Higher Order Execution Drives Inox Wind’s Revenue Up 32% YoY in Q1 FY 2026

The company’s quarterly wind installations increased by 4% YoY to 146 MW

August 14, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Wind energy solutions provider Inox Wind reported a revenue of ₹8.63 billion (~$98.57 million) in the first quarter (Q1) of the financial year (FY) 2026, a 32% year-over-year (YoY) increase from ₹6.55 billion (~$74.87 million).

Earnings before interest, taxes, depreciation, and amortization (EBITDA) also rose 39% YoY to ₹2.2 billion (~$25.14 million) from ₹1.58 billion (~$18.05 million).

The company’s quarterly net profit sustained its growth momentum from the previous quarters, reaching ₹973.4 million (~$11.12 million), up 134% YoY from ₹ 415.9 million (~$4.75 million). This marks the highest ever net profit for Q1.

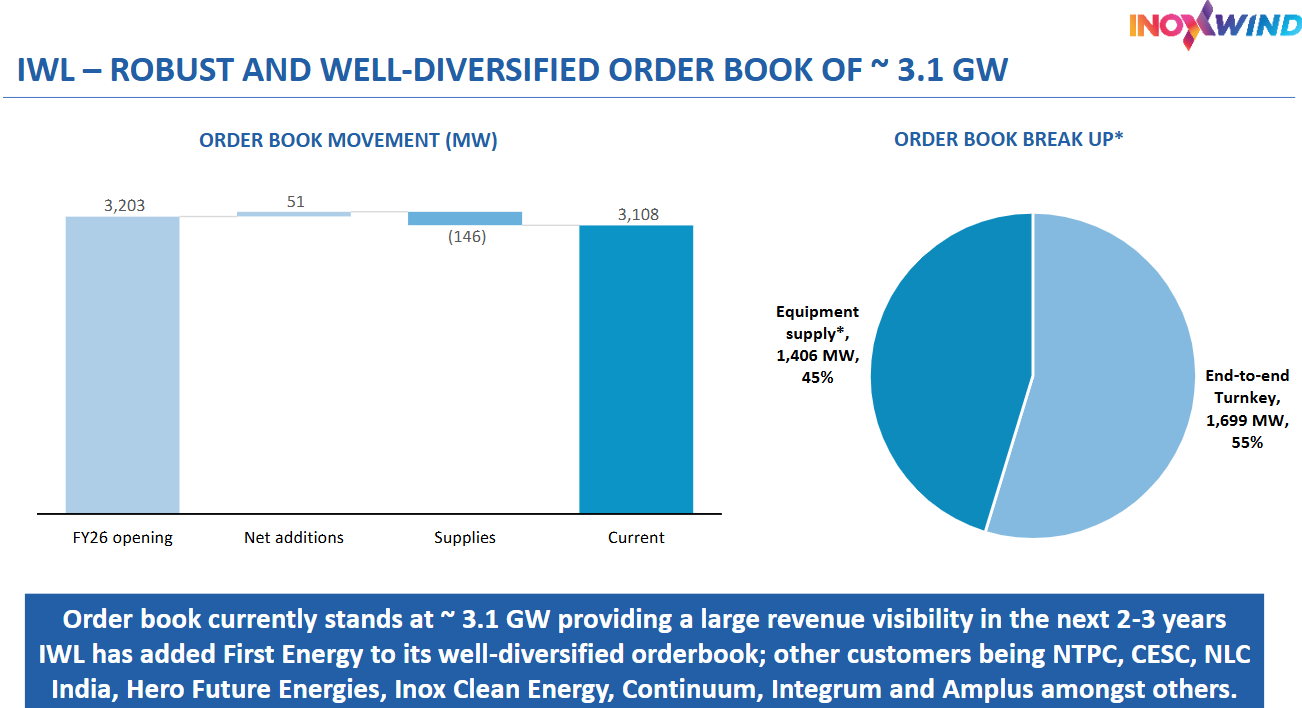

The company’s quarterly wind installations increased by 4% YoY to 146 MW compared to 140 MW in the corresponding quarter last year.

The company’s order book rose by 7% YoY to 3,108 MW from 2,917MW, with a mix of 55% turnkey projects and 45% equipment supply.

The company plans to execute more than 1,200 MW of projects this financial year.

Inox Wind stated that it has a manufacturing capacity of over 2.5 GW and produces and operates 2 MW and 3 MW wind turbine generator platforms with multiple variants. It has secured a license for 4.X MW wind turbine generator and has operationalized its new nacelle plant near Ahmedabad, Gujarat, and a transformer manufacturing unit in Rajasthan.

Inox Wind reported its highest-ever quarterly profit in the fourth quarter of FY 2025. The company reported a profit after tax of ₹1.9 billion (~$21.72 million), a 391% year-over-year (YoY) increase from ₹390 million (~$4.46 million). Its revenue increased 130% to ₹13.11 billion (~$149.84 million) from ₹5.69 billion (~$65.01 million) in the same period of the previous year.

In June, the National Company Law Tribunal, Chandigarh bench, approved the merger of Inox Wind and Inox Wind Energy. The merger will reduce Inox Wind’s liabilities by ₹20.5 billion (~$234.27 million), strengthening the company’s balance sheet.

In September last year, Inox Wind Energy signed an agreement with a consortium of banks led by ICICI Bank for a financing facility of ₹22 billion (~$251.49 million). The consortium comprised ten banks, as well as several marquee private and foreign banks. The limit would likely be enhanced to ₹24 billion (~$274.27 million) as per ICICI Bank’s working capital assessment.