China’s Record Low Silver Inventory Raises Global Solar Supply Chain Risk

The silver market is running a substantial deficit of 400 million ounces annually

December 11, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

China’s long role as an invisible stabilizer in the silver market is starting to break down. For years, whenever the West ran short of metal, flows from China quietly eased the strain. However, that era may be at risk of ending, and with it, the world may be moving into a prolonged phase of silver scarcity.

The source of this pressure is the changing nature of demand. Silver has always been a workhorse of the electrical and electronics industries. In the past few years, AI data centers, high-end semiconductors, and solar power have all relied heavily on silver’s unparalleled electrical and thermal conductivity.

Industrial users, particularly in the solar photovoltaic sector, are buying aggressively into the fourth quarter, when installations peak and silver use in solar components surges. For these manufacturers, silver accounts for only a small share of a module’s total cost but is critical to performance.

Role of Silver in Solar Technology

Silver is pivotal in solar cell production due to its unparalleled conductivity. The process involves converting silver into a paste, which is then loaded onto a silicon wafer. When light strikes the silicon, it liberates electrons, and silver efficiently carries the generated electricity for immediate use or storage in batteries.

The shift from p-type to n-type high-efficiency solar cells, such as Tunnel Oxide Passivated Contact (TOPCon) and Heterojunction (HJT) technologies, has significantly increased the demand for silver paste.

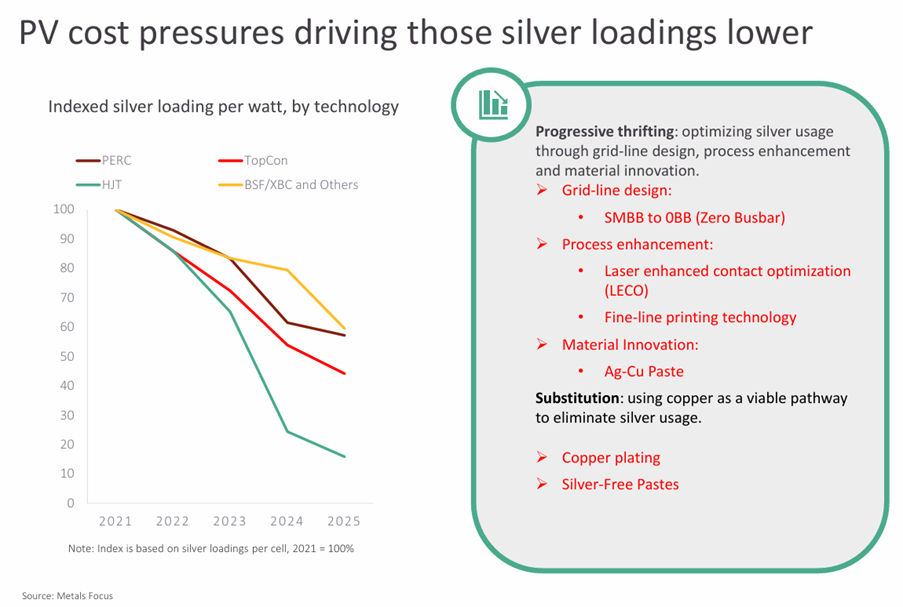

However, the ongoing price competition in modules is pushing manufacturers to use less silver each year, regardless of the cell technology they produce.

To do this, companies are following two complementary strategies. The first is progressive thrifting, meaning they still rely on silver, but stretch it further by redesigning the metal grid on the cell and improving how it’s printed and connected. This includes shifting to newer grid layouts that rely on many thinner current-collecting lines or even remove traditional busbars altogether, so the same electrical function is achieved with less paste.

It also involves manufacturing upgrades such as laser-based techniques that improve the quality of the metal-silicon contact, and fine-line screen or stencil printing that lays down narrower, more precise fingers, cutting silver use without hurting performance. Materials science also plays a role here, with pastes that partially replace silver with copper while maintaining printability and conductivity.

The second strategy is substitution, which is a longer-term push to remove silver from the process entirely by switching to copper-based metallization, especially through copper plating methods or the development of fully silver-free conductive pastes.

On the solar side, Philip Newman, Managing Director at Metals Focus, points out that the photovoltaic industry has already been steadily reducing silver content and that this trend is set to accelerate at today’s price levels.

Drawing on Metals Focus’ Silver Interim presentation from mid-November, he notes that panel and module manufacturers are under intense cost pressure and will continue to cut silver loadings where possible. “With current prices, this thrifting will likely accelerate,” he says, though he stresses that reducing silver content is only one of several levers manufacturers can pull to manage costs.

Engineers can trim usage and recycle the metal; they have been trying, but there is still no widely available substitute that matches silver’s performance in the most demanding applications. When reliability, efficiency, and miniaturization are non-negotiable, silver remains the default choice.

Recent research has focused on reducing the use of silver in solar technology. In May this year, scientists at Germany’s Fraunhofer Institute for Solar Energy Systems ISE claimed to have produced silicon heterojunction solar cells with a total silver consumption of 1.4 mg per watt of peak power. This consumption would be one-tenth compared to the current industrial production standard.

Scientists at the University of Camerino have developed a novel way of extracting silver from end-of-life solar cells. By combining hydrometallurgical and electrochemical processes, the scientists have reportedly recovered pure silver with an efficiency of 98%. The process of recovering the metal involves the use of base-activated persulfate along with ammonia.

Engineers at the University of New South Wales introduced a unique method for recycling solar panels and efficiently recovering valuable materials, particularly silver. As governments place silver on critical minerals or strategic materials lists, the metal shifts into a different category. It stops being just another commodity that trades freely across borders and becomes a strategic resource that policymakers worry about securing. The U.S. recently placed silver on the critical minerals list.

Global Scenario

Chinese exchange-tracked silver inventories have fallen to their lowest levels since around 2015, according to figures from the Shanghai Futures Exchange.

The spot price for silver has recently surged, breaking records and trading at around $60 to $61 per ounce on almost all global commodity exchanges.

Globally, too, the silver market is running a substantial and persistent deficit. The mining industry produces about 820 million ounces a year, while total demand has pushed beyond 1.2 billion ounces. Industry data and analyst estimates imply an annual shortfall of roughly 400 million ounces. That is not a temporary mismatch caused by a single cycle but reflects the gap between the amount of silver the world mines and the amount it consumes.

Newman expects silver prices to hold up over the next couple of years, broadly tracking the same forces that are lifting gold.

Newman links silver’s resilience to ongoing de-dollarization, investor unease over the U.S. administration’s weaponization of tariffs, and mounting concern about Washington’s ability to service its growing debt.

Questions around Federal Reserve independence and the impact of anticipated rate cuts are also seen as supportive for precious metals. While he concedes that geopolitical risk primarily benefits gold, he notes that silver should also benefit from positive spillovers as investors diversify away from stretched S&P 500 valuations into hard assets. Overall, He characterizes the silver market as quite tight, which should further underpin prices.

Once more nations formally recognize silver as critical to national energy systems, defense capabilities, and digital infrastructure, the incentive to treat it as a purely market-driven asset weakens. Export restrictions, strategic stockpiles, and state-backed procurement can follow, tightening the market further and fragmenting global trade.

Financial markets are already reflecting pieces of this story. Silver prices have climbed dramatically, rising roughly 70–80% this year to record highs above $62/ounce, according to the Silver Institute.

The US government’s move to classify silver as a critical mineral has raised questions about future policy – and, by extension, price implications – but Newman cautions that it’s still too early to draw conclusions.

“Honestly, we have no idea,” he admits when asked how this designation might affect the market. Metals Focus is waiting to see whether Washington opts for tariffs, stockpiling, or support for domestic mining, or chooses a different route altogether. For now, Newman emphasises that any assessment of policy impact is purely speculation.

For now, the industry’s reliance on silver will continue because key technologies cannot do without it. Policymakers are beginning to treat it as a strategic asset tied to energy, defense, and digital infrastructure. Experts feel it is too early to conclude the impact of such policymaking on silver availability and prices.