Shoals’ Revenue Jumps 33% in Q3 on Higher Project Volumes

The company reported a net profit of $11.9 million in the quarter

November 18, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

U.S.-headquartered Shoals Technologies Group, a manufacturer of electrical balance of systems (EBOS) for solar, energy storage, and emobility, reported a 32.8% year-over-year (YoY) increase in revenue to $135.8 million in the third quarter (Q3) of 2025 from $102.2 million.

The company attributed the revenue growth to strong underlying demand for EBOS products, the impact of market share capture initiatives, and an increase in project volumes during the year.

Shoals posted a net profit of $11.9 million against a net loss of $267,000 in Q3 2024.

Adjusted EBITDA rose by 30.61% to $32 million from $24.5 million in the same quarter last year.

Shoals’ earnings per share (EPS) came in at $0.07 compared to nil EPS in Q3 2024.

9M Results

In the first nine months (9M) of 2025, Shoals’ revenue jumped 11.9% YoY to $327 million from $292.2 million.

Net profit rose by 56.06% YoY to $25.45 million from $16.31 million.

The company’s adjusted EBITDA stood at $69.24 million, a YoY decrease of 4.73% from $72.68 million.

Its EPS in 9M 2025 was $0.15, compared to $0.1 in 9M 2024.

Business Highlights

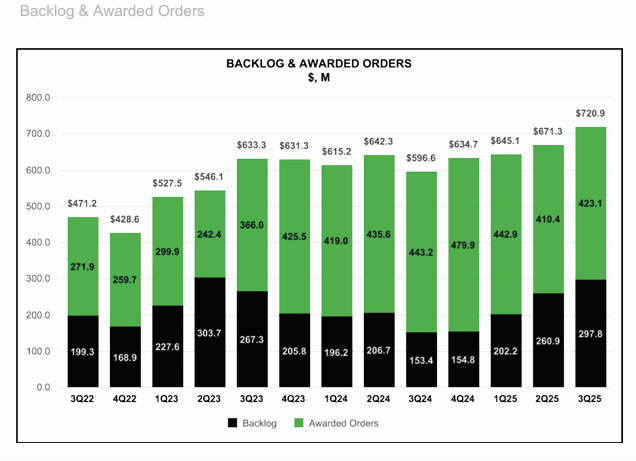

Shoals reported backlog and awarded orders of $720.9 million at the end of Q3, representing a 21% YoY increase, driven by growth in other international markets, which accounted for 11.5% of the total orders. Backlog orders consisted of $298 million in the quarter.

The company has an order pipeline exceeding 20 GW, including projects in Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

It also signed two master supply agreements in Q3 to deliver EBOS solutions in emerging battery energy storage system (BESS) markets, such as data centers.

At the end of Q3, Shoals had approximately $18 million of BESS projects in its backlog and awarded orders.

Outlook

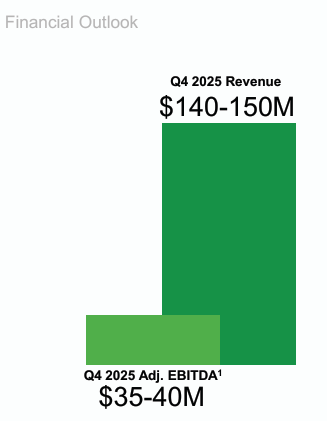

Shoals expects revenue to be in the range of $140 million to $150 million in Q4 and within the range of $467 million to $477 million for the full year 2025.

It foresees rising demand for its BESS solutions from utilities and data centers.

Brandon Moss, Director and CEO at Shoals, said that the massive investment cycle in AI and data centers, combined with industrial reshoring and manufacturing growth, will drive demand well beyond historical levels. “The U.S. Department of Energy has acknowledged that solar will play a critical role in meeting this growing demand due to its speed of deployment and cost advantages.”

The company also believes that it is largely insulated from cost increases resulting from tariffs during the quoting process, as it can adjust the costs once final purchase orders are placed.

Moss added that, following the passage of HR 1 in July and the Treasury guidance in August, developers can now navigate the tax incentive landscape effectively.

In Q2 of 2025, the company reported a revenue of $110.8 million, increasing 11.7% YoY from $99.2 million.