Workforce Demand for Onshore and Offshore Wind Rises Sharply: GWEC

Global wind workforce to exceed 1 million FTE by 2030

December 9, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

The global wind energy sector is expected to require at least 1 million full-time equivalent (FTE) workers between 2025 and 2030 to meet projected installation and operational targets, according to the Global Wind Energy Council (GWEC) and the Global Wind Organisation (GWO).

This workforce will be essential across construction, installation, assembly, operation, and maintenance (O&M) activities. Of the one million FTEs, approximately 700,000 will be required for construction and installation, with 300,000 to support O&M operations, according to the Global Wind Workforce Outlook 2025.

An additional workforce will also be needed across project planning, site assessment, supply chain development, manufacturing, and repowering activities, but these figures focus on direct employment linked to project delivery.

Wind expansion has created high demand for construction jobs, which are often structured around project boom-and-bust cycles. Safety and competency standards, particularly those aligned with GWO, are critical to enabling workforce mobility, efficiency, and project delivery.

Wind deployment is set to reach record levels through the rest of the decade, with the world on course to deliver 1TW of wind energy between 2025 and 2030. That will take total installed wind capacity past 2.1 TW globally. To build and maintain this expanding fleet, the wind industry will require more than 628,000 skilled wind technicians by 2030.

The findings of this Outlook reaffirm that workforce readiness must be elevated to the same priority level as supply chain investment, permitting reform, and grid development. Achieving 2030 wind deployment goals will require coordinated, strategic investment in technician training, certification, and long-term retention, the report said.

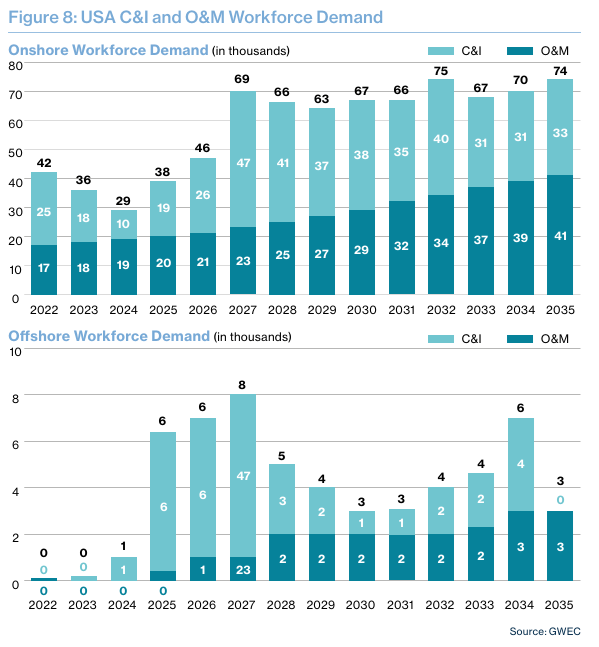

Lower Wind Projection for US

The U.S. had exceeded 154 GW of onshore wind installations at the end of 2024. Despite this, new onshore capacity in 2024 fell below 4 GW, the lowest annual figure since 2014, due to market saturation, permitting delays, supply chain constraints, inflation, and political uncertainty.

Nearly 16 GW of onshore wind was under construction and 9.3 GW in advanced development across 79 projects. However, policy changes, including the rollback of the Inflation Reduction Act under the One Big Beautiful Bill Act, have reduced the projection for U.S. onshore wind capacity between 2025 and 2030 by 30% compared to previous forecasts.

Offshore wind development faces additional challenges, including a vulnerable local supply chain and macroeconomic pressures, creating a complex environment for workforce planning. Developers and contractors require clear visibility on pipelines to effectively mobilize and train the workforce, particularly for new offshore hubs.

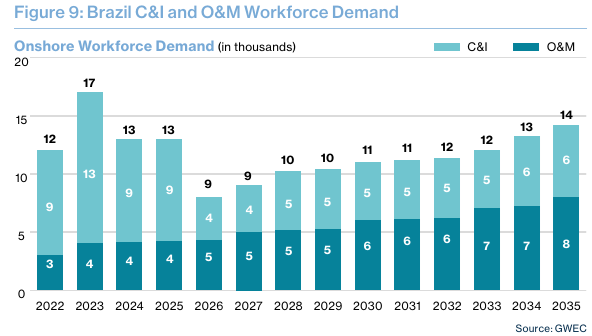

Brazil

Brazil’s wind market, driven by private power purchase agreements, accounted for two-thirds of the region’s capacity additions over the past four years, establishing it as the largest wind market in Latin America.

By the end of 2024, Brazil had installed 33.7 GW of wind capacity across 1,103 wind farms, comprising 11,720 turbines. Offshore wind development is expected to gain traction in the early 2030s, supported by Brazil’s experience in offshore oil and gas, including specialized vessels, subsea engineering expertise, and port infrastructure.

Workforce employment grew from 12,013 in 2022 to 16,686 in 2023, then moderated to 12,857 in 2024. Projections indicate a gradual increase to 13,552 workers by 2035, driven by both onshore installations and Brazil’s first commercial offshore projects.

Growth is expected to moderate in the short term due to weaker electricity demand, limited new energy auctions, and curtailment challenges, but medium- and long-term projections remain positive.

India

India added 3.4 GW of new wind capacity in 2024, raising operational capacity to around 53 GW, ranking it fourth globally. Forecasts anticipate more than 40 GW of additional capacity over the next five years, dependent on policy implementation, investment flow, and grid readiness.

Workforce demand spans engineering, manufacturing, construction, logistics, EPC, commissioning, and O&M. Employment increased from 15,643 in 2023 to 16,997 in 2024, with projections reaching 32,439 by 2030 and exceeding 41,000 by 2035, reflecting over 2.5 times growth.

Offshore wind development, estimated at 70 GW potential, will demand specialized skills in marine operations, port logistics, offshore safety, heavy equipment handling, subsea cable installation, and specialized maintenance.

NIWE’s Vayumitra Skill Development Programme and other initiatives have expanded the number of certified personnel from 2,000 in 2018 to 20,000 in 2024, with GWO-aligned training providers increasing from 1 to 27.

OEMs are scaling up their involvement in Engineering, Procurement, and Construction, and collaborative partnerships with developers and utilities are emerging for multi-gigawatt pipelines. Annual installation targets of 8 GW could generate around 116,000 direct and indirect jobs, while a more ambitious 15 GW scenario could create approximately 154,000 jobs.

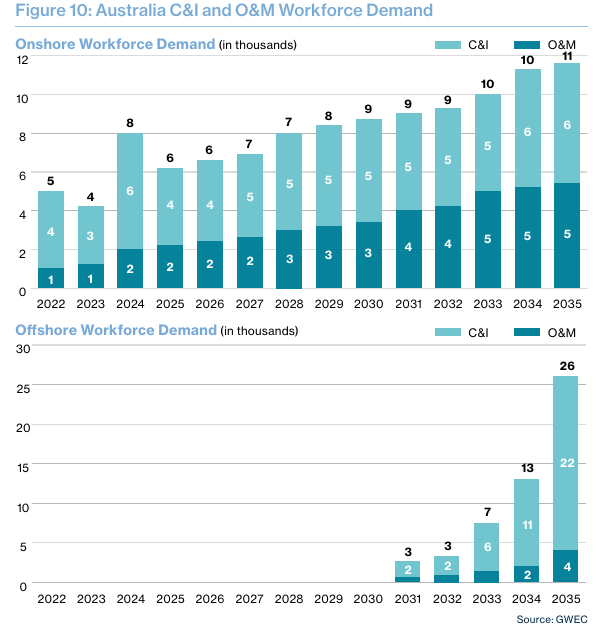

Australia

Australia had over 12 GW of installed onshore wind capacity by 2024, accounting for 13.4% of national electricity generation. In 2024, seven wind farms totaling 836 MW were commissioned, following a weak 2023.

Financial commitments reached 2,218 MW, with 19 projects worth 5.8 GW either under construction or committed. Offshore wind in Victoria saw total licensed capacity rise to 25 GW, supported by legislative targets of 2 GW by 2032, 4 GW by 2035, and 9 GW by 2040.

Construction and O&M of offshore projects could generate an estimated 4,000 jobs, with 500 long-term positions and 3,500 indirect roles in manufacturing. By 2030, Australia will need approximately 85,000 additional workers to deliver renewable infrastructure.

The Powering Skills Organisation highlights a projected shortfall of 42,000 clean-energy workers by 2030, particularly in technician roles, which threatens timely project delivery and may increase costs or cause commissioning delays.

Germany

Germany surpassed 70 GW of installed capacity by the end of 2024, driven by policy support, faster permitting, and the WindLandG mandate. Onshore additions reached nearly 11 GW through oversubscribed tenders, led by North Rhine-Westphalia, Lower Saxony, and Brandenburg.

Offshore wind also set a European record with 8 GW awarded. Rapid deployment, repowering, and robust auction schedules are expected to generate high workforce demand, with onshore technician requirements rising from roughly 19,834 in 2025 to over 40,000 by 2035, while offshore demand peaks at around 19,200 technicians in 2032–2033.

Specialized training in offshore operations, marine engineering, and safety ensures a skilled workforce, with over 27,000 people trained by the end of 2024. Continued policy stability and skills development will consolidate Germany’s leadership in Europe’s wind sector.

France

France reached 24.5 GW of installed capacity by the end of 2024, with wind contributing 11% of electricity generation. Offshore wind is advancing with 1.5 GW operational and additional projects under construction, including floating technology. Onshore growth slowed, adding 1.1 GW due to strict height restrictions, permitting delays, and legal challenges.

Workforce needs are growing, with over 31,000 people employed in the sector, and peak offshore demand expected to exceed 4,500 workers in 2025. France is expanding training capacity through GWO-certified centers.

Despite regulatory and logistical challenges, France anticipates adding more than 11.3 GW of onshore wind by 2030, requiring sustained workforce planning and training to meet future project demands.

Recently, the GWEC reported that offshore wind energy capacity additions reached 8 GW at the end of 2024, a 26% decrease from the previous year.

In June this year, the GWEC reported that global offshore wind saw its second-highest capacity installations in 2023. The industry added 10.8 GW of new capacity in 2023, up 24% from the previous year, bringing the global total to 75.2 GW.