India Reclaims Third Position Behind China, US in Global Wind Installations

The country is forecast to add 6.2 GW of wind projects this year, nearly doubling from 2024

December 26, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

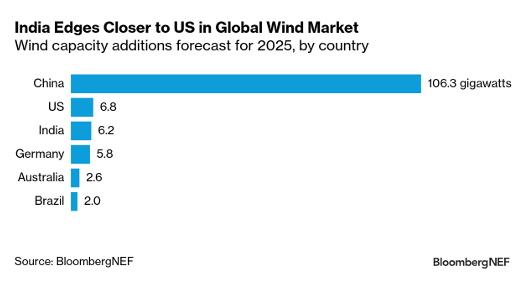

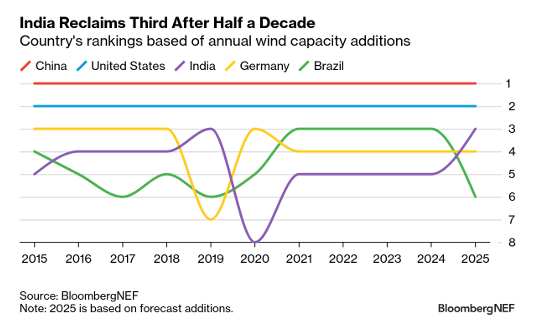

India has reclaimed the third position behind China and the U.S. in the global wind market in 2025 after record additions, according to BloombergNEF.

The country is forecast to add 6.2 GW of wind projects this year, nearly double the capacity installed in 2024, putting it within striking distance of the U.S., the second-largest market at 6.8 GW.

The sharp rise in annual wind installations is set to propel India ahead of Brazil and Germany, both of which have been ranked above it over the past three years. India returns to third place for the first time since 2019, after holding fifth place for four straight years through 2024, driven by a steady uptick in annual wind additions since 2020.

India added 5.8 GW of new wind capacity through November 2025, surpassing its 2017 annual record of 4.2 GW.

The abrupt shift from the feed-in tariff mechanism to clean energy auctions in 2017 led to a sharp decline in 2018. Standalone wind tenders were the main driver for wind capacity additions.

However, more recently, hybrid tenders and firm-power procurement structures, such as firm and dispatchable renewable energy and round-the-clock renewables, have become the dominant route for large-scale wind buildout.

These tender formats typically bundle wind with solar and storage to deliver more predictable, schedulable electricity versus variable, standalone wind. To meet firmness and delivery obligations, developers often oversize renewable capacity and combine technologies to match contracted supply profiles better, making wind an important component of portfolios designed for higher reliability.

Now, India’s wind sector is reviving on the back of hybrid tenders and auctions, and is expected to reach nearly 8 GW by 2030.

Another reason for the surge in capacity additions this year is a spillover of projects that were expected to be commissioned in 2024 but were delayed due to the absence of grid connectivity. Grid access has historically been a bottleneck for renewable project developers, as the expansion of the transmission network has a longer gestation period than that required to construct a solar or wind asset.

India added 1.4 GW of wind energy capacity in the third quarter (Q3) of 2025, a 105% year-over-year increase from 706.5 MW in Q3 2024, according to Mercom India Research.

In August, the Ministry of New and Renewable Energy renamed the Revised List of Models and Manufacturers of Wind Turbines (RLMM) as the Approved List of Models and Manufacturers (Wind).

The ministry also mandated the use of major wind turbine components, such as blades, towers, gearboxes, generators, and special bearings, from the Approved List of Models and Manufacturers (Wind Turbine Components) for the manufacturing of listed wind turbines.