In Temporary Cheer for Solar Sector, Silver Prices Crash After Months-long Rally

The silver market will continue to remain volatile before settling higher from its record lows

February 2, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

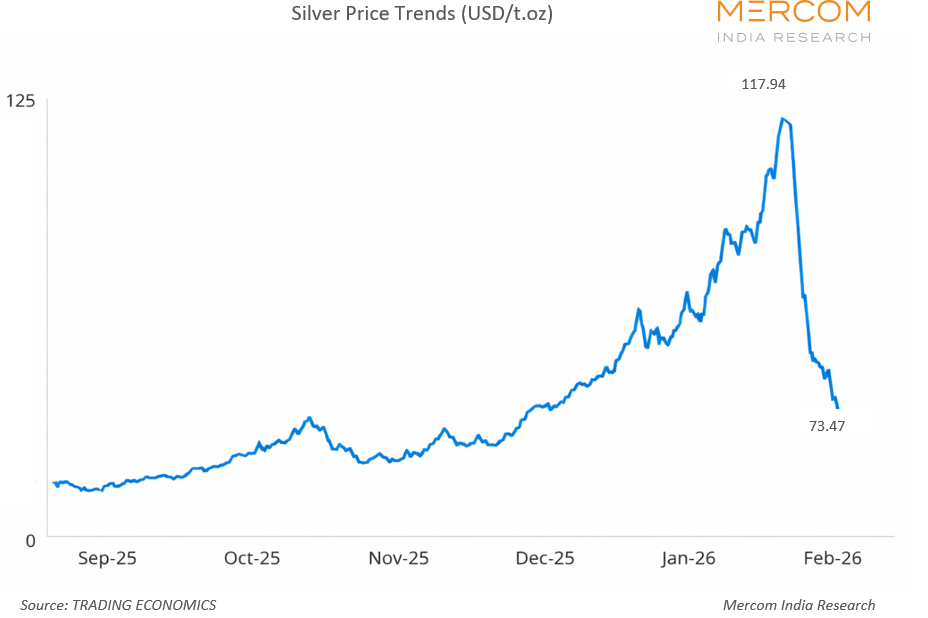

Global silver prices crashed at the end of last week, ending a sustained six-month rally driven by demand, safe-haven buying, and inventory dips in China.

In one of the worst single-day falls in history, spot silver prices plunged by up to 37% across global markets on January 30, 2026. Silver futures fared slightly better, plummeting about 30%.

The metal had traded above $115 in the last week of January before falling to around $84 an ounce.

Starting around $35 an ounce in mid-2025, prices climbed in the third and fourth quarters of the year, before reaching unprecedented highs into the new year.

Market watchers attributed the sharp drop in silver and gold to a strengthening dollar and aggressive profit-booking by investors. A stronger dollar means precious metals become costlier for non-U.S. buyers.

President Donald Trump’s decision to nominate economist Kevin Warsh, considered to have ‘hawkish’ positions on monetary policy, to chair the U.S. Federal Reserve may also have led to the meltdown.

Indian markets mirrored the global correction, with silver sliding by about 25% on the Multi Commodity Exchange (MCX). Analysts said the medium-term case for silver remains intact, driven by strong industrial demand, though they expect elevated volatility in the near term.

According to trade analysts, all is not lost for silver, though. While futures are now hovering around ₹240,000 (~$2562.86) a kg in India, they believe that, given the tight inventory and high demand, silver could settle higher in the coming weeks. Volatility will, however, remain.

Silver and Solar Panels

The sharp drop is likely to offer short-term relief to the solar energy industry, which is among the largest industrial consumers of silver due to its role in solar cell manufacturing.

A Silver Institute survey said solar PV could account for one-fifth of the metal’s demand. Due to its unparalleled conductivity, silver is vital to solar cell production. Industry estimates suggest that the prolonged rise in silver prices in 2025 significantly increased input costs, with silver accounting for more than a quarter of solar module manufacturing costs in some cases.

The shift from p-type to n-type high-efficiency solar cells, such as Tunnel Oxide Passivated Contact (TOPCon) and Heterojunction (HJT) technologies, has significantly increased the demand for silver paste.

Parallelly, the PV industry has initiated research and development efforts to reduce silver use in panel manufacturing. Last year, scientists at Germany’s Fraunhofer Institute for Solar Energy Systems ISE claimed to have produced silicon heterojunction solar cells with a total silver consumption of 1.4 mg per watt of peak power. This consumption translates to one-tenth of the current industrial production standard.