Average Cost of Large-Scale Solar Projects Drop by 8% YoY in Q2

The slump in solar module prices contributed to the declining project costs

September 4, 2023

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

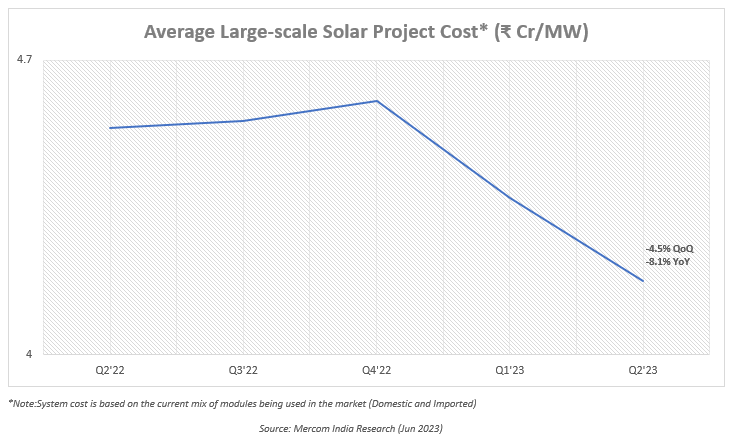

The average cost of large-scale solar projects in India declined by 8.1% year-over-year in the second quarter (Q2) of 2023. Continuing from the previous quarter, the cost reduction was primarily driven by the falling module prices, which account for approximately 60% of the solar project cost.

The average project costs decreased by 4.5% quarter over quarter (QoQ).

The findings were published in Mercom India Research’s recently released Q2 2023 India Solar Market Quarterly Update.

With increasing production and falling polysilicon prices and other solar module value chain components in China, the procurement costs of solar modules have reduced significantly.

According to the Chinese Ministry of Industry and Information Technology (MIIT), the country’s

national output for polysilicon, wafers, cells, and modules increased 72% year-over-year (YoY) in March and April 2023. Polysilicon prices in China declined steeply during Q2 2023 as several new manufacturing facilities became operational in 1H 2023.

The Chinese mono PERC modules’ average selling price (ASP) has fallen 8.8% QoQ and 28% YoY.

India imported solar cells and modules totaling $926.6 million (~₹76.1 billion) in Q2 2023, a QoQ increase of 14.1% compared to $812 million (~₹66.7 billion) in Q1 2023. Imports were up 55.1% YoY compared to $597 million (~₹49.0 billion) in Q2 2022. Solar cells accounted for 55% of the quarter’s imports.

The declining cell prices and increasing competition because of the Approved List of Models and Manufacturers (ALMM) postponement resulted in lower ASPs of Indian modules. The ASPs of Indian mono PERC modules dropped 4.3% QoQ and 16.1% YoY.

Developers expect module prices to fall further until the end of Q1 2024 due to high inventory and increasing production levels in China. Additionally, the stay on the ALMM implementation until March 2024 is expected to enable module procurement at competitive prices for domestic solar projects.

Module mounting structure costs were down about 13% QoQ, adding to the drop. Solar inverter cost, on the other hand, climbed QoQ.

During Q2 2023, India’s quarterly capacity additions were down almost 58% YoY, with 1.7 GW installed, of which utility-scale installations accounted for over 1.3 GW, down 64% YoY and 7% QoQ.

India’s cumulative installed solar capacity, including rooftop solar installations, surpassed 66 GW as of June 2023.

Mercom’s Q2 2023 India Solar Market Quarterly Update is 82 pages long and covers all facets of the Indian solar market and a detailed analysis of the project cost trends. For the complete report, visit: https://www.mercomindia.com/product/q2-2023-india-solar-market-update.