PJM Must Deploy 16 GW Energy Storage to Meet Peak Demand by 2032: Report

PJM could face up to 14,000 MWh of load shedding over a three-day cold event without energy storage

October 21, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

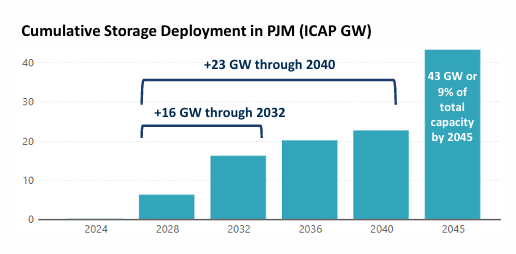

The Pennsylvania-New Jersey-Maryland (PJM) interconnection must deploy at least 16 GW of energy storage by 2032 and 23 GW by 2040 to ensure system reliability, according to a new report from the U.S. Energy Storage Coalition.

The report finds that energy storage will be essential for addressing tight supply conditions, mitigating reliability risks during extreme weather, and supporting the integration of renewable generation resources.

The PJM Interconnection is a regional transmission organization in the U.S. It is part of the Eastern Interconnection grid operating an electric transmission system serving all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and the District of Columbia.

The report states that PJM faces a period of significant strain as peak electricity demand is forecast to grow by 19% between 2025 and 2030.

The region’s summer peak load is projected to increase by 16 GW by 2028 and by 30 GW by 2032.

Over the next decade, total summer and winter peaks are expected to rise by about 56 GW and 62 GW, respectively, driven largely by data center expansion and electrification of heating and transportation.

Interconnection queue backlogs constrain PJM’s ability to add new supply, lengthy approval timelines for new gas capacity, and trade barriers affecting renewable and storage equipment.

Demand for gas turbines currently exceeds manufacturing capacity, and project delays could further restrict resource adequacy.

The report assumes that by 2028, up to 7.4 GW of new gas capacity, 10 GW of battery storage, 3 GW of wind, and 20 GW of solar could be deployed from the current queue. By 2032, an additional 10.5 GW of new gas capacity could come online if supply conditions improve.

The report indicates that PJM must also delay most planned fossil retirements until between 2033 and 2036 to accommodate load growth. Even with these delays, both new gas generation and storage are required to prevent capacity shortages.

The report identifies four-hour duration storage as the only cost-effective option under PJM’s projected conditions, with six-hour and eight-hour storage found to be uneconomical at less than 50% renewable penetration.

The cost of four-hour lithium-ion battery systems could decline from $334/kWh in 2024 to as low as $108/kWh or remain as high as $307/kWh by 2050.

Without battery storage, the analysis shows that PJM would experience large-scale reliability violations and forced load shedding, especially during winter cold snaps similar to Winter Storm Elliott.

The study estimates that without 16 GW of storage, PJM could face up to 14,000 MWh of load shedding over a three-day cold event in 2032, resulting in costs between $400 million and $1.2 billion.

In contrast, storage deployment can prevent up to 15 GW of load shed risk in 2032 and maintain compliance with PJM’s resource adequacy standards.

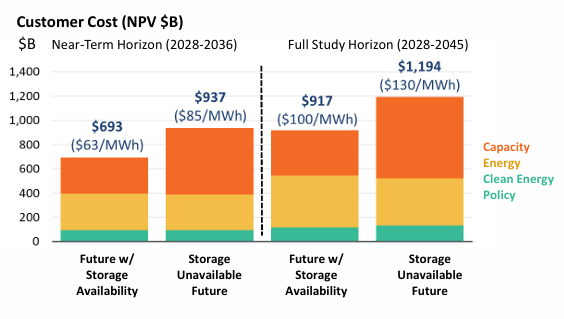

The report also finds that customer costs would be about 30% higher between 2028 and 2045 if storage is not available. The calculation excludes transmission and distribution impacts, which currently amount to under $50 billion per year in PJM.

Without storage, PJM would have to rely on more expensive or insufficient alternatives, leading to a higher dependence on alternative compliance payments to meet state renewable portfolio standards.

The report assumes that PJM’s states will continue to pursue renewable and clean energy mandates, resulting in growing shares of wind, solar, and nuclear generation.

By 2045, renewables and nuclear together are projected to provide about 50% of PJM’s total generation, with solar, wind, and nuclear each contributing roughly one-third of the clean energy mix. The remaining 50% of generation is expected to come from fossil fuels.

The report further notes that battery storage can generate between $20/kW and $65/kW annually in real-time energy and ancillary service revenues, primarily from synchronized reserves.

In the longer term, as renewable energy deployment expands, the value of storage will continue to increase through enhanced energy arbitrage and operational flexibility. By 2045, PJM is projected to rely on around 43 GW of battery storage, 40 GW of new gas capacity, and expanded renewable generation to maintain reliability and meet policy targets.

The report recommends reforms to PJM’s interconnection queue process, improvements in capacity accreditation for storage, and the establishment of clear procurement goals to support timely storage deployment.

The U.S. energy storage market achieved its strongest ever quarter in the second quarter of the financial year 2025, with total installations reaching 5.6 GW/17.8 GWh.