World Lags 2030 Renewable Energy Goals Despite Record 741 GW Additions: Report

China led with 445 GW or 60.2% of the total renewable capacity additions in 2024

June 25, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Despite global renewable energy capacity adding a record 741 GW in 2024, the world is projected to fall short of the goal to triple renewable capacity by 2030 by 800 GW, according to the Renewables 2025 Global Status Report published by REN21.

China led with 445 GW or 60.2% of the total capacity additions. Europe followed with 92 GW, Oceania and Asian countries, excluding China and India, added 73 GW, and North America contributed 56 GW. India installed 36 GW, Brazil 18 GW, the rest of Latin America and the Caribbean 8 GW, and Africa and the Middle East together added 13 GW.

Power Mix

Global electricity generation reached an all-time high of 30.9 thousand TWh in 2024, with renewables contributing 31.9% of the total. Fossil fuels remained the dominant source, accounting for 18.2 thousand TWh or 59.1%, although their share continued to decline. Nuclear power accounted for the remaining 9%.

Among renewable sources, hydropower was the largest at 14.3%, while solar and wind saw the fastest growth. Solar generation increased 16-fold between 2015 and 2024, reaching 2,132 TWh, or 6.9% of the global total. Wind power increased nearly fourfold to 2,494 TWh, representing 8.1% of total energy consumption. Bioenergy and geothermal sources together added 800 TWh or 2.6%.

Source: REN21

Total installed solar capacity reached 2.25 TW in 2024, more than double the 2022 figure. An estimated 602 GW of new solar capacity was added, a 32% increase from 2023. China accounted for about 60% of this growth, followed by the U.S. with 8% and India with 5%. Pakistan emerged as a notable market, accounting for 3% of new capacity, surpassing the combined solar additions by Italy, France, and Australia, as battery-backed solar systems became a preferred option for achieving energy independence.

Wind power also reached a record high in 2024, with 116.8 GW of new capacity connected to grids. Onshore wind rose 3.1% to 109 GW, while offshore wind fell by 27.5%. China was again the primary driver, contributing 68.3% of total additions. Excluding China, global wind capacity additions declined by 9.6%.

By the end of the year, total installed wind capacity had reached 1,135.4 GW, an 11.2% increase. The wind sector faced ongoing challenges, including policy uncertainty, rising costs, permitting delays, grid constraints, and growing local opposition in some countries. Despite these challenges, deployment picked up in select emerging markets, supported by improved policy frameworks.

Despite the continuous expansion of renewable energy deployment, the world remains significantly behind the 2030 target of 11,000 GW of installed capacity. Reaching this goal will require more than doubling the current capacity within the next six years, demanding an unprecedented developmental pace.

Energy Storage

Battery energy storage systems were the fastest-growing storage technology in 2024, with 69 GW of new capacity added globally. This increased the total installed battery storage capacity to an estimated 150 GW, with grid-connected systems making up 78% of the year’s additions.

China led the deployment, accounting for 67% of new installations, driven by policies mandating battery storage alongside new solar and wind projects. The U.S. and Canada followed, with the U.S. alone adding 10.4 GW to reach a total of 26 GW. Other regions showing strong growth included Europe, Latin America, and the broader Asia Pacific.

Both the size and discharge duration of battery systems increased in 2024. Seventeen installations of more than 1 GW were deployed, up from just four in 2023. Around 140 such large-scale projects are planned for 2025 and 2026. In Europe, the average storage duration increased from one hour and forty minutes in 2023 to two hours in 2024, while in the U.S. and Canada, it reached three hours.

Pumped hydro storage remained the dominant energy storage technology, with total global capacity reaching 189 GW. Additions in 2024 totaled 8.4 GW, a 4.5% increase from the previous year.

The global energy storage capacity additions are expected to grow by 35% in 2025 to 94 GW or 247 GWh.

Investments

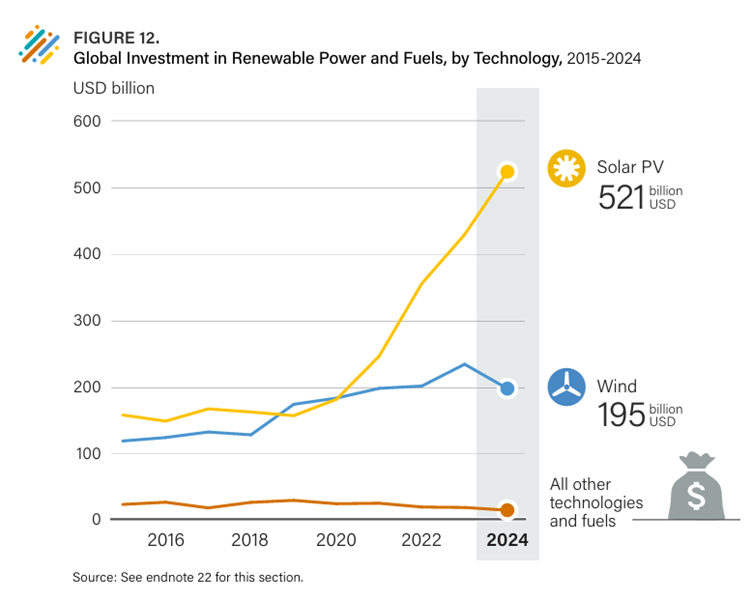

Global investment in renewable energy reached $728 billion, representing an 8% increase from the previous year. This increase was significantly lower than the 19% growth in 2023 and 23 23% in 2022. Solar power and electric vehicles received the bulk of the funding, highlighting an imbalance in investment across technologies. At just 48% of the annual level required through 2030, renewable energy investment remains insufficient to meet the target of net-zero greenhouse gas emissions by 2050.

Source: REN21

Annual investment in solar power surged 22% in 2024 to reach $521 billion, outpacing the 20% growth in 2023 and underscoring the continued dominance of solar in the energy transition.

Investment trends show significant regional disparities. Between 2015 and 2024, China consistently led global renewable investment, peaking at over $290 billion in 2024. Investments in the European Union and the UK dropped from $142 billion in 2023 to $114 billion in 2024, while U.S. investment fell from $110 billion to approximately $97 billion. In contrast, investment in Asia (excluding China), Africa, and the Middle East continued to accelerate.

Wind energy investment decreased by roughly 15% in 2024, falling to its lowest level since 2021. Persistent permitting issues, supply chain problems, and weak policy signals drove this decline. Several U.S. and European offshore wind projects defaulted in 2023 and 2024 due to unhedged costs and inflexible revenue-support programs. Rising prices for materials, labor, and logistics added pressure, as did the broader economic fallout from the war in Ukraine, which raised capital expenditures for developers worldwide. These factors, combined with narrow margins and unfavorable project economics, made conditions especially difficult for wind developers.

Investment in power grids and energy storage reached new highs in 2024. Grid spending increased 15% to $390 billion, with growth in all regions, particularly in Europe. Energy storage investment increased by 36% to $54 billion, driven mainly by projects in Asia and the U.S. However, grid investment must rise further to accommodate the scale of renewable generation needed to meet global climate goals.

High capital costs continue to be a significant barrier to the deployment of renewable energy in emerging and developing economies. For utility-scale solar and wind projects, the weighted average cost of capital is often more than double that in advanced economies due to political and economic instability, currency risks, and underdeveloped financial markets. These hurdles raise financing costs and make renewable projects less viable. Reducing the capital costs in these regions could substantially lower global financing needs.

A one percentage point reduction could cut the cost of reaching net zero by $150 billion annually. In countries such as Kenya and Senegal, high interest rates and currency risks make renewable investments far more expensive compared to developed markets. Without targeted policy and financial support, these regions risk falling behind in the energy transition.

Outlook

Source: REN21

As governments prioritize energy security and resilience, renewable energy sources are becoming increasingly central to national strategies. New national and international commitments highlight the growing recognition of renewable energy as vital for climate mitigation and adaptation.

Distributed and off-grid solar systems are also expanding rapidly in emerging economies, driven by public demand and demonstrating the effectiveness of decentralized energy solutions. Power purchase agreements, particularly from tech firms and industrial players, reflect growing confidence in renewables as a reliable and cost-effective source of energy.

The integration of renewable energy across housing, mobility, and industry is also opening new avenues for its adoption as the energy transition aligns with broader economic strategies. Advances in digitalization and artificial intelligence are improving grid operations. They are also enhancing system planning and enabling more adaptive energy systems.