of approximately 24% between Q2 2024 and Q2 2025. Uttar Pradesh and Madhya Pradesh followed with growth rates of roughly 19% and over 13%, respectively.

Speaking about Assam, Sanjay said the state benefited primarily from the PM Surya Ghar program. The northeastern states face terrain and weather challenges when it comes to solar installations. Assam has announced some capacity additions under state policies, but it has witnessed considerable rooftop installations under the PM Surya Ghar program.

Challenges to Further Growth

Despite the growth, supply chain concerns, including domestic module availability and cost escalation, remain significant issues. Sanjay emphasized that these challenges are considerably hindering the accelerated development of rooftop solar. Although subsidies are tied to the use of domestic content requirement (DCR)-compliant modules, many developers are opting for non-DCR components. The developers state that non-DCR installations will need approximately the same amount of investment, or sometimes, even less.

C&I entities are also not very receptive to using the Indian-made solar modules, even if they are not DCR-compliant. They would prefer behind-the-meter projects whenever possible.

Additionally, a shortage of DCR-compliant modules has been slowing the progress of the PM Surya Ghar: Muft Bijli Yojana. Also, until recently, manufacturers were opting for export contracts over domestic supply, particularly to the U.S. As a result, domestic project developers and vendors were unable to access essential DCR modules.

The Q2 2025 Mercom India Rooftop Solar Report is 92 pages long and covers all facets of India’s rooftop solar market. For the complete report, visit: https://www.mercomindia.com/product/rooftop-solar-market-report-q2-2025