Solar Installations in India Surge 53.7% YoY in 9M 2025 with 26.6 GW

As of September 2025, India's cumulative installed solar capacity stood at 125.5 GW

November 18, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

India added a solar capacity of 26.6 GW in the first nine months (9M) of the calendar year (CY) 2025, an increase of 53.7% year-over-year (YoY) from 17.3 GW, according to the newly released Q3 2025 India Solar Market Update Report by Mercom India Research.

Large-scale solar accounted for 81.5% of the capacity commissioned in 9M 2025, while rooftop solar contributed 18.5%. Within large-scale additions, solar open access projects accounted for 28.3% of the total during the period.

“Solar installations in the first nine months of 2025 were the highest India has ever recorded, surpassing all of 2024. The industry made solid progress this quarter, but supply constraints, grid congestion, and curtailment continued to hinder execution. DCR supply remains tight and expensive, though long-term visibility is improving. The GST cut provided some relief, but higher cell and module duties offset much of the gain. Looking ahead to 2026, grid constraints remain the primary concern, and transmission capacity must scale rapidly to support growth at this pace,” commented Raj Prabhu, CEO at Mercom Capital Group.

The upcoming Approved List of Models and Manufacturers (ALMM) List-II compliance window in June 2026 was another contributory factor.

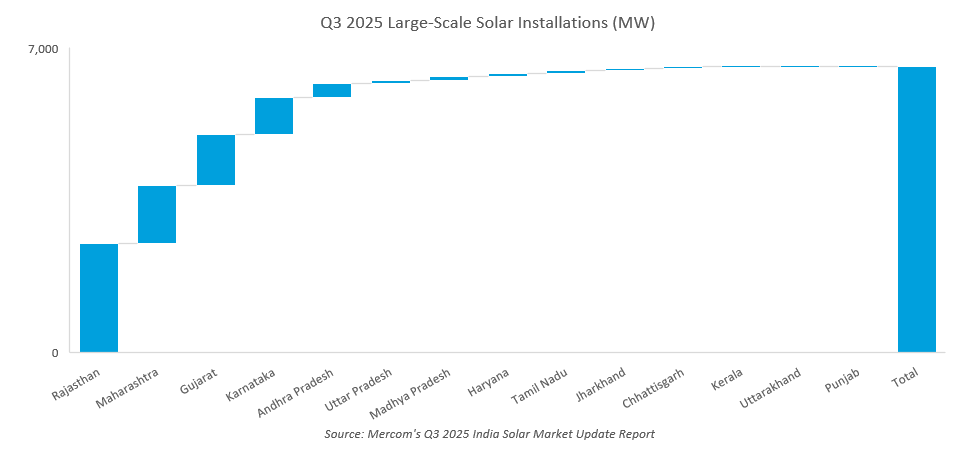

In the third quarter (Q3) of 2025, installations of large-scale solar projects rose by 141% YoY to 6.6 GW from 2.7 GW. However, installations dropped 32.3% quarter-over-quarter (QoQ) from 9.7 GW.

Priya Sanjay, Managing Director at Mercom India, attributed the sequential drop partially to the impact of the extended monsoon this year.

As of September 2025, India’s cumulative installed solar capacity stood at 125.5 GW.

Utility-Scale Projects

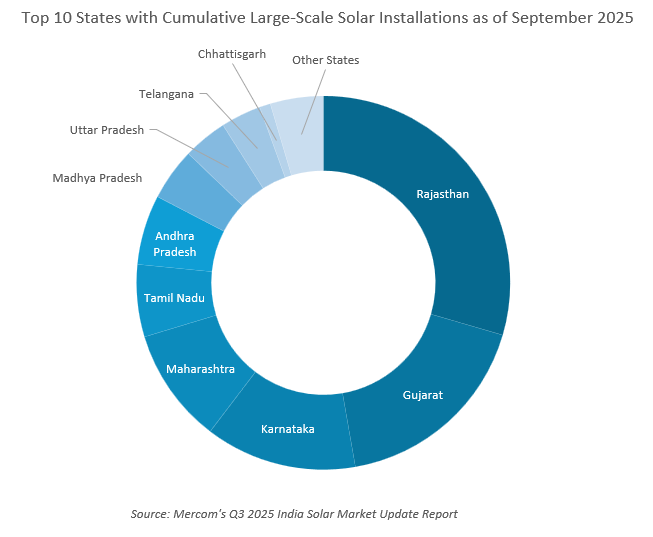

Large-scale projects accounted for 85.2%, and rooftop solar accounted for 14.8% of cumulative installations as of September 2025.

As of September 2025, solar projects accounted for 25.1% of India’s total installed power capacity and 51% of the total installed renewable energy capacity.

Rajasthan, Maharashtra, and Gujarat led large-scale solar capacity additions in Q3, contributing 38.2%, 20.2%, and 17.7% of the capacities commissioned, respectively.

The top ten states accounted for 99.3% of the large-scale solar capacity additions in Q3 2025.

Rajasthan, Gujarat, and Karnataka were the top three states in cumulative installations of large-scale solar projects, accounting for over 29.5%, 17.7%, and 13.1%, respectively.

India’s large-scale solar project pipeline stood at 191.9 GW, with another 162.5 GW of projects tendered and pending auction as of September 2025.

Sanjay commented that tenders are seeing very low participation in a competitive environment. “Developers are wary about the uncertainty around the signing of power purchase agreements and how the rise in module costs is likely to impact the PPA tariffs.”

The average cost of large-scale solar projects also dropped by 1% QoQ.

Tenders and Auctions

In Q3 2025, tenders announced fell by 17.8% YoY to 16.5 GW. However, tender activity rose nearly 137.6% QoQ from 6.9 GW.

Sanjay added that an impending rise in project costs due to the upcoming mandate under ALMM List-II is creating ambiguity in auctions.

Auctions in Q3 dropped by 66.8% to 2.2 GW, from 6.5 GW in the same quarter last year. Within the quarter, auctions jumped by 21.4% QoQ from 1.8 GW.

In 9M 2025, 35.7 GW of tenders were called, representing a 48% YoY decrease compared to 72 GW.

Sanjay felt there would be considerable uncertainty in Q4 due to ALMM-List II. “Installations are expected to be higher in Q4, backed by the urgency to complete projects before the ALMM-List-II deadline.”

She added that the developers are of the view that the government should implement a phased roll-out of the ALMM List-II until India has sufficient cell capacity to meet the demand from the module manufacturing sector.

Mercom’s Q3 2025 India Solar Market Update report is 120 pages long and covers all facets of India’s solar market.

For the complete report, visit: https://www.mercomindia.com/product/q3-2025-india-solar-market-update.