Torrent Power Swings to Profit in Q4 on Higher Generation and Power Demand

The company’s installed renewable energy generation stood at 1,068 MW

May 30, 2023

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Gujarat-based power company Torrent Power posted a profit of ₹4.88 billion (~$58.97 million) for the fourth quarter (Q4) of the financial year (FY) 2022-23 against a loss of ₹4.84 billion (~$58.49 million) in Q4 FY22 primarily due to continued growth in the company’s transmission business supported by higher power demand and increased generation.

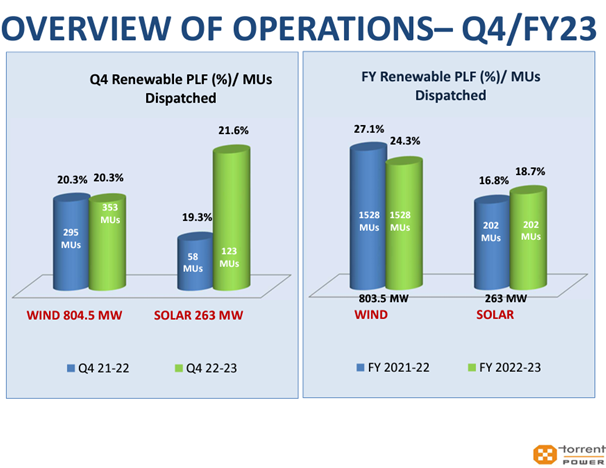

The company’s solar generation capacity increased to 123 million units (MU), and the plant load factor grew to 21.6% from 19.3% during Q4 FY22. The wind generation capacity continued to stay consistent year-over-year.

By the end of the quarter, Torrent Power’s installed power generation capacity stood at 4,160 MW, comprising 2,730 MW of gas-based capacity, 1,068 MW of renewables, and 362 MW of coal-based capacity.

The installed renewable generation capacity includes 263 MW of solar projects spread across five locations and 804.5 MW of wind projects operating across ten sites.

The company also has 300 MW of utility-scale solar and 21 MW of C&I solar projects under development, along with 415 MW of wind projects.

Torrent Power’s revenue increased by 61% year-over-year (YoY) to ₹60.38 billion (~$729.69 million), mainly due to the reduction in transmission and distribution (T&D) losses along with increased generation.

The company’s Earnings Before Interest, Tax, Depreciation, and Amortization (EBITDA) for the January-March quarter grew by 9% YoY to ₹11.86 billion (~$143.33 million).

Full Year

The company’s profit increased by 371% YoY to ₹21.71 billion (~$262.36 million) in FY23, mainly due to reduced T&D losses and higher generation throughout the quarters.

The revenue jumped by 80% YoY to ₹256.94 billion (~$3.1 billion) in FY23.

Torrent’s Chairman Samir Mehta said, “During the year, we successfully integrated five acquisitions— licensed distribution business of Daman & Diu and Dadra Nagar Haveli, wind power plants of 156 MW, and solar power plants of 125 MW. The company incurred a capital expenditure of ₹26.98 billion (~$326 million) during the year. We also successfully navigated through the volatility in LNG prices on account of the Russia-Ukraine war.”

The company recorded a YoY growth of 34% in EBITDA at ₹51.41 billion (~$621.28 million) for the year.

The company recorded improved operational performance in the Union Territory of Dadra & Nagar Haveli and Daman and Diu (DNH&DD) acquired last year, which contributed to the company’s existing licensed distribution businesses.

The power company distributes around 28 billion units to more than 4.03 million customers across select major cities in Gujarat, Maharashtra, Uttar Pradesh, and DNH&DD.

Torrent Power posted a profit of ₹6.94 billion (~$83.87 billion) for the third quarter of FY23, up by 88% YoY. The rise in profit was fueled by the reduction in T&D losses and an increase in the cost of power.

Mercom recently reported on how stricter financing rules and penalties for non-payment of dues have helped improve the performance of various DISCOMs across all states.