US Slaps 102.72% Antidumping Duty on Chinese Active Anode Material Imports

February 13, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

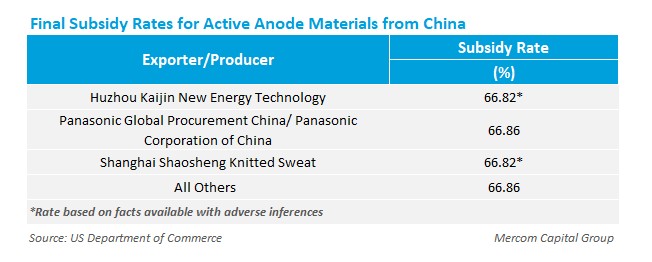

The U.S. Department of Commerce has determined antidumping (AD) and countervailing duties (CVD) of up to 102.72% and 66.86%, respectively, on the imports of active anode material from China.

The duty imposition followed investigations after the American Active Anode Material Producers filed petitions with Commerce and the United States International Trade Commission seeking the imposition of 920% tariffs on imports of natural and synthetic graphite from China to make lithium-ion battery anode material.

The Active Anode Material Producers is a coalition of five U.S.-based firms: Anovion Technologies, Syrah Technologies, NOVONIX Anode Materials, Epsilon Advanced Materials, and SKI US.

Last year, Commerce determined a preliminary weighted-average dumping margin of 93.5% on imports of active anode-grade graphite material from China, following an investigation into alleged unfair trade practices.

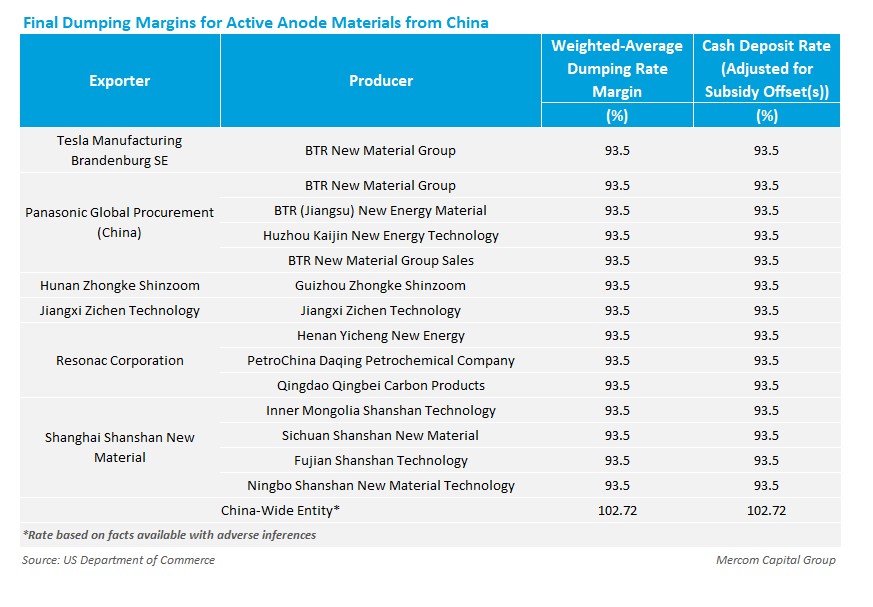

In its investigations, Commerce found that active anode material from China is being sold in the U.S. at less than fair value. For non-selected Chinese exporters, a dumping margin of 93.5% was calculated based on revised petition margins. The China-wide entity rate is even higher, at 102.72%, assigned using the adverse facts available method.

Last year, the U.S. issued preliminary CVD of up to 721% on imports of active anode material from China.

Chinese imports of active anode material into the U.S. totaled 84.29 million kg ($347 million) in 2023, 103.5 million kg ($380 million) in 2022, and 60.98 million kg ($143.29 million) in 2021.

Active anode materials are among the primary components of lithium-ion batteries, which power electric vehicles, consumer electronics, medical equipment, and other applications.

According to the petitioners, the demand for higher tariffs on graphite imports from China stems from years of significant volumes of such imports. While most graphite from China is currently subject to a 25% tariff, the petitioners argued that the duty is inadequate.

In another development, Commerce concluded that revoking the prevailing AD/CVD on crystalline silicon photovoltaic product imports from China and Taiwan will lead to a recurrence of dumping. It decided to retain the duties after final affirmative determinations in the second sunset review of the 2015 AD/CVD orders.