Solar Installations in India Jumped 31% YoY in 1H 2025

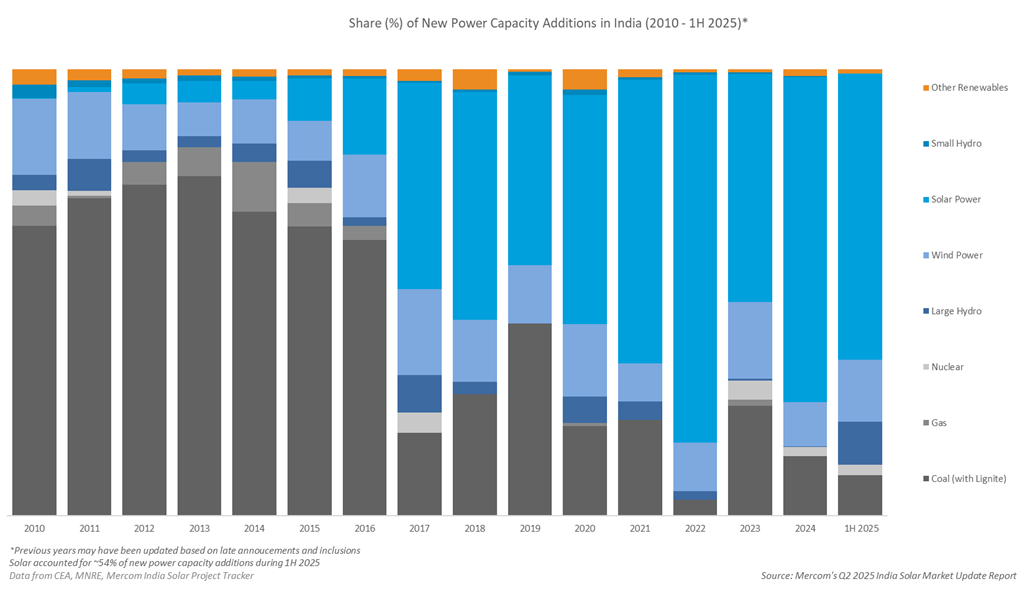

Solar accounted for 64% of new power capacity additions in Q2 2025

August 26, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

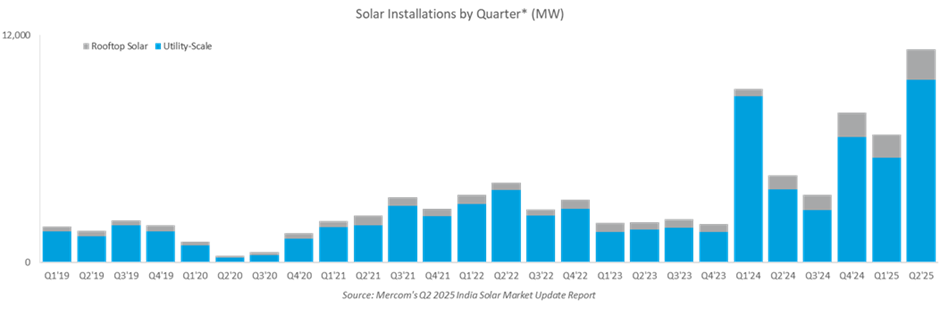

India added solar projects totaling 18 GW in the first half (1H) of 2025, a 31% year-over-year (YoY) increase from the same period last year, according to Mercom India Research’s newly released Q2 2025 India Solar Market Update.

In the second quarter (Q2) of 2025, India added 11.3 GW of solar capacity, a 145.4% YoY increase from 4.6 GW and a 66.9% increase from Q1 2025.

Solar accounted for 64% of new power capacity additions in Q2 2025.

In 1H 2025, solar project commissioning in India accelerated due to regulatory deadlines.

Developers aimed for partial commissioning before June 2025 to secure interstate transmission system (ISTS) charge waivers, supported by the rising demand from distribution companies (DISCOMs) for round-the-clock (RTC) power.

According to Priya Sanjay, Managing Director at Mercom India, the rush to commission projects before the expiry of the interstate transmission system charges waiver was the major driver behind solar capacity additions in Q2.

She added that the installations would have been higher if there were fewer challenges in securing modules compliant with domestic content requirements (DCR).

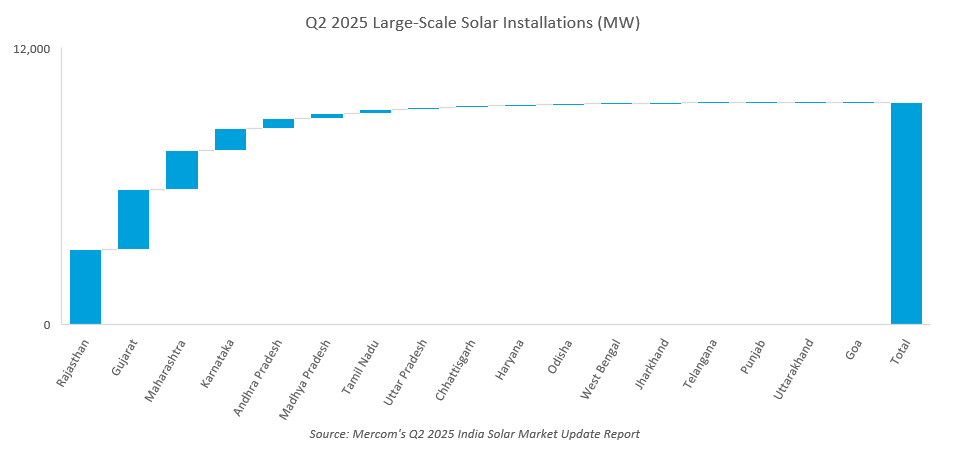

Rajasthan, Gujarat, and Maharashtra led in large-scale solar capacity additions for the quarter, accounting for 33.7%, 27%, and 17.4% of installations, respectively.

About the future of vanilla solar projects, Sanjay said the extent of demand for vanilla projects will depend on the demand from DISCOMs. “One of the reasons for the likelihood of wind-solar hybrid projects to take the forefront is better utilization of land and transmission infrastructure for hybrid projects. If there is a smaller tariff gap between hybrid and vanilla projects, even DISCOMs may prefer offtake from hybrid projects.”

“India’s solar installations surged in Q2 with over 11 GW added, making it one of the strongest quarters to date. Developers continue to face shortages of DCR-compliant modules, transmission and substation bottlenecks, and delays in power purchase agreement signings. At the same time, the market is transitioning toward storage, RTC, and hybrid projects to address grid challenges and curtailment risks. Without stronger domestic manufacturing output and balanced policy interventions, installations will remain under pressure and lag behind the expanding pipeline,” said Raj Prabhu, CEO at Mercom Capital Group

Utility-Scale Projects

Large-scale solar capacity rose by 20% YoY from 12.6 GW in 1H 2024.

As of June 2025, India’s cumulative installed solar capacity stood at 116.4 GW.

Large-scale projects accounted for nearly 86%, and rooftop solar accounted for almost 14% of the cumulative installations. Solar projects accounted for 24% of India’s total installed power capacity and over 49% of the total installed renewable energy capacity as of the end of June 2025.

Rajasthan, Gujarat, and Karnataka were the top three states in cumulative installations of large-scale solar projects, accounting for around 29%, 18%, and 13%, respectively.

As of June 2025, the top 10 states accounted for over 95% of cumulative large-scale solar installations.

Tenders and Auctions

As of June 2025, India’s large-scale solar project pipeline stood at almost 191 GW, with an additional over 131 GW of projects tendered and pending auction.

In Q2 2025, tenders issued for utility-scale solar capacity dropped by 65% YoY to 6.5 GW from 18.6 GW and 53.8% quarter-over-quarter (QoQ) from 14.1 GW, as the Ministry of New and Renewable Energy is yet to announce detailed quarterly targets or allocate capacities to implementing agencies, adding to the uncertainty

In 1H 2025, 20.6 GW of large-scale solar capacity tenders were announced, down 58.2% from 49.3 GW during the same period in 2024.

Sanjay noted that the drop was due to the confusion among developers on whether to account for ISTS waiver charges in the tariff. “Module availability remains another issue unaddressed.”

Auctions for utility-scale solar projects in Q2 2025 totaled 1.6 GW, down 75.2% from 6.7 GW from the same period last year and 74.1% QoQ from 6.4 GW.

In 1H 2025, 8.1 GW of utility-scale solar projects were auctioned, a 74% drop from 31.8 GW in 1H 2024.

With the issuance of the Approved List of Models and Manufacturers (ALMM) List II for cells, Sanjay sees a short-term supply crunch.

She said developers and manufacturers agree there will be a short-term supply shortage of modules manufactured using cells from ALMM-List II.

“Cell manufacturing plants take longer to come online compared to modules. Many existing cell manufacturing plants may not even be operating at their full production capacity, and the government should account for that when estimating the country’s cell manufacturing capacity.”

Sanjay said developers feel that the government should extend some leeway on a case-by-case basis.

Mercom’s Q2 2025 India Solar Market Update report is 94 pages long and covers all facets of India’s solar market. For the complete report, visit: https://www.mercomindia.com/product/q2-2025-india-solar-market-update