Global Offshore Wind Records Second Best Year Ever, Adds 8.8 GW in 2022

The total global offshore wind power capacity reached 64.3 GW

September 6, 2023

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

The offshore wind industry achieved notable growth by adding 8.8 GW of new capacity to the grid in 2022, which was its second-best performance ever, according to the Global Wind Energy Council’s (GWEC) “Global Offshore Wind Report for 2023.”

While this was a 58% decrease compared to the record-setting year of 2021, it still marked the second-highest year for offshore wind installations on record.

The total global offshore wind power capacity reached 64.3 GW across 19 countries. This was a year-on-year (YoY) growth of 16% and accounted for 7% of the cumulative global wind power capacity.

China continued to lead the global offshore wind development, even though its new installations dropped from 21 GW in 2021 to 5 GW in 2022, mainly due to the conclusion of the feed-in tariff (FiT) program.

According to GWEC, other markets in the Asia-Pacific region, such as ‘Chinese Taiwan’ (1,175 MW) and Japan (84 MW), reported new offshore wind installations.

Vietnam did not see any intertidal (nearshore) wind projects come into commercial operation in 2022 due to the absence of a ceiling price for negotiations with investors.

In contrast, Europe contributed the remaining 2.5 GW of capacity in 2022, with France and Italy commissioning their first commercial offshore wind projects. Despite a lower installation rate than previous years, Europe’s total offshore wind capacity reached 30 GW, with 46% originating from the UK.

As of 2022, Asia-Pacific had a total installed offshore wind capacity of 34 GW, surpassing Europe, previously the largest offshore wind market.

However, Europe remained a leader in floating wind, with Norway adding 60 MW of floating wind capacity in 2022, bringing its total installations to 171 MW, representing 91% of the global installations in this category.

Asia-Pacific followed with 16.7 MW, while North America had 42 MW of offshore wind in operation.

Market Outlook

The report noted that the offshore wind sector faces both exciting opportunities and significant challenges as it plays a crucial role in electrifying and decarbonizing energy systems.

To achieve carbon neutrality by 2050, as outlined by leading energy institutions like the International Energy Agency (IEA) and the International Renewable Energy Agency (IRENA), substantial growth in offshore wind capacity is essential.

The IEA’s roadmap requires annual offshore wind installations to increase from 8.8 GW in 2022 to 80 GW by 2030, with 70 GW to be deployed annually between 2031 and 2050. IRENA envisions nearly 500 GW of cumulative offshore wind capacity by 2030 and nearly 2,500 GW by 2050.

According to GWEC, offshore wind installations are expected to exceed 30 GW in 2026 and reach 50 GW by 2030, with a compound average annual growth rate (CAGR) of 31% until 2027 and 12% up to the early 2030s.

However, the full potential of floating offshore wind projects is not expected until 2030 due to various factors, including higher costs and supply chain bottlenecks, resulting in a lowered projection of 10.9 GW by 2030, down 42% from the previous estimate.

The GWEC has revised its short-term offshore wind growth forecasts for Europe and North America downward by 17%, citing delays caused by permitting and regulatory issues. Supply chain challenges also pose a risk for all regions except China.

GWEC’s projection indicates that a significant 380 GW of new offshore wind capacity will be constructed by 2032. Almost half of this capacity is expected to come from the Asia-Pacific region, followed by Europe (41%), North America (9%), and Latin America (1%). This would result in a total offshore wind capacity of 447 GW by the end of 2032.

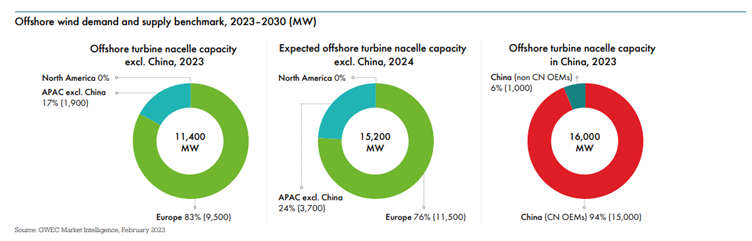

Globally, 30 turbine assembly plants are operational, with 55 more in development. China leads with 20+ operational and 47 under construction, producing 16 GW annually and owning 58% of the global market. Excluding China, the Asia-Pacific region has 1.9 GW capacity.

Europe is second, currently producing 9.5 GW, and is set to reach 11.5 GW next year. North America and LATAM, Africa, & the Middle East have no operational facilities yet. Currently, European OEMs can handle demand, but starting in 2026, Europe’s offshore turbine capacity may need expansion to meet growing demand.

It is worth noting that only about one-third of this anticipated new capacity will be added between 2023 and 2027 due to challenging market conditions. GWEC noted that increasing investment and global cooperation will be crucial to address these bottlenecks and accelerate progress.

According to GWEC CEO Ben Backwell, the offshore wind industry has continued to demonstrate remarkable growth, building upon the previous year’s record-breaking achievements. Such sustained growth can potentially create a transformed, clean, and reliable energy system, especially in the Asia-Pacific region.

Backwell underscored the importance of governments and industries worldwide collaborating closely to unlock this growth potential. He stressed the significance of trade and industrial policies focusing on partnerships and cooperation to facilitate the necessary investment and expansion.

Meeting Great Expectations

Offshore wind has a promising future but faces challenges. The gap between targets and annual installations, along with the pace of growth, must align with climate goals.

GWEC suggests collaboration and decisive action in various areas, including leasing, permitting market design, and supply chain, are vital to fulfilling offshore wind’s potential.

The Global Wind Energy Alliance (GOWA) was established in September 2022 as a collaborative initiative involving the government of Denmark, IRENA, and the GWEC. The alliance now has 14 country members, including Denmark, Australia, Belgium, Germany, Japan, Colombia, Ireland, Netherlands, Norway, Portugal, Spain, St. Lucia, State of Victoria, UK and USA.

Its mission is to accelerate the adoption of offshore wind energy on a global scale. GOWA seeks to achieve this by mobilizing political support and fostering a worldwide community of practice.

GOWA aims to contribute to achieving a global offshore wind capacity of at least 380 GW by 2030 and an impressive 2,000 GW by 2050.

To make substantial progress toward these goals, GOWA plans for an average deployment of 35 GW annually during the 2020s and a minimum of 70 GW each year starting in 2030.

GOWA operates as a multi-stakeholder initiative guided by principles of public-private partnership.

According to a GWEC report, India will likely have a cumulative wind energy capacity of 63.6 GW, with a potential range spanning from 59.3 GW to 68.1 GW, by 2027, which is currently 41.9 GW.

Last March, Ireland, Italy, Morocco, the Philippines, and the United States were identified as the vanguards spearheading the forthcoming wave of floating offshore wind development, according to the GWEC.