Higher Solar Module Sales Boost Waaree Energies’ Revenue in Q3 FY 2026

The company reported a 118.35% YoY increase in PAT in Q3

January 22, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Solar module manufacturer Waaree Energies’ revenue from operations for the third quarter (Q3) of FY 2026 rose 118.8% year-over-year (YoY) to ₹75.65 billion (~$826.77 million) from ₹34.57 billion (~$377.84 million).

The company attributed the revenue increase to strong module sales. Its module sales rose 124.9% YoY to ₹69.9 billion (~$763.92 million) from ₹31.08 billion (~$339.71 million).

It also reported a 22.87% YoY growth in its power generation business to ₹92.4 million (~$1.01 million) from ₹75.2 million (~$822,000).

Waaree’s engineering, procurement, and construction business increased by 138.7% YoY to ₹8.38 billion (~$91.63 million) from ₹3.51 billion (~$38.38 million).

Earnings before interest, taxes, depreciation, and amortization (EBITDA) stood at ₹19.28 billion (~$210.74 million), a 167.16% increase from ₹7.22 billion (~$78.88 million) in the same quarter of the previous year.

The company’s profit after tax (PAT) rose 118.35% YoY to ₹11.07 billion (~$121.03 million) from ₹5.07 billion (~$55.40 million).

Earnings per share (EPS) for the quarter came in at ₹36.89 (~$0.40) compared to ₹18.33 (~$0.20) a year ago.

9M FY 2026 Results

In the first nine months (9M) of FY 2026, Waaree reported consolidated revenue from operations of ₹180.57 billion (~$1.97 billion), a 72.95% YoY increase from ₹104.41 billion (~$1.14 billion).

EBITDA stood at ₹43.32 billion (~$473.39 million), a 140.79% increase from ₹18.00 billion (~$196.63 million) in the same period of the previous year.

The company’s PAT rose 114.84% YoY to ₹27.58 billion (~$301.45 million) from ₹12.84 billion (~$140.30 million).

EPS for the period came in at ₹92 (~$1.01) compared to ₹46.44 (~$0.51) a year ago.

The company recorded an order book of ~₹600 billion (~$6.56 billion).

During the quarter, Waaree commissioned an additional 2.1 GW solar module manufacturing facility at Chikli, Gujarat, and a 3 GW facility at Samakhiali. It also commissioned a 3.05 GW inverter manufacturing facility at Sarodhi.

During the quarter, Waaree commissioned an additional 2.1 GW solar module manufacturing facility at Chikli, Gujarat, and a 3 GW facility at Samakhiali. It also commissioned a 3.05 GW inverter manufacturing facility at Sarodhi.

Waaree raised ~₹10.03 billion (~$109.63 million) to establish a 20 GWh lithium-ion cell and battery pack manufacturing facility. This funding was part of the company’s capital expenditure (CAPEX) plan of ~₹100 billion (~$1.09 billion).

The Waaree Group also invested $30 million in United Solar Holdings, a polysilicon producer in Oman. This investment will enable the company to establish a fully traceable supply chain and support its expanding manufacturing footprint across the United States and global markets..

Amit Paithankar, Whole Time Director & CEO, Waaree Energies, said the company plans to grow in battery energy storage systems, inverters, transformers, renewable power infrastructure, and green hydrogen electrolyzer markets.

As of Q3 FY 2026, Waaree has a module manufacturing capacity of ~23 GW and a cell manufacturing capacity of 5.4 GW.

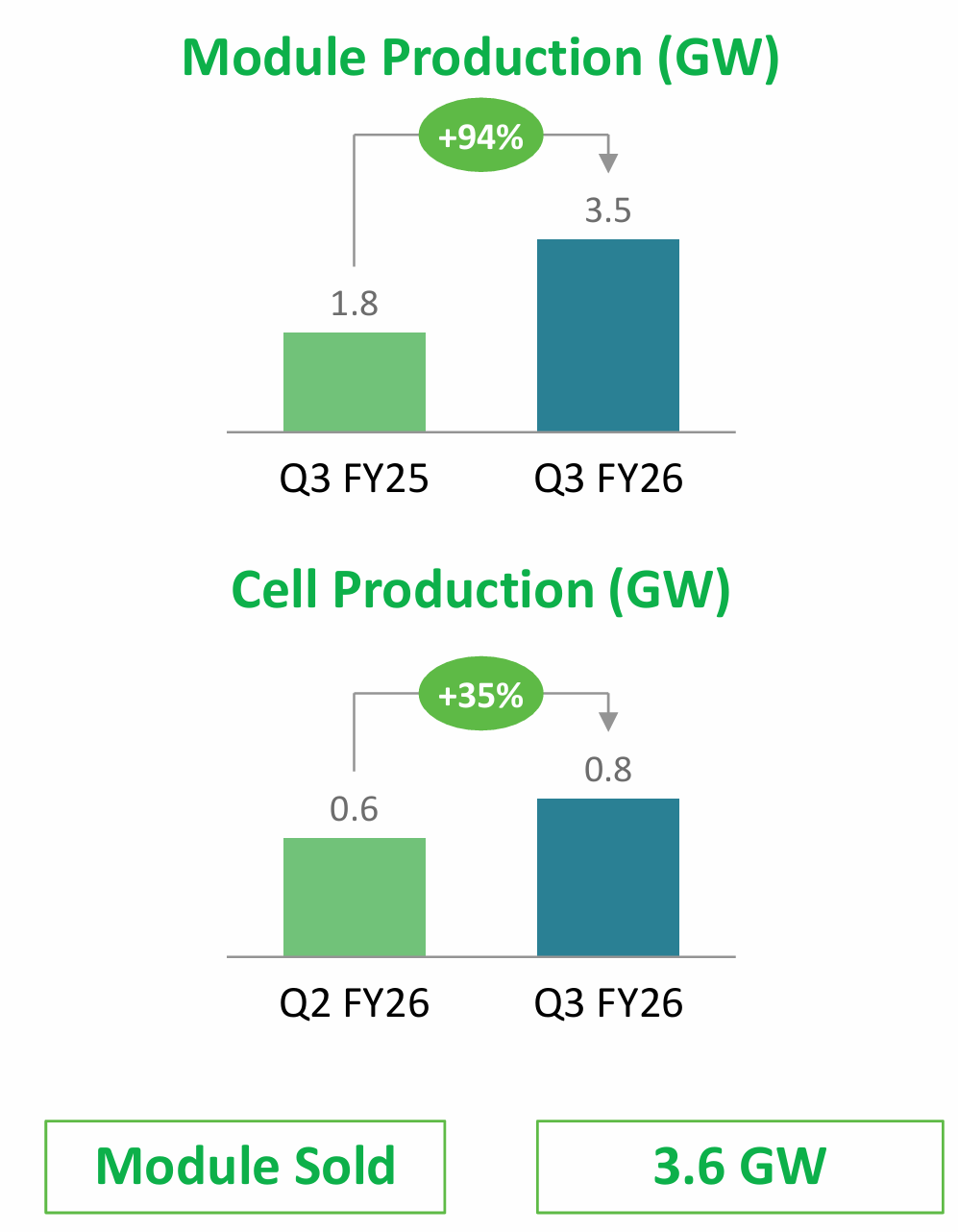

Its module production capacity increased by 94% YoY to 3.5 GW in Q3 FY 2026, up from 1.8 GW, while cell manufacturing capacity rose by 35% to 800 MW in Q3 from 600 MW in the same quarter last year.

Outlook

Outlook

Waaree plans to develop a 4 GW inverter manufacturing facility by FY 2027, with a CAPEX outlay of ~₹1.8 billion (~$19.67 million). In the first phase, 3 GW will be commissioned, followed by 1 GW in the second phase.

The company is also planning to increase its transformer manufacturing capacity by 16,000 MVA with a planned CAPEX outlay of ~₹1.92 billion (~$20.99 million). It has an order book of ₹2.45 billion (~$26.78 million) for transformer supply.

Waaree has decided to invest significantly in battery energy storage system (BESS) manufacturing, including LFP cells, packs, and containers, while pursuing further backward integration to indigenize a large portion of the value chain.

In the first phase, 3.5 GWh of BESS manufacturing will be commissioned by FY 2027, followed by 16.5 GWh by FY 2028.

The company has signed power purchase agreements for 713 MW with creditworthy utilities and global commercial and industrial customers. It has also secured connectivity for ~6.1 GW of renewable energy projects, with an outlay of over ₹22.5 billion (~$245.94 million).

In the green hydrogen segment, Waaree plans to add a 1 GW electrolyzer manufacturing plant with a planned CAPEX of ~₹6.76 billion (~$73.90 million). The company has secured production-linked incentives for developing 300 MW of electrolyzer capacity, worth ₹4.44 billion (~$48.54 million), and for 90,000 TPA of hydrogen production, worth ₹5.10 billion (~$55.75 million).

In Q2 of FY 2026, Waaree Energies’ total income rose 69.96% YoY to ₹62.27 billion (~$708.41 million) from ₹36.63 billion (~$416.80 million).