US Solar PPA Prices Jump 4% in Q3 Amid Tariffs and Tax Shifts

Solar PPA prices averaged $59.77/MWh for the quarter

October 22, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

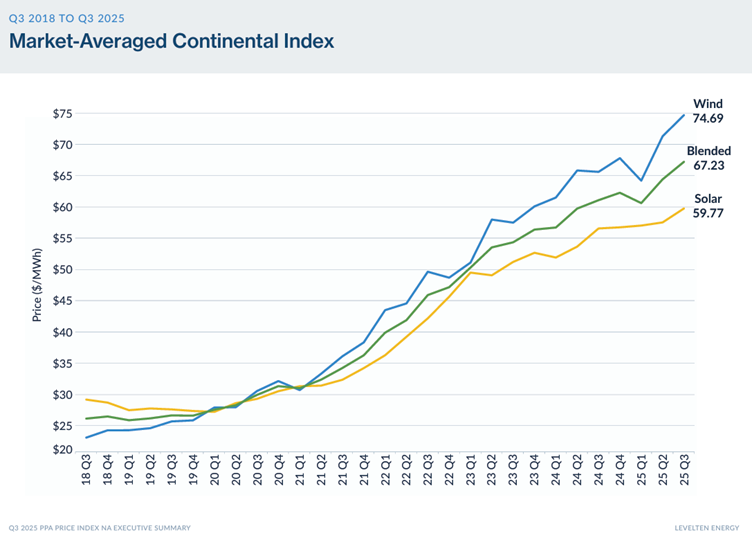

Solar power purchase agreement (PPA) prices in North America rose by 4% quarter-over-quarter in the third quarter (Q3) of 2025, per LevelTen Energy’s new report.

This increase is driven by rising material costs, federal tariff measures, and changes to clean energy tax credit timelines under new legislation.

The Q3 data covers virtual PPA offers uploaded between June and September 2025, representing financial settlements in the real-time wholesale energy markets of AESO (Alberta Electric System Operator), CAISO (California ISO), ERCOT (Electric Reliability Council of Texas), ISO-NE (ISO New England), MISO (Midcontinent ISO), PJM Interconnection, and SPP (Southwest Power Pool).

Solar PPA Prices

The solar PPA prices in Q3 2025 were influenced not only by tax credit timelines but also by rising costs of essential materials. P25 solar PPA prices averaged $59.77/MWh, up 4% from Q2. Key drivers include tariffs on steel, aluminum, and copper, which increased construction and EPC costs.

Developers are accelerating project timelines to “safe harbor” as many projects as possible before the July 2026 deadline, helping preserve eligibility for federal tax credits. The surge in construction activity is increasing the supply of tax-credit-eligible projects for buyers, but it also raises PPA prices in the short term.

In addition, anti-dumping and countervailing duties investigations into solar manufacturers in India, Indonesia, and Laos, combined with pending foreign entity of concern rules, are expected to elevate compliance and material costs further.

Developers have started incorporating price adjusters and indexation clauses in PPA contracts, allowing pricing adjustments post-signing if tariffs, trade investigations, or supply chain issues arise. These measures reflect a shift in the market, with developers increasingly sharing risk with corporate buyers.

Wind Market

The wind PPA prices increased by nearly 5% during Q3 2025. P25 wind prices averaged $74.69/MWh, marking a 14% rise year over year. Developers face tighter federal review processes, particularly for projects on public lands or private lands requiring federal review, with some previously approved projects being revoked.

Section 232 tariffs and potential levies on critical minerals add to project costs, making PPAs more expensive. Wind developers are seeking risk-sharing arrangements with buyers to close deals, reflecting the combined pressures of regulatory scrutiny and rising material expenses.

Section 232 tariffs impose steep 50% duties on aluminum, steel, and copper – key materials for solar and wind projects, as well as for grid infrastructure such as transformers and electrical wiring. This additional 50% tariff, applied on top of existing country-specific duties, has significantly increased the cost of essential components used across the renewable energy sector.

Despite challenges, wind remains highly attractive to corporate buyers, particularly technology companies and data center operators seeking clean energy at night. While developing new wind projects may face hurdles in the near term, strong buyer demand is expected for developers who can successfully bring new capacity to market.

Policy Changes

The PPA price increases were driven by the rush to qualify projects under the One Big Beautiful Bill Act, signed on July 4, 2025. The legislation shortens the federal tax credit qualification window, requiring projects beginning before July 4, 2026, to operate within four years, and projects starting after that to be operational by 2028.

Treasury guidance issued on August 15, 2025, eliminated the previous “5% Safe Harbor Rule,” requiring developers to meet the “physical work test” through tangible progress such as foundation excavation, module installation, or transformer manufacturing to qualify for Investment tax credits (48E) and production tax credits (45Y).

Developers must act quickly to secure tax credits, as missed deadlines could result in increased project costs and reduced returns.

An ongoing investigation by the Trump Administration into polysilicon imports could further raise costs for solar projects, alongside a recent anti-dumping and countervailing duty investigation into PV component manufacturers in Indonesia, India, and Laos. Collectively, these trade measures are contributing to rising solar prices, prompting developers to seek cost-sharing arrangements with buyers to offset higher capital expenditures and development risks stemming from evolving trade policies.

Regional Impacts

The PJM Interconnection region reported a record-high capacity auction clearing price of $329.17/MW-day in July 2025, up 22% year over year, driven by high data center demand and tight capacity supply.

Despite these challenges, companies such as Origis Energy, operating 1 GW of solar and storage, 3 GW under construction, and 25 GW in development, remain active in the market.

A LevelTen’s report for the first quarter of 2025 stated that PPA prices for renewable energy remained largely stable across North America.

In February this year, solar power purchase agreement prices in the U.S. rose by a modest 0.3% quarter-over-quarter in the fourth quarter of 2024, according to LevelTen’s Market-Averaged Continental Index.