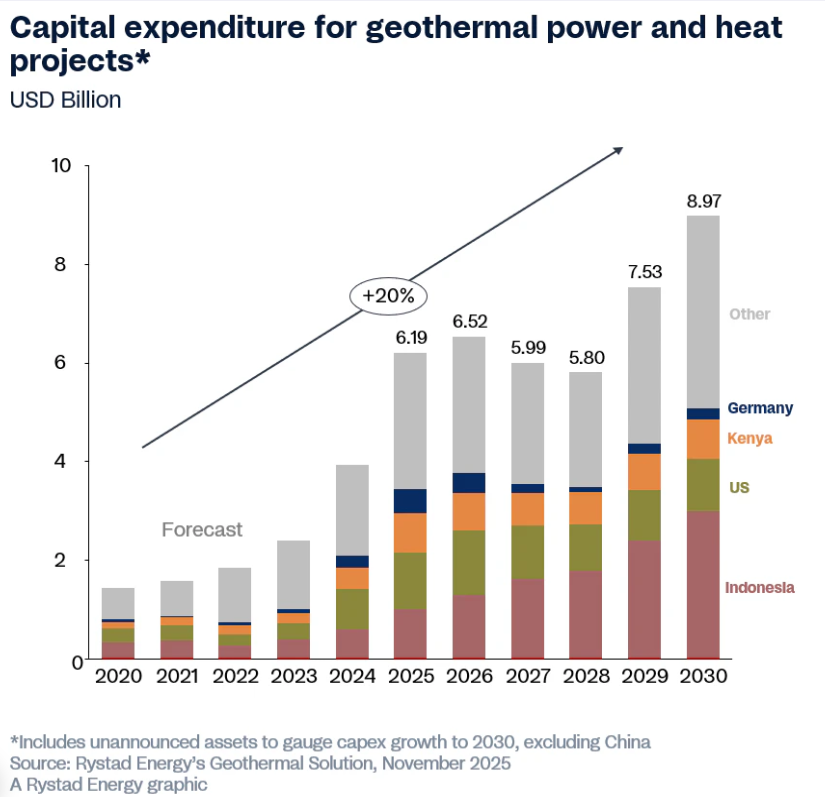

Global Geothermal Investment to Grow 20% Annually by 2030: Report

Geothermal is expanding into new regions and beyond mature hubs

December 22, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Global investment in geothermal energy is entering a phase of accelerated growth, with capital expenditure expected to increase by about 20% annually through 2030, according to Rystad Energy’s latest geothermal economics model.

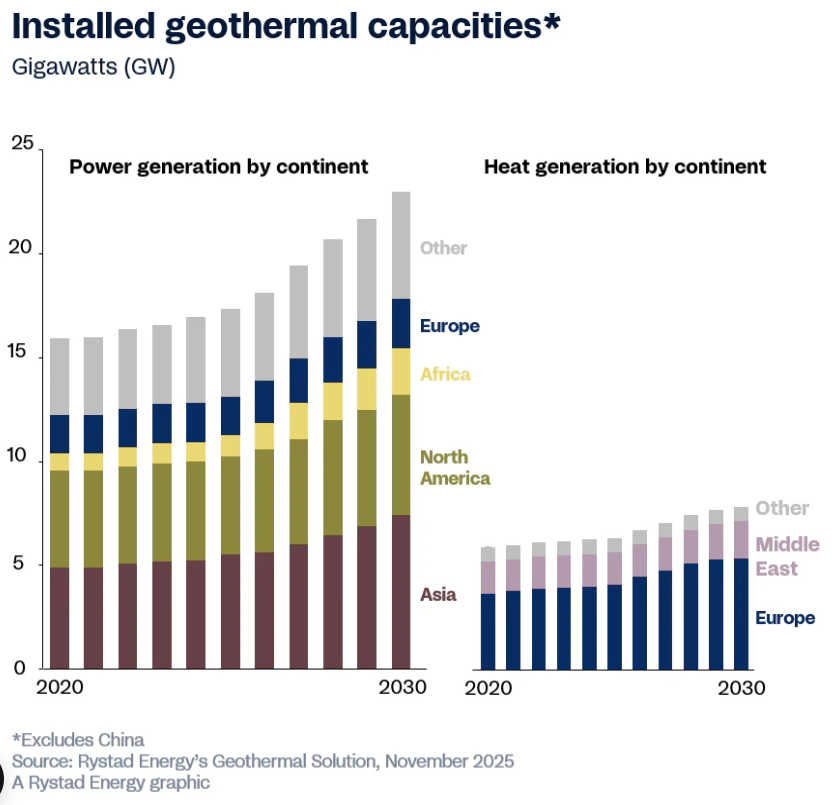

Geothermal energy, produced by tapping heat from deep within the earth, is no longer limited to mature markets in Southeast Asia and the U.S. Interest is steadily expanding in regions such as Africa and Europe, contributing to a broader global footprint.

Despite this geographic expansion, the distribution of spending across development categories remains largely stable due to consistent cost structures associated with drilling, surface facilities, and steam field infrastructure.

Stable Cost Structure

Currently, just over half of total geothermal spending is allocated to surface facilities, around 47% to subsurface development, and approximately 2% to activities before the final investment decision (FID).

This cost distribution is broadly consistent across most markets and has become a defining characteristic of geothermal project economics. While pre-FID spending represents a relatively small share of total investment, it carries significant risk, as early-stage exploration determines whether a project proceeds or is abandoned.

The stability in cost allocation also helps explain why geothermal project timelines and financing requirements remain relatively uniform across regions, even as overall investment activity increases.

Cost Comparison

Rystad Energy’s analysis evaluates individual geothermal assets and their specific cost components, including drilling operations, equipment, and surface infrastructure, rather than focusing only on total project costs.

Geothermal projects are primarily used for district heating systems or electricity generation and are among the few energy sources capable of providing continuous, clean baseload energy.

District heating projects typically require about $3/watt, roughly half the investment needed for geothermal power plants, which average around $6/watt.

These cost differentials are critical for policymakers, investors, and developers when assessing project feasibility, selecting technologies, and planning long-term geothermal development strategies.

Regional Deployment

Geothermal deployment varies significantly across continents, shaping both installed capacity and investment patterns. Europe stands out as a market dominated by district heating projects, driven by ambitious decarbonization targets and extensive municipal heating networks.

In contrast, Asia, particularly Indonesia, and North America focus primarily on electricity-generating geothermal projects, reflecting strong baseload power needs and favorable geological conditions.

These differences influence how capital is allocated within projects. In Europe, a larger share of investment is directed toward subsurface development for heating applications, even though surface infrastructure costs are lower.

Asia and North America, meanwhile, exhibit a more balanced demand between drilling and surface facilities required for power generation.

Role of EGS

Technological developments are further expanding geothermal’s potential. Enhanced geothermal systems (EGS) reduce reliance on naturally occurring aquifers by requiring only hot rock, significantly reducing site dependence and unlocking additional clean power and heat potential.

EGS also supports geothermal’s role as a stable baseload energy source. Beyond power and heating, geothermal technology is showing long-term promise in cooling applications.

Pilot projects in the Middle East are exploring this use case, including the UAE’s first geothermal cooling facility, the G2COOL project, which aims to provide cooling solutions for data centers.

Projects Moving Toward FID

Global geothermal investment momentum is strengthening as more projects progress toward FID. Rystad Energy’s research indicates that geothermal energy is increasingly being adapted to meet regional energy needs, reflecting its dual role as a source of clean, reliable power and a provider of heat.

In the U.S., growth is being driven by the expansion of EGS and rising demand for baseload electricity from data centers. Europe’s geothermal development is primarily focused on decarbonizing heat, while Southeast Asia is increasingly turning to geothermal energy to meet growing electricity demand.

According to Alexandra Gerken, Vice President, New Energies Analysis at Rystad Energy, geothermal energy’s ability to deliver stable baseload power and heat is strengthening its role in the global energy transition, with emerging applications such as cooling also gaining attention.

Geothermal capacity has the potential to meet up to 15% of the global electricity demand growth by 2050 with continued technological improvements and a reduction in project costs, according to the International Energy Agency’s ‘The Future of Geothermal Energy’ report.

In May this year, the U.S. Geological Survey indicated that geothermal energy in Nevada’s Great Basin and adjoining areas could potentially supply electricity equivalent to one-tenth of the current U.S. power demand.