Geothermal Energy Could Meet 15% of Global Power Demand by 2050: IEA

India is expected to be the third-largest market for next-generation geothermal power capacity by 2050

August 22, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Geothermal capacity has the potential to meet up to 15% of the global electricity demand growth by 2050 with continued technological improvements and a reduction in project costs, according to the International Energy Agency’s (IEA) ‘The Future of Geothermal Energy’ report.

The geothermal energy potential is increasing as developers access higher heat resources at greater depths by exploring and utilizing newer technologies.

Primarily, two new drilling methods, geothermal systems (EGS) and advanced geothermal systems (AGS), are being explored. These methods reduce the need for natural-reservoir dependency and enable the technical exploitation of geothermal heat in almost any location.

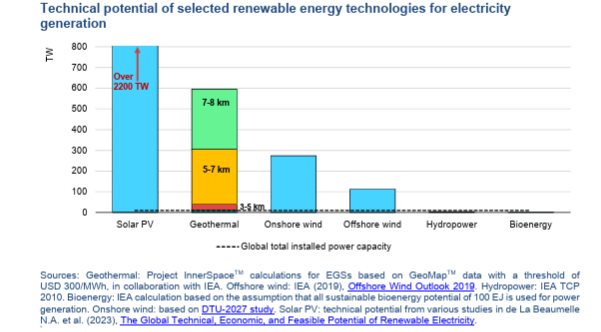

These new drilling technologies, which explore resources at depths beyond 3 km, increase the potential for geothermal energy in nearly all countries.

Utilizing thermal resources at depths below 8 km can provide nearly 600 TW of geothermal capacity with an operating lifespan of 25 years.

According to the report, Africa has one-fifth (115 TW) of EGS power potential and the largest untapped conventional geothermal potential.

The technical potential of geothermal energy would be more than enough to meet all electricity and heat demand in Africa, China, Europe, Southeast Asia, and the U.S.

The cost-effective deployment with newer drilling technologies could effectively generate 8,000 terawatt-hours (TWh) per year.

Currently, geothermal accounts for less than 1% of global energy demand, with primary activity concentrated in the U.S., Iceland, Indonesia, Türkiye, Kenya, and Italy.

On average, global geothermal capacity has a utilization rate of over 75% in 2023, compared to 30% in wind and less than 15% in solar projects.

Investments

In 2023, investments in geothermal power and heat exceeded $47 billion, accounting for over 5% of total spending on all renewable energy projects. China alone registered for over 70% of all geothermal investments.

With deep cost reductions for next-generation geothermal, the report estimates that total investment in this sector could reach $1 trillion cumulatively by 2035 and $2.8 trillion by 2050.

According to the IEA, geothermal energy is also seeing significant interest from power-intensive sectors, such as data centers.

Heating applications for residential and commercial buildings, including ground-source heat pumps, make up over 95% of global geothermal investments.

Harnessing the potential of geothermal power sources could help countries like China, India, and those in Southeast Asia transition away from coal-based power sources. It could also complement the power generation of solar and wind projects in Europe and the U.S.

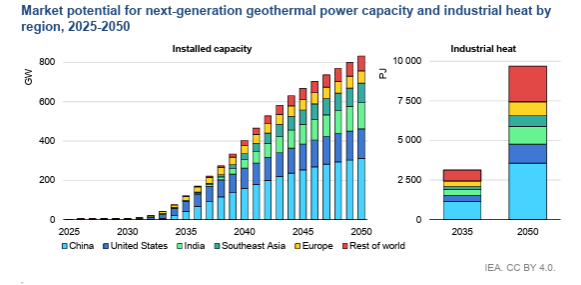

China, the U.S., and India are considered markets with the greatest potential for next-generation geothermal electricity, accounting for three-quarters of the total global potential.

Cost-competitiveness

Conventional geothermal power generation costs are site-specific, and lower expenses can be achieved only in certain locations with favourable natural resource availability.

As a result, generation costs for geothermal plants built during 2010 to 2023 vary widely, with the estimated levelized cost of electricity (LCOE) ranging from $40/MWh to over $240/MWh.

As a result, the global average annual generation costs reported over the past decade have been in the range of $60/MWh to $80/MWh. While a limited number of large-scale projects achieved electricity generation costs below $80/MWh, this exceeds the LCOE of most solar and wind installations.

With the right support for next-generation geothermal energy, the costs of geothermal power generation could decrease by 80% by 2035.

Newer geothermal projects could deliver electricity for around $50/MW, making it one of the most cost-effective dispatchable sources of low-emissions electricity, on par with or below hydro, nuclear, and bioenergy.

Policy changes

According to IEA, policy support is lagging for large-scale adoption of geothermal energy.

More than 100 countries have policies in place for solar and/or onshore wind, but less than 30 have implemented policies for geothermal.

The IEA has urged governments to elevate geothermal energy on the energy policy agenda by incorporating it as a prominent part of national energy planning, with dedicated goals and technology roadmaps.

The report recommends creating risk mitigation programs for early-stage project development in collaboration with national, regional, and international finance institutions.

To attract investments on a scale, IEA stressed the importance of long-term revenue certainty and fair remuneration, supported by contracts and programs that value geothermal’s contribution to grid adequacy and flexibility.

It also suggested simplifying and streamlining administrative processes, including the introduction of dedicated geothermal permitting regimes that are distinct from those for mineral mining.

The report also emphasized the need to expand geothermal-specific research and innovation programs, including the demonstration and field testing of emerging technologies, as a priority.

Outlook

Global conventional geothermal capacity is expected to increase by almost 50% to 22 GW by 2030 and to nearly 60 GW by 2050 in the IEA Stated Policies Scenario.

Under this scenario, projects currently under development and planned for the upcoming decade will be deployed in accordance with existing government policies.

Beyond 2030, the untapped economic potential of hydrothermal resources, long-term government goals, and increasing geothermal competitiveness are expected to drive further growth through 2050.

India

The report noted that India is expected to be the third-largest market for next-generation geothermal power capacity by 2050.

The dispatchability of next-generation geothermal would pair well with the production profile of solar energy in the country, which is expected to reach 35% of total electricity generation by 2035 and 50% by 2050.

If next-generation geothermal expands quickly enough in India, it could also eliminate the need for some portion of solar capacity and batteries, creating a more diverse clean energy mix.

According to the U.S. Geological Survey, geothermal energy in Nevada’s Great Basin and adjoining areas could potentially supply electricity equivalent to one-tenth of the current U.S. power demand. This represents a significant increase from current levels, as geothermal energy currently contributes less than 1% to the national power grid. The report updates a previous assessment from 2008 and emphasizes the role of EGS in unlocking this potential.