Rajasthan Regulator Proposes Demand Flexibility/Management Regulations

The draft regulations aim to integrate demand-side resources into the power system

January 30, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

The Rajasthan Electricity Regulatory Commission (RERC) has issued the draft Rajasthan Electricity Regulatory Commission (Demand Flexibility/Demand Side Management) Regulations, 2026, proposing a comprehensive regulatory framework to integrate demand-side resources into the state’s power system.

The draft regulations are a structural response to the growing operational and cost challenges from Rajasthan’s solar capacity expansion.

Stakeholders must share their comments by February 27, 2026.

The state’s solar capacity expansion has resulted in the ‘duck curve’ phenomenon. This occurs when solar generation peaks during the daytime but demand rises significantly in the evening. The phenomenon results in distribution companies (DISCOMs) needing to ramp up thermal generation and short-term power purchases.

This development has increased power costs and system balancing risks.

RERC said the draft regulations aim to address these issues by shifting power consumption to low-cost, solar-rich periods and reducing peak demand through structured demand response and energy efficiency measures.

Demand Flexibility and Management

The draft regulations have adopted a two-fold approach, combining short-term demand flexibility with long-term demand side management (DSM), making these measures formal, measurable obligations for DISCOMS.

Demand flexibility focuses on the energy consumers’ ability to temporarily increase, reduce, or shift consumption in response to system needs, particularly during peak demand periods or renewable energy surplus hours.

This focus aims to provide fast-acting, dispatchable support to the grid.

DSM focuses on sustained reductions in power consumption through energy efficiency measures. These measures include replacing inefficient appliances, adopting advanced technologies, and encouraging behavioral changes in consumption.

The two-fold approach aims to reduce reliance on high-cost peak power, defer or reduce costly capacity additions and power purchases, and improve renewable energy absorption.

The draft regulations also aim to create opportunities for investors across multiple value chains. These opportunities can apply to digital demand response programs, efficient appliance deployment, smart charging solutions, and behind-the-meter storage.

The regulations note that combining flexibility and efficiency will deliver system-wide cost savings that can stabilize or reduce consumer tariffs.

Institutional Obligations and Targets

The draft regulations introduce mandatory institutional and performance obligations for DISCOMs. These regulations mandate DISCOMs to establish dedicated demand flexibility/DSM cells, headed by a senior officer of Chief Engineer rank. These cells will conduct load research and design programs tailored for different consumer segments.

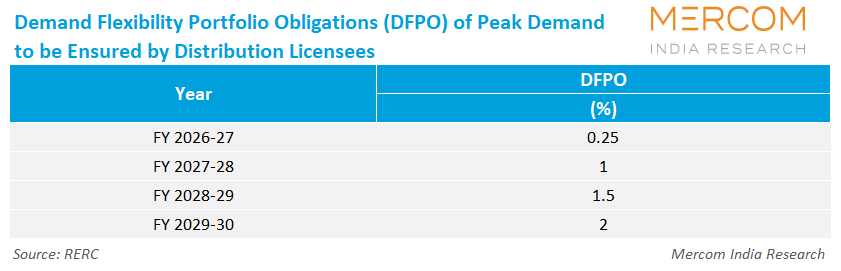

The DISCOMs must also meet specific flexible demand targets. They must comply with the Demand Flexibility Portfolio Obligations (DFPO). These obligations mandate a minimum percentage of flexible demand relative to the previous year’s peak load.

The draft regulations lay down the following trajectory for flexible demand under DFPO to establish a measurable pathway for scaling demand flexibility:

RERC proposes performance-linked incentives and penalties of ₹2 million (~$21,754.6)/MW for excess achievement and underachievement of the DFPO requirements, respectively.

Aggregators and Market Participation

The draft regulations introduce the role of aggregators. Such entities can pool flexible loads from multiple consumers and offer these loads to DISCOMs as a single resource.

Aggregators can combine loads from electric vehicle charging stations, agricultural pumps, commercial heating, ventilation, and air conditioning, and residential smart appliances to deliver demand response services at scale.

RERC stated that this role of aggregators will lower entry barriers for smaller consumers who may lack the technical or financial capacity to participate independently in the demand flexibility or demand response programs.

Additionally, it will create a structured market for third-party participation in demand-side services. This development will open investment opportunities in aggregation platforms, data analytics, automation technologies, and customer engagement tools.

Under the draft regulations, DISCOMs can meet DFPO targets through utility-led programs or by procuring capacity from registered aggregators.

The proposed regulations mandate that aggregators must remain independent of verification agencies to ensure governance separation.

Key Sectors and Demand Flexibility

The draft regulations identify multiple key sectors where demand flexibility and DSM initiatives are expected to deliver the highest system value.

Agriculture is one of the main priority sectors identified by RERC through the regulations. The Commission highlights the shifting irrigation loads to daytime solar hours and the leveraging of solarized pumps under the PM-KUSUM program.

Electric mobility is also identified as a key sector. RERC identified smart charging for two-wheelers, three-wheelers, passenger vehicles, fleet operations, and public transport buses as a key demand response opportunity.

The proposed regulations also identify behavioral demand-response programs that require minimal capital investment and are supported by consumer awareness and digital tools.

Participation in these programs is voluntary, with the regulations providing safeguards for consumer consent, withdrawal rights, and data privacy.

Economic and Tariff Safeguards

The draft regulations provide a structured mechanism for cost recovery. This mechanism enables DISCOMs to recover demand flexibility/DSM-related expenditures through multi-year tariffs and annual revenue requirement filings.

Costs that are eligible for recovery include load research, program design, technology deployment, aggregator engagement, monitoring, and evaluation expenses.

The regulations mandate that all programs pass the Total Resource Cost test to demonstrate net system benefits and the Ratepayer Impact Measure (RIM) test to ensure minimal tariff impact on non-participating consumers.

Programs that fail the RIM test but meet the minimal threshold can still be allowed for implementation under demand flexibility/DSM.

Independent verification agencies will validate actual energy savings and demand reduction using internationally recognized protocols to ensure credibility and transparency.

Last December, RERC approved the detailed procedure for granting green energy open access in the state in line with the RERC (Terms and Conditions for Green Energy Open Access) Regulations, 2025.

Subscribe to Mercom’s real-time Regulatory Updates to ensure you don’t miss any critical updates from the renewable industry.