US Energy Storage Installations Hit 5.6 GW in Q2 2025

The utility-scale energy storage market accounted for 4.9 GW

September 29, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

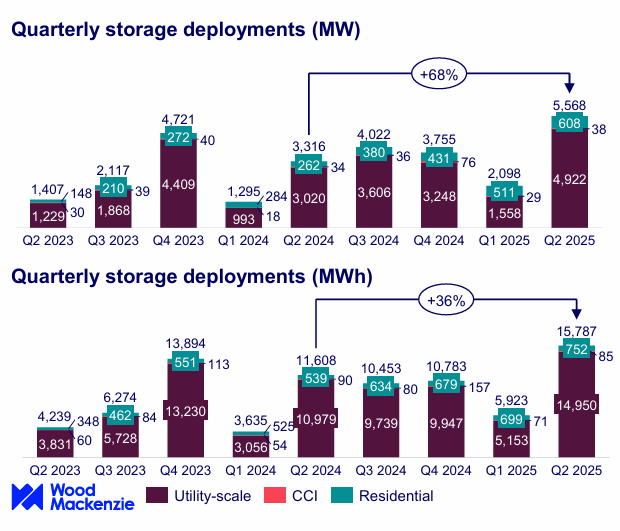

The U.S. energy storage market achieved its strongest ever quarter in the second quarter (Q2) of the financial year 2025, with total installations reaching 5.6 GW/17.8 GWh, according to the latest U.S. Energy Storage Monitor report from the American Clean Power Association and Wood Mackenzie.

The utility-scale segment accounted for 4.9 GW/15 GWh of this total, a 63% year-on-year increase. Texas, California, and Arizona together contributed nearly 75% of this newly installed capacity, each adding around 1.2 GW.

Oklahoma re-entered the utility-scale market with three projects totaling 170 MW, while the national project pipeline has seen some contraction, falling from 1,080 projects in 2024 to 801 in 2025, a 26% decline.

Installations for the residential storage sector increased by 8% quarter-on-quarter, with California, Arizona, and Illinois driving the majority of the growth. The rise is largely attributed to state-level policies such as California’s Net Billing Tariff, declining solar export rates, and additional state incentives in California, Arizona, and Illinois.

Higher-capacity systems are increasingly being adopted in the residential market, which is projected to outpace solar in growth due to high policy resilience, strong attachment rates in markets such as California and Puerto Rico, and continued access to the federal investment tax credit (ITC), particularly under third-party ownership models.

For 2025 alone, residential storage growth is forecast to reach 96% in terms of megawatts and 41% in terms of the number of installations.

CCI Market Gains Momentum

The community, commercial, and industrial (CCI) market posted its best second quarter since 2023, driven by commercial solar-plus-storage deployments in California under the state’s Net Energy Metering 3.0 framework.

Storage incentive programs in New York, Illinois, and Massachusetts are also contributing to steady growth, although community storage remains limited due to high development costs and policy constraints.

Massachusetts’ upcoming SMART 3.0 program is expected to provide future support, though nationwide CCI capacity is projected to remain under 1 GW by 2029.

OBBBA and Federal Policy

Federal policy developments under the One Big Beautiful Bill Act (OBBBA) have preserved ITC benefits for most storage applications but introduced new equipment sourcing requirements that take effect after 2025.

This has led to a rush to begin project construction ahead of the restrictions, temporarily boosting forecasts according to the report. While domestic cell supply is expected to ramp up, supply chain limitations and U.S.–China trade barriers are likely to create challenges.

Distributed storage remains highly sensitive to OBBBA impacts, with the CCI sector potentially benefiting from reduced solar incentives, which could lead to an increase in solar-plus-storage installations. However, growth is expected to remain slow. For residential storage, the decline in solar incentives may accelerate the adoption of virtual power plants and third-party ownership models.

Low Case Forecast and Risks

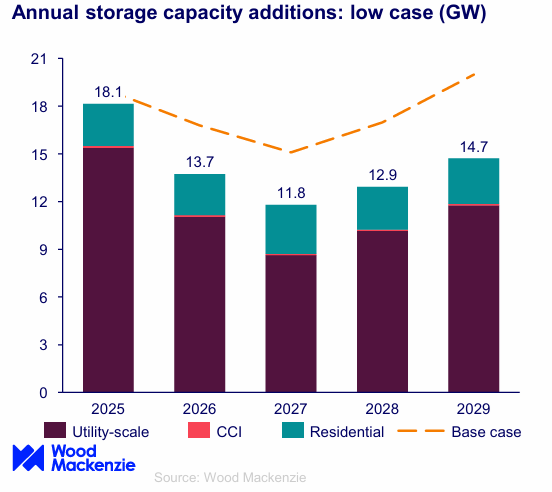

The low-case scenario forecasts a potential reduction of 16.5 GW, or 19%, in cumulative installations between 2025 and 2029, driven by risks including supply shortages compliant with the Foreign Entity of Concern (FEOC) rule, sustained trade barriers with China, and delays in federal land permitting for renewable projects.

In this downside case, utility-scale projects would be most affected, particularly those not safe-harbored in 2025. Residential forecasts would be constrained by uncertainty around FEOC-compliant supply and potential restrictions on third-party ownership qualification for the ITC.

The CCI sector would face further headwinds if the rollout of Massachusetts’ SMART 3.0 program is slow, and costs remain high.

However, the report notes that the final version of OBBBA was less restrictive than the House bill, which had proposed a 60-day construction start window and a 2028 in-service deadline to qualify for the ITC.

As a result, the low-case outlook was raised by 23% quarter-on-quarter compared to the earlier baseline, which had assumed the stricter House version would pass.

Beyond the 2025–2029 outlook period, downside risks remain if gas supply chain bottlenecks ease and permitting restrictions increase for solar and storage projects. These conditions could slow the pace of deployment in the longer term.

Financial and Market Implications

The scale of Q2 2025 installations underscores the growing importance of storage as a vital component of the U.S. energy transition. With 7.6 GW installed in the first half of 2025, the year is expected to set a new annual record for storage deployment.

While policy and supply chain challenges persist, particularly in terms of equipment sourcing requirements and federal permitting, the resilience of the residential market and the dominance of leading states such as California, Texas, and Arizona position the U.S. storage sector for continued growth.

The utility-scale market remains vulnerable to policy and trade uncertainty; however, the extension of the ITC provides a foundation for sustained development over the next decade.

Residential and distributed storage are increasingly adapting through models such as virtual power plants and third-party ownership, ensuring continued deployment even as solar incentives decline.

The CCI segment, though lagging, is likely to see incremental growth supported by state-level incentive programs and the eventual rollout of SMART 3.0 in Massachusetts.

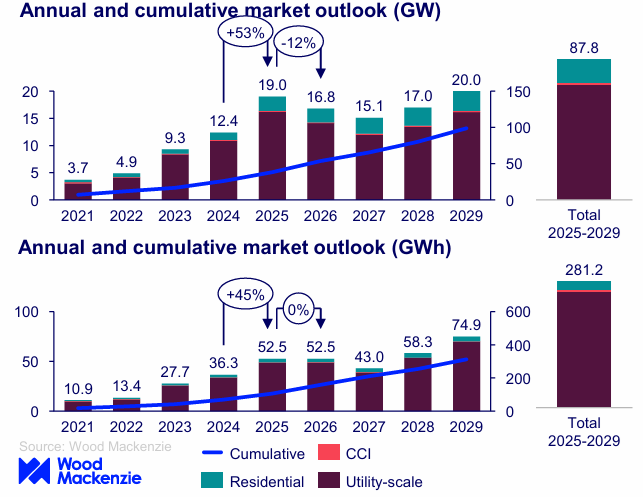

Overall, the report underscores both the opportunities and challenges facing the U.S. storage market. Strong near-term growth is balanced by risks of supply shortages and policy headwinds, but the cumulative capacity of nearly 88 GW by 2029 remains achievable under the base case.

Outlook

The report projects that cumulative U.S. energy storage capacity will reach 87.8 GW/261.2 GWh by 2029, with growth led by residential and utility-scale storage. Utility-scale capacity is forecast to reach 72 GW/259 GWh by 2029 despite a projected 10% year-on-year decline in 2027.

After 2025, which is expected to remain the record year for utility-scale installations, annual deployments are not expected to reach similar levels until 2029. Federal policy will continue to be a significant factor in shaping the outlook.

While the ITC has been extended through 2033, new equipment sourcing requirements and continued uncertainty in global trade are expected to slow growth. The strongest markets for utility-scale deployment will continue to be California, Texas, and other states with favorable storage policies, coupled with high load growth.

The residential segment is expected to remain the most resilient, with growth supported by virtual power plant models and third-party ownership structures, even as solar incentives decline.

The CCI segment is forecasted to experience gradual growth, although the sector will face challenges from high costs and slower transitions to programs that reduce support for solar projects.

The U.S. energy storage market added more than 2 GW across all segments in the first quarter of 2025, marking the highest Q1 on record, according to U.S. Energy Storage Monitor report from the American Clean Power Association and Wood Mackenzie.