Solar PPA Prices in Europe Fall 2.4% in Q3 on Weak Industrial Demand

The wind market was stable with just a 0.1% dip across 19 countries

October 22, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Solar power purchase agreement (PPA) prices in Europe declined 2.4% quarter-over-quarter in the third quarter (Q3) of 2025, according to a report by LevelTen Energy. Wind PPA prices remained stable, decreasing only 0.1%.

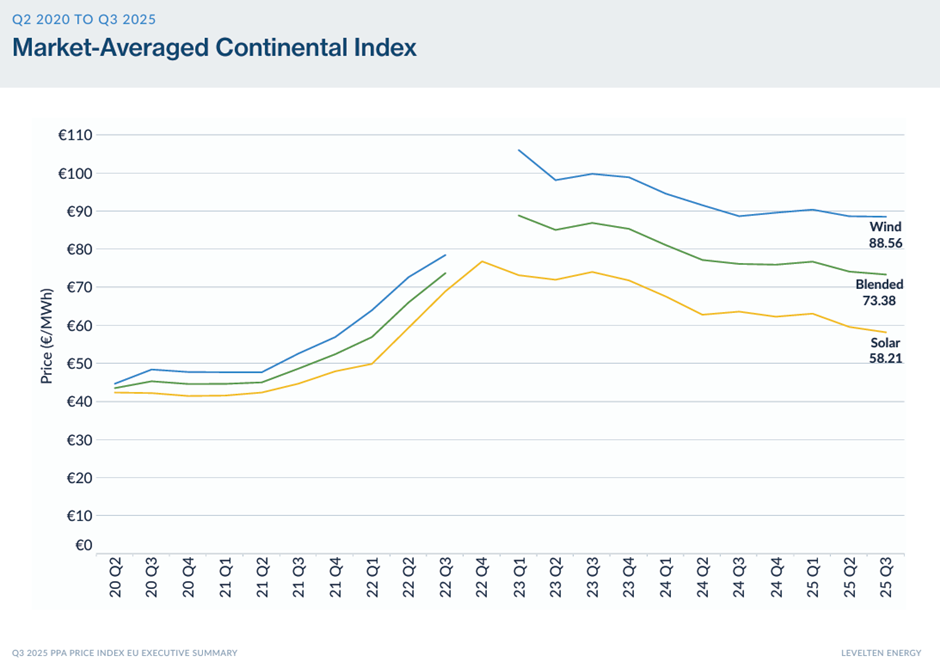

The market-averaged P25 prices were €58.21 (~$67.93)/MWh for solar, €88.56 (~$103.37)/MWh for wind, and €73.38 (~$85.61)/MWh for blended renewables. Data were sourced from 280 offers across 215 projects in 19 countries, including new additions such as Portugal to the Wind Index.

The report said Europe’s solar market is affected by oversupply and negative wholesale prices, particularly in Germany and Spain, suppressing revenues for standalone solar projects.

In Q2, P25 prices in Europe fell by over 5% after three quarters of stable trends.

Industrial demand has been weaker than expected in several countries, though data center energy consumption in Ireland, Finland, and Spain continues to drive demand for renewable PPAs. Hybrid PPAs, combining solar or wind with battery energy storage systems (BESS), are increasingly being adopted in Europe to mitigate price volatility and revenue cannibalization.

Solar PPA prices in Europe showed divergence across regions. Ireland posted the highest P25 solar prices due to ongoing high demand from rapidly expanding data centers. Portugal recorded the lowest prices, with developers offering contracts below Spanish levels to remain competitive amid overgeneration.

Overall, the European solar market continues to struggle with oversupply, price cannibalization, and negative wholesale electricity periods, particularly in Germany, where more than 100 GW of solar capacity is installed.

Developers in Germany are increasingly turning to hybrid PPAs with BESS to stabilize revenue streams. Current storage capacity in Germany is estimated at 20 GWh, while projections suggest that 100 GWh will be required by 2030 to meet system flexibility needs and support industrial demand.

Europe Wind Market

Europe’s wind PPA market remained largely stable during Q3 2025. Finland recorded the lowest P25 wind prices, while Italy reported the highest. France re-entered the wind index for the first time since Q2 2024, with corporate buyers seeking alternatives following the end of the nuclear access program, resulting in a €20 (~$23.26)/MWh reduction in wind P25 prices compared with 15 months prior.

Across seven markets reporting adequate offers, the wind sector has demonstrated resilience compared with solar, benefiting from government policy liberalizations, new project pipelines, and recovery from pandemic-era permitting delays.

Developers, including IGNIS Energy, which operates across ten countries with 30 GW of solar, wind, and storage projects and 10 GW under management, continue to face challenges such as permitting bottlenecks, grid constraints, and falling PPA prices.

Policy and Regulatory Context

Several policy developments impacted the European market. In France, political instability marked by a second government collapse within a year has increased uncertainty around renewable energy policy, encouraging reliance on PPAs as a more secure procurement option.

The UK retained a single national electricity price, providing certainty for developers and investors.

Finland’s proposed Land Use Act, which mandates wind turbine setbacks eight times turbine height, poses potential constraints for new wind projects. These dynamics shape investment strategies and PPA structures across the continent.

Across Europe, hybrid PPAs combining wind, solar, and storage are gaining traction, particularly in Germany, Spain, and France, as buyers seek revenue stability amid price cannibalization and policy uncertainty.

The European wind and solar PPA markets remained stable in Q1 2025. Solar PPA prices in the Market-Averaged Continental Index rose by just 1% from the previous quarter, while wind PPA prices increased by 1%.