US Energy Storage Hits New Q1 Record with Over 2 GW Installed: Report

Cumulative energy storage installations reached 630 GWh by the end of 2025

January 22, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

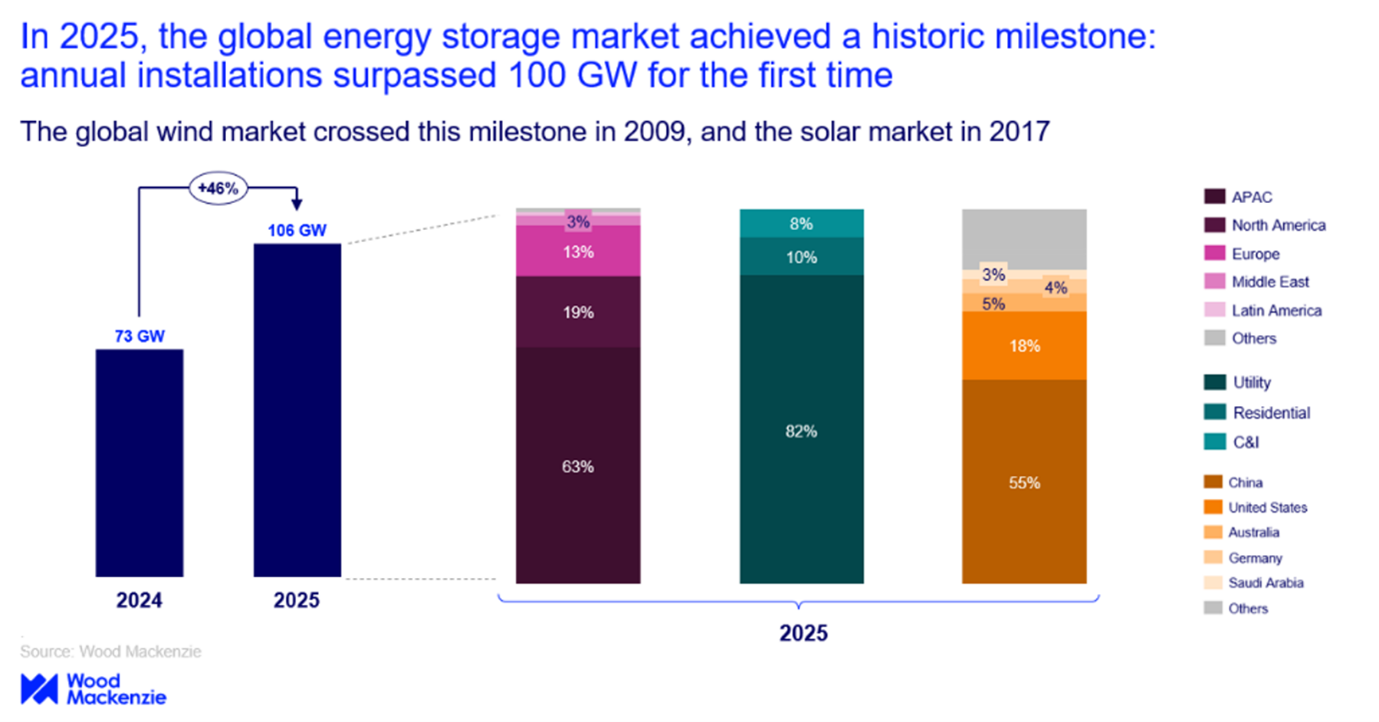

The global energy storage market grew 43% year over year in 2025, adding 106 GW of new capacity worldwide, a significant increase from 73 GW in 2024, according to Wood Mackenzie.

The cumulative energy storage installations stood at 270 GW/630 GWh by the end of 2025. The energy storage market is projected to reach 1,545 GW by 2034.

China led global energy storage deployments in 2025, accounting for 54% of worldwide installations.

However, Wood Mackenzie stated that China is likely to face considerable challenges in energy storage projects entering 2026-2027, with the removal of mandatory renewable-storage coupling requirements and the absence of established revenue frameworks creating substantial uncertainty. Despite the challenges, China is expected to lead the energy storage market, contributing 50% of new storage capacity between 2025 and 2034.

Large-Scale Utility Projects

Of the total energy storage installations in 2025, large-scale utility projects accounted for 82%. The large-scale segment continued to outpace both residential and commercial and industrial installations, driven by large grid applications, renewable energy integration requirements, and government procurement programs.

By 2025, global average utility-scale energy storage durations reached approximately 2.5 hours, with some markets, such as Chile and Saudi Arabia, developing projects with durations of 3-4 hours to address specific grid requirements.

The large-scale energy storage segment is expected to continue to grow through 2034, backed by declining battery costs, improved project economics, and increasingly diverse revenue opportunities.

Wood Mackenzie stated that government-led tenders also drove high numbers of large-scale storage system deployments in 2025.

According to a report by Ember, the capital cost for long-duration (4 hours or more) utility-scale battery energy storage systems in markets outside China and the U.S. reached roughly $125/kWh by October 2025,

The U.S. solar industry added a capacity of 11.7 GW in the third quarter of 2025, a 20% YoY and a 49% quarter-over-quarter increase, according to US Solar Market Insight Q4, a joint report by Wood Mackenzie and Solar Energy Industries Association.

United States (U.S.)

Energy Storage installations in the U.S. grew 53% YoY despite federal policy changes.

Wood Mackenzie stated that initially, the passage of reconciliation legislation introduced supply chain restrictions for projects seeking federal tax credits, creating initial market uncertainty.

However, it highlighted that the forecast for large-scale energy storage projects rose in the U.S. following the bill’s passage, driven by announcements of domestic cell manufacturing facilities and committed large electricity loads.

During the period, developers also accelerated construction on over 13 GW of “safe-harbour” projects to qualify under previous policy frameworks.

The energy storage installations in the U.S. were driven by capacity-constrained markets where storage provided critical reliability services, as well as by state-level incentives and mandates. The surge in energy storage deployments was also driven by the country’s first wave of battery augmentation projects.

Nearly 12% of existing systems required capacity additions in 2025, creating a new market segment expected to expand significantly in the coming years.

Emerging Key Markets

Australia continued to grow in 2025, showing a 55% growth, driven by the expanded Capacity Investment Scheme and successful state-level procurement auctions. Over 6.5 GW of capacity is currently under construction, with the National Electricity Market projected to host more than 30 GW of large-scale storage by 2034.

Germany retained the leading position in Europe’s distributed storage segment in 2025, supported by strong policy frameworks, high retail tariffs, and the potential elimination of feed-in tariff programs.

The country was also Europe’s most active large-scale storage market, as high-power price volatility, increasing renewable energy penetration, and market liquidity drove demand for large-scale energy storage projects.

Saudi Arabia established itself as a significant new market with major GW-scale projects. The country commissioned four standalone projects in 2025 and has plans to continue expansion.

2026 Forecast

The rise in energy storage installations in 2025 is expected to moderate in 2026 due to policy transitions in the U.S. and China.

However, sustained long-term growth remains strong, supported by government tenders driving large-scale deployment and by support programs accelerating adoption in the distributed segment.