Europe’s Power Market Reprices as Renewables Reshape Value: Pexapark

Falling capture rates and negative prices push capital toward flexibility

February 4, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

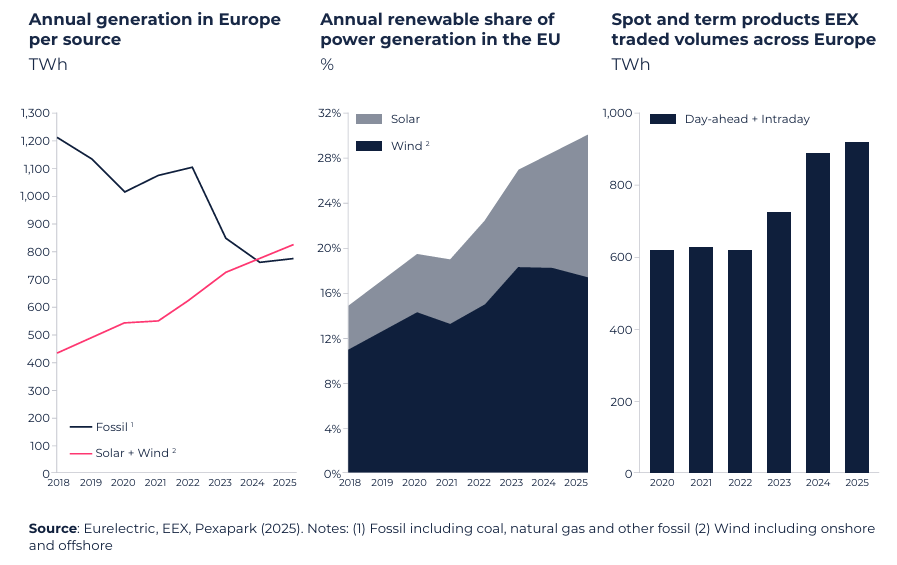

Europe’s power system has entered a phase dominated by renewables, fundamentally changing price formation, risk allocation, and revenue stability. In 2025, renewables accounted for 47.8% of total EU electricity generation, with solar output exceeding 340 TWh, representing 12.6% of the power mix, according to Pexapark’s Renewables Market Outlook 2026.

Solar and wind together contributed around 30% of total generation, overtaking fossil fuels and nuclear as the single largest technology block. This transition has not resulted in stable low prices but in what the report terms a “Big Repricing,” where headline prices matter less than capture rates, volatility exposure, and risk-adjusted revenues.

Renewable Dominate

As renewable penetration has increased faster than system flexibility, capture factors for solar and wind have eroded sharply across Europe. In core markets such as Germany, Spain, and France, solar capture factors fell to roughly 50% to 60% of baseload prices in 2025, compared with near-baseload parity just a few years earlier.

Germany’s solar capture factor declined to about 53%, Spain’s to 51%, and France’s to 58%. Onshore wind capture factors in high-penetration regions such as Finland and Sweden also converged within a range of 52% to 55%.

Negative pricing has shifted from an edge case to a central market feature. Europe recorded more than 9,000 negative price hours across all bidding zones in 2025, with Germany and Spain each experiencing negative prices for over 6% of total hours.

Daily price stands widened significantly, with day-ahead volatility rising by up to EUR30 (~$35.41)/MWh year-over-year (YoY) in some markets. Pexapark expects capture factors to reach new lows and negative price events to increase further in 2026 before stabilizing later in the decade, assuming flexibility deployment accelerates.

PPAs Under Pressure

These dynamics have fed directly into power purchase agreement (PPA) markets. European PPA volumes declined to 13.1 GW in 2025 from 15.3 GW in 2024, reflecting buyer caution and widening price gaps between offtakers and developers.

Solar PPAs proved relatively resilient, declining only about 7% YoY despite severe cannibalization, while offshore wind PPA activity collapsed to 286 MW from 1.87 GW in 2023 due to cost inflation and pricing mismatches. Mixed-technology PPAs fell 33% YoY.

PPAs themselves are becoming more complex. Contracts increasingly include shared-risk structures, explicit treatment of negative prices, curtailment clauses, and financial overlays rather than fixed-price baseload assumptions.

In the U.S., clean energy PPA volumes declined 22% YoY despite record solar and storage deployment, largely due to policy uncertainty following the passage of the One Big Beautiful Bill, which heightened uncertainty around tax credits and tariffs.

Pexapark estimates this could reduce cumulative U.S. solar and wind buildout by around 41 GW by 2030.

Storage Moves to the Core

Battery energy storage systems (BESS) have moved from a niche asset class to core market infrastructure. Around 12 GW / 24 GWh of BESS capacity was contracted in Europe in 2025 under fixed-price agreements (FPAs) and optimization contracts, roughly three times the volume seen a year earlier.

Fixed-revenue FPAs alone reached 6.5 GW, up about 100% YoY, while utility-scale BESS installations added 16 GWh in 2025, representing 80% YoY growth and a 92% compound annual growth rate over five years.

Utilities dominated this segment, accounting for 77% of the contracted BESS FPA volumes in Europe, reflecting their balance sheet strength and ability to intermediate risk.

The UK emerged as the largest BESS FPA market, representing more than 75% of disclosed European capacity, with floor structures accounting for around 80% of deals.

Two market archetypes have emerged: merchant-driven storage markets such as the UK and Germany, and subsidy-backed markets such as Italy and Spain, where CAPEX support schemes underpin investment.

Co-located storage is growing rapidly, but from a low base, with contracted volumes up around 850% YoY in 2025. Despite this growth, standalone systems still dominate, particularly in merchant-oriented markets. Pexapark forecasts new European FPA volumes exceeding 10 GW in 2026, with at least one-third using financial structures, such as day-ahead swaps.

According to a Wood Mackenzie report, Europe’s BESS market has matured, with deployments reaching 11 GW in 2024. Installations are expected to grow 45% YoY to 16 GW by the end of 2025 and 35 GW by 2034.

Shifting Roles Across the Value Chain

These market shifts are reshaping participant roles. Utilities have re-emerged as central risk managers, increasing PPA offtake volumes by over 200% YoY and expanding across PPAs, FPAs, optimization, balancing, and portfolio hedging.

Independent Power Producers (IPP) face margin pressure from falling capture rates, persistent negative prices, and rising imbalance costs, which in some Nordic markets reached up to 15% of day-ahead prices.

Many IPPs are shifting from asset-centric models to revenue- and portfolio-management approaches, with greater reliance on structured offtake and storage.

Large technology companies and data center operators are advancing toward firm, system-aligned clean power, including nuclear, hydro, and hybrid portfolios, as well as “bring-your-own-power” models.

Regional Divergence and Outlook

At a regional level, Spain remained Europe’s largest PPA market at 3.9 GW despite having the lowest solar capture factors, supported by pipeline depth and wind PPAs used to rebalance solar-heavy portfolios.

Germany saw the sharpest contraction in PPA volumes due to severe solar cannibalization but emerged as a key growth market for merchant BESS and virtual tolling FPAs.

Italy and Poland gained momentum through policy-backed schemes such as Italy’s MACSE auctions and Poland’s CAPEX subsidy programs. In the Nordics, wind-heavy systems experienced high imbalance costs, while Southeastern Europe remains early-stage but attractive for initial BESS deployment.

Solar PPA prices in Europe declined 2.4% QoQ in Q3 2025, according to a report by LevelTen Energy.