IREDA’s Q1 FY 2026 Profits Fall 35% as Non-Performing Assets Expand

The company’s revenue from operations increased 29%

July 22, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Government-owned lender Indian Renewable Energy Development Agency (IREDA) has reported a consolidated revenue of ₹19.48 billion (~$226 million) for the first quarter (Q1) of the financial year (FY) 2026, a 29% year-over-year (YoY) increase from ₹15.1 billion (~$176 million).

This revenue growth can be attributed to the 26% expansion of IREDA’s loan book.

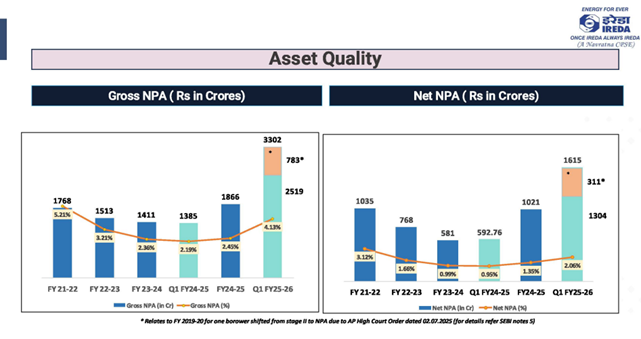

IREDA’s profit after tax was ₹2.47 billion (~$29 million), decreasing 35% from ₹3.84 billion (~$44 million) in the same period of the previous year. This decline was attributed to an increase in the company’s non-performing assets (NPAs) to 4.13% from 2.45%.

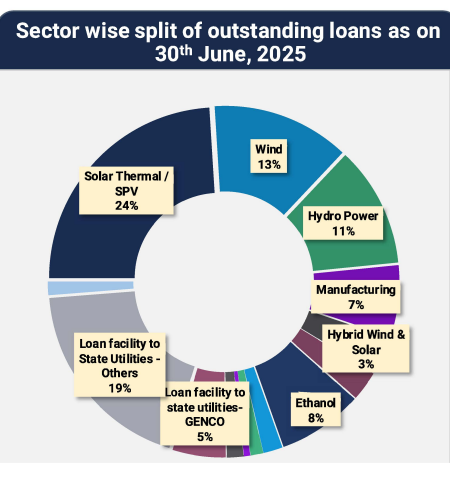

Its loan outstanding increased by 27% from ₹632.07 billion (~$7.3 billion) to ₹799.41 billion (~$9.3 billion). Solar had the highest share, at 24% of the total loan outstanding, followed by wind at 13%, hybrid wind and solar at 3%, and hydro power at 11%.

IREDA’s loan approvals grew by 29% YoY to ₹117.4 billion (~$1.3 billion), and loans disbursed saw a 31% YoY increase to ₹69.81 billion (~$1.3 billion). The company’s earnings per share came in at ₹0.91 (~$0.011), compared to ₹1.43 (~$0.017) in the same period the previous year.

Last quarter, IREDA reported a 49% YoY increase in profit after tax for the fourth quarter of the FY 2025 to ₹5.02 billion (~$56.6 million) from ₹3.37 billion (~$39.3 million). IREDA attributed the increase to a decline in NPAs.

In April, the company announced a 27% rise in loan approvals to ₹474.53 billion (~$5.5 billion) in FY 2025 compared to ₹373.54 billion (~$4.3 billion) for FY 2024. Its loan disbursements rose to ₹301.68 billion (~$3.5 billion) from ₹250.89 billion (~$2.9 billion) in FY 2024.

In March, IREDA raised ₹9.1 billion (~$106.16 million) by issuing privately placed subordinated Tier II bonds. IREDA aims to use these funds to enhance its Tier II capital to increase its net worth and capital risk-weighted assets ratio.