Strong 9M Performance Drives REC’s Revenue Up 10%

The company’s net profit grew 13%

February 2, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Public infrastructure finance company REC’s revenue from operations increased by 10% to ₹446.41 billion (~$4.87 billion) against ₹407.52 billion (~$4.45 billion) in the first nine months (9M) of the financial year (FY) 2025-26.

For the period ended December 31, 2025, REC’s net profit stood at ₹129.2 billion (~$1.41 billion), up 13% from ₹114.77 billion (~$1.25 billion) in the corresponding period of the previous year.

Net interest income rose by 10% to ₹156.77 billion (~$1.71 billion) from ₹141.91 billion (~$1.55 billion) in the same period last year.

Asset quality continued to improve, with net credit-impaired assets declining sharply to 0.20% from 0.74% a year earlier.

REC maintained its financial margins, reporting a spread of 2.73% and a net interest margin of 3.52%. As a result, the annualized earnings per share for the period ended December 31, 2025, increased by 13% to ₹65.42 (~$0.71), compared with ₹58.11 (~$0.63) as of December 31, 2024.

The company reported a third interim dividend of ₹4.60 (~$0.05)/equity share for FY26. With this payout, the total interim dividend declared for the FY26 stands at ₹13.80 (~$0.15)/share on equity shares of face value ₹10 (~$0.11) each, continuing the company’s dividend distribution track record.

Loan Book

REC’s overall loan book stood at ₹5.82 trillion (~$63.5 billion), sustaining its growth trajectory, up from ₹5.66 trillion (~$61.8 billion) in the previous period. As part of efforts to strengthen portfolio quality, term loans grew by 10% YoY.

During the same period, the Revolving Bill Payment Facility loan book and stage-3 loan assets declined by 55% and 54%, respectively. The company’s capital position remained robust, with a capital adequacy ratio of 24.26% as of December 31, 2025.

Net worth increased 13% year-on-year to ₹862.62 billion (~$9.42 billion) from ₹765.02 billion (~$8.35 billion), supported by higher profitability.

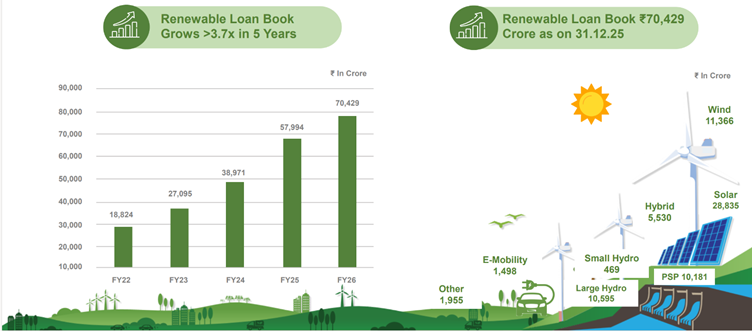

Alongside its financial performance, REC continued to scale its financing of clean and renewable energy projects. The renewable energy loan book stood at ₹704.29 billion (~$7.69 billion), reflecting a more than 3.7-fold increase from FY 2022 to FY 2026 and accounting for around 12% of total outstanding loan assets.

The loan portfolio includes solar projects amounting to ₹288.35 billion (~$3.15 billion), wind projects of ₹113.66 billion (~$1.24 billion), pumped storage projects of ₹101.81 billion (~$1.11 billion), large hydro projects of ₹105.95 billion (~$1.16 billion), hybrid renewable projects of ₹55.30 billion (~$604 million), small hydro projects of ₹4.69 billion (~$51 million), e-mobility projects of ₹14.98 billion (~$164 million), and other renewable segments totaling ₹19.55 billion (~$213 million).

Loan Approvals

Business growth remained strong during the period, with total loan disbursements rising 14% YoY to ₹1.65 trillion (~$18.06 billion) from ₹1.46 trillion (~$15.90 billion). Loan approvals increased 23% to ₹3.33 trillion (~$36.39 billion) compared to ₹2.72 trillion (~$29.66 billion) in the previous year, marking the highest-ever sanction level achieved by the company for a nine-month period.

REC has approved approximately 64 GW of renewable energy capacity to date, positioning it among the largest financiers of utility-scale renewable projects in India.

REC posted a net profit of ₹44.14 billion (~$530.4 million) for the Q2 of the FY26, up from ₹40.37 billion (~$484.9 million) in the corresponding period of the previous year, reflecting a 9.4% increase.

The company reported its highest-ever quarterly net profit of ₹44.51 billion (~$514.09 million) for the first quarter of FY 2026, a 29% YoY increase from ₹34.42 billion (~$397.55 million).