Global Battery Demand Soars, but Margins Tighten on Overcapacity

The Li-ion battery industry is grappling with 900 GWh of overcapacity

January 20, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

The global lithium-ion (Li-ion) battery industry is at an inflection point characterized by rapid demand growth, falling prices, technological advancements, and intensifying global competition, according to a report published by McKinsey & Company.

The demand for Li-ion batteries crossed 1 TWh in 2024 and reached nearly 1.6 TWh in 2025. However, at the moment, the industry is grappling with significant overcapacity, which was around 900 GWh in 2025, especially in Asia.

Significant manufacturing overcapacity in Asia has pushed battery prices to historic lows, with prices falling to around $108/kWh in 2025.

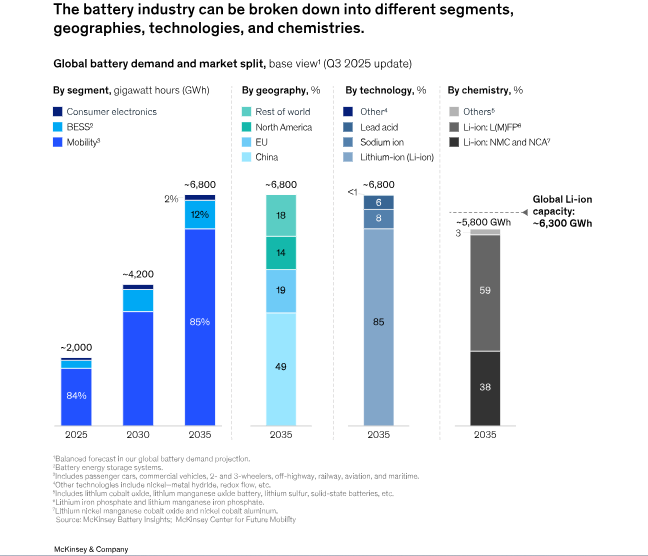

Looking ahead, the global battery market is expected to grow to about 4.2 TWh by 2030 and 6.8 TWh by 2035, with Li-ion technologies accounting for more than 85% of demand.

Looking ahead, the global battery market is expected to grow to about 4.2 TWh by 2030 and 6.8 TWh by 2035, with Li-ion technologies accounting for more than 85% of demand.

Lithium Iron Phosphate (LFP) batteries are projected to gain market share due to their lower cost and safety, especially in the electric vehicle (EV) market and battery energy storage systems (BESS), while Nickel-Manganese-Cobalt (NMC) chemistries will remain important for long-range vehicles.

Rise of Lithium Iron Phosphate Batteries

The report forecasts that the LFP battery market share will reach 49% in the European Union in 2030 and 52% in 2035, with North America at 47% in 2030 and 49% in 2035.

According to the report, LFP batteries are expected to expand their market share due to their low cost, safety, and suitability for mass-market EVs and energy storage, while NMC chemistries will remain essential for long-range and premium vehicles. Incremental improvements—such as higher silicon content in anodes, better electrolytes, and safer separators.

Emerging technologies like sodium-ion and solid-state batteries show promise but are unlikely to displace conventional Li-ion batteries at scale. LFP batteries are expected to expand their market share due to their low cost, safety, and suitability for mass-market EVs and energy storage, while NMC chemistries will remain essential for long-range and premium vehicles.

Key to Survival of Li-ion Batteries

In 2025, Li-ion battery pack prices fell by 8%, continuing their downward trajectory after a 20% reduction in 2024. This drop indicates that competition and margins are tightening as the global battery supply significantly exceeds demand.

Going forward, costs are expected to remain relatively stable, possibly even rising slightly, as continued technological improvements are balanced by a gradual rebound in material prices.

The cost of four-hour Li-ion battery systems could decline from $334/kWh in 2024 to as low as $108/kWh or remain as high as $307/kWh by 2050, according to the National Renewable Energy Laboratory.

Emerging Regions

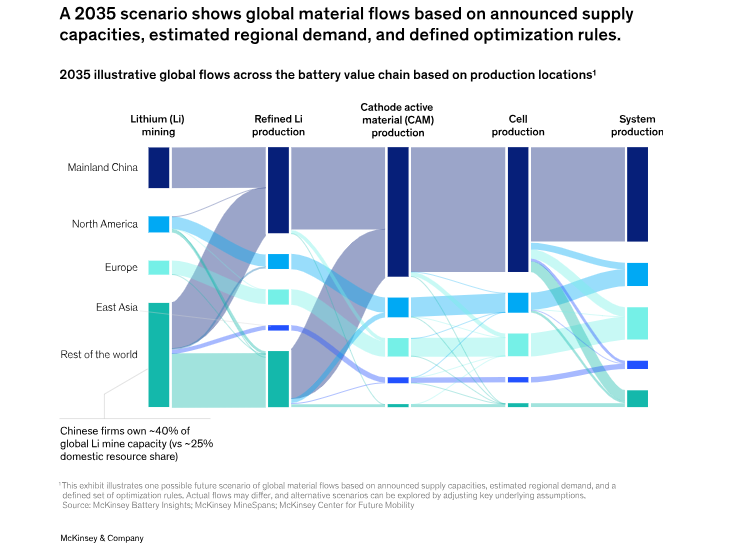

Europe and the U.S. are emerging as the two regions that must significantly accelerate efforts to build competitive battery industries. Although Asian producers, especially China, currently dominate global battery supply chains, both Europe and North America are pushing to localize production.

In Europe, the Green Deal Industrial Plan and the Critical Raw Materials Act aim to ensure that by 2030 at least 40% of clean-technology needs are met domestically. To achieve global competitiveness, Europe will need to invest an estimated €300 billion (~$348.66 billion) by 2035 across the full battery value chain.

The U.S. is pursuing a parallel path, largely driven by the Inflation Reduction Act (IRA). Although the federal EV purchase tax credit expired in 2025, the IRA’s Section 45X production credit of $35/kWh remains a powerful incentive, reducing battery cell manufacturing costs by nearly 50%.

Both regions face structural challenges due to imbalanced supply chains, particularly in midstream activities such as anode graphite and cathode precursor production, where the EU and US each account for less than 10% of global capacity.

BESS to the Fore

Beyond EVs, the report places strong emphasis on the rapid growth of BESS. As renewable energy generation increases, grid-scale storage is becoming essential for balancing supply and demand. The report notes that while battery chemistry is important for BESS, project economics depend more on system design, regulatory frameworks, and revenue mechanisms such as energy arbitrage and ancillary services.

McKinsey estimates that total installed BESS capacity will reach 200 GWh by the end of 2025 and will likely reach between 500 GWh and 700 GWh by 2030. In the U.S., 2025 is expected to be another record year for BESS capacity additions. Increasing data center power demand due to growth in AI and cloud computing is catalyzing BESS installations.

Europe has a BESS project pipeline of about 60 GWh by 2030, but it lags behind the storage volumes needed to balance renewable growth.

According to an Ember report, the capital cost for long-duration (4 hours or more) utility-scale BESS in markets outside China and the U.S. reached roughly $125/kWh by October 2025. Such reductions translate into a levelized cost of storage of $65/MWh for large, contracted projects.

Technology Outlook

LFP batteries are expected to dominate short- to medium-duration storage, with sodium-ion batteries emerging as a lower-cost option for stationary applications.

By 2035, the BESS market is likely to be segmented by use-case and duration. LFP is expected to remain the prime option for up to 6-hour systems due to its cost, safety, and reliability. Also, sodium-ion batteries may offer a low-cost alternative to Li-ion batteries.