Global Energy Transition Investment Touched $2.4 Trillion in 2024

The investment, however, fell short of the required levels to align with the 1.5°C pathway

November 21, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Global investments in energy transition technologies reached a record high of $2.4 trillion in 2024, a 20% increase from the average annual levels of 2022/2023, according to the International Renewable Energy Agency’s (IRENA) ‘Global Landscape of Energy Transition Finance 2025’ report.

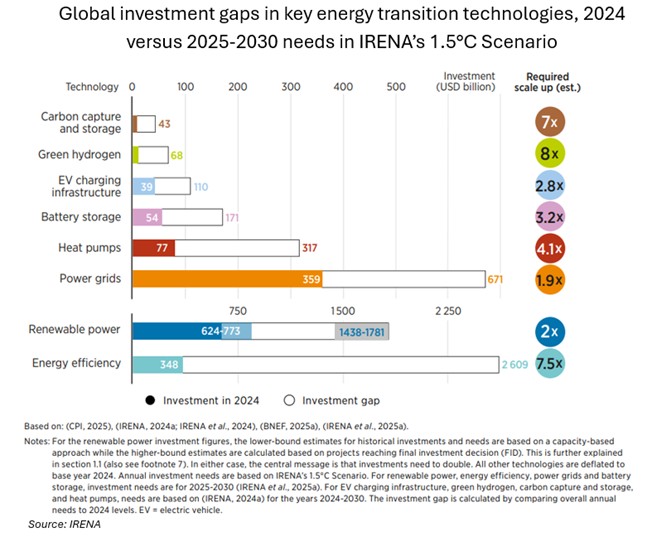

The annual investments in critical transitional technologies, however, remain short of the required levels to align with IRENA’s 1.5°C pathway.

Growth in relatively developed technologies, such as renewable energy, energy efficiency, grids, and electrified transport, continued in 2024. However, the growth occurred at a slower pace in earlier years.

Investment in nascent technologies, such as green hydrogen and carbon capture and storage, decreased in 2024.

In contrast, battery storage sustained significant growth during the year. The report stated that the investment share in renewable energy remained mostly consistent at 35% in 2024.

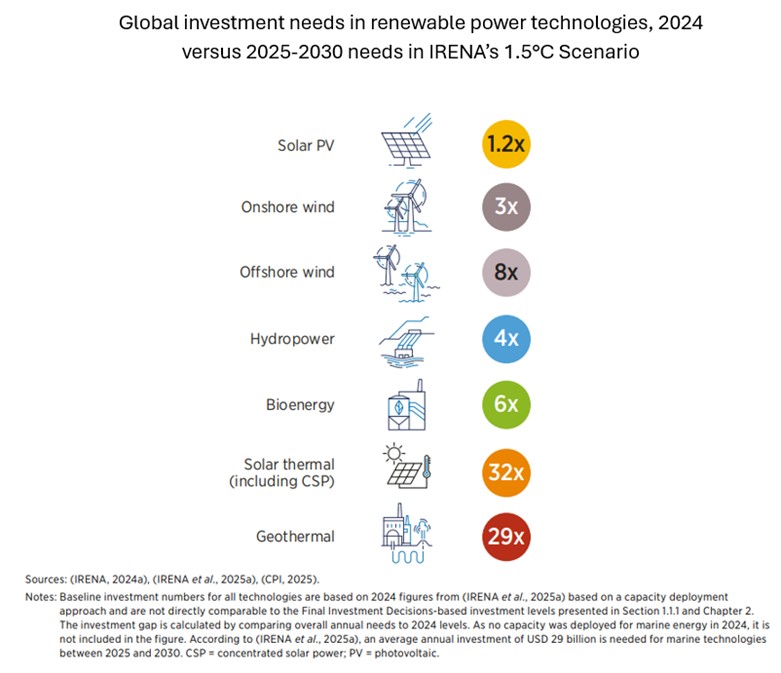

The IRENA report said solar is the only technology that has investment levels almost in line with IRENA’s 1.5°C scenario.

According to the report, the drivers and constraints faced by each technology are underpinned by investment distribution and investment amounts.

Critical technologies witnessed a significant disparity in investment distribution, with China and advanced economies being the primary hubs for innovation, deployment, and value creation. China and the advanced economies accounted for 90% of energy transition investment in 2024, contributing 44% and 46%, respectively.

The least developed countries (LDCs) accounted for less than 0.22% of energy transition investments and approximately 2.2% of renewable energy investments. A majority of these countries are in Sub-Saharan Africa.

Additionally, despite considerable recent progress, annual investments in critical transitional technologies remain short of the required levels to align with IRENA’s 1.5°C pathway.

According to IRENA, annual investments in renewable energy generation must nearly double from the current levels to reach its $1.4 trillion per year target between 2025 and 2030. A significant increase in investment in renewable energy is also required for end uses beyond power, such as heating and transport.

The energy efficiency segment requires the largest increase in investment, needing to grow by seven and a half times to reach the target of $2.6 trillion annually between 2025 and 2030.

Energy Transition Investments

The report stated that global renewable energy investments in 2024, calculated based on final investment decisions (FIDs), reached $807 billion, rising 22% from the annual average of 2022/2023.

Approximately 96% of these investments were in the power sector, reaching $773 billion. Projects such as heating and transport with direct renewable energy use received 1% of the investments, totaling $10 billion.

Current investment levels in renewable energy are roughly half of what is needed to triple power capacity to 11.2 TW by 2030.

Solar is the only technology that has investment levels almost in line with IRENA’s 1.5°C scenario. Solar’s rapid cost decline, as well as global widespread policy support, drove these investments over the previous decade.

Adoption of solar technologies in emerging markets and developing economies (EMDEs) was further driven by distributed systems, such as rooftop projects, as an alternative to grid-based power when it is unreliable, unavailable, or unaffordable.

Annual investments in concentrated solar power (CSP) need to scale up by 32 times from the current levels between 2025 and 2030.

IRENA stated that investments in onshore and offshore wind technology need to scale up by three and eight times, respectively, from the 2024 levels. Wind projects face challenges such as longer permitting processes, grid connection issues, and public resistance in some countries.

Investments in other renewable energy technologies, including marine energy, geothermal power, bioenergy, and hydropower, remain far below the required levels.

The installed renewable energy worldwide is expected to increase by 4,600 GW by 2030, according to the International Energy Agency’s ‘Medium-Term Forecast’ report.

Grid Investments

Power grid investments, including in transmission and distribution, rose 14% in 2024 compared to the 2022/2023 averages, reaching $359 billion.

Annual grid investments need to nearly double to reach $671 billion between 2025 and 2030, to support the integration of renewable energy and the adoption of technologies such as EVs and heat pumps, as was called for under the 1.5°C scenario.

Global spending on grids is projected to continue rising based on recently announced plans. However, most of these plans have been made in China, advanced economies such as Australia, the European Union, Japan, the Republic of Korea, and the U.S., and EMDEs such as India, Brazil, and Indonesia.

However, for many countries, particularly EMDEs and LDCs, the core financing hurdles stem from limited government and utility resources, as well as the inability to recover costs from consumers due to non-cost-reflective tariffs.

IRENA said the private sector may be increasing its share of grid investment in some economies recently. Countries such as India and Brazil are increasingly relying on the private sector to expand their grids.

In economies with grid investments, only 16% of the overall investment in 2024 was directed to new connections, 44% to replacing ageing assets, and the remaining 40% to grid reinforcements.

Over 1,650 GW of wind, solar, and hydro projects were awaiting grid connection in 2024, up from 1,500 GW in 2023. The capacity of queued projects in 2024 was five times the new capacity commissioned in 2022.

In 2023, 65% of global grid investments were financed through market-rate debt. This investment came directly from commercial financial institutions and corporations. Project-level equity accounted for 33% of the investments, and the remaining 2% was funded through grants.

Only one-quarter of global grid investment in 2023, totalling $86 billion, was directed to renewable energy generation.

Battery Storage

Global investment in energy storage reached $54 billion in 2024, increasing 73% from the average investment in 2022/2023, and over 11 times the 2019/2020. IRENA said annual investments would need to triple to align with a 1.5°C pathway.

Battery investment growth was underpinned by a 94% decline in costs between 2010 and 2024. This was driven by scale-up in manufacturing, improved material efficiency, and advancements in manufacturing processes.

China is the largest global battery manufacturer, making up 40% of the worldwide investments in this technology in 2024. It also installed the highest capacity at 84 GWh (36 GW), an 80% growth over 2023, and accounting for half of the global additions. Provincial subsidies, co-location mandates, and the domestic availability of battery technology supported this growth.

China has set a target to install over 180 GW of energy storage capacity by 2027, up from 95 GW as of June this year. The capacity addition will involve an investment of approximately RMB250 billion (~$35 billion).

The U.S. benefited from incentives under the Inflation Reduction Act in 2024, making it the second-largest battery storage investment destination during the year, accounting for 29% of the global total. It added 41 GWh (13 GW), nearly a quarter of the worldwide capacity.

Germany was the third-largest destination for investments, making up 11% of the global total.

Battery storage investments in developing nations such as Chile, India, South Africa, and the Philippines are growing, accounting for 3% of global investments.

Electric Mobility

In 2024, global investments in EVs, including battery EVs (BEVs), plug-in hybrid EVs, and fuel cell EVs, rose 33% from 2022/2023 to $763 billion.

The share of EVs in the worldwide car sales increased from 4.4% in 2022 to 22% in 2024. V charging investment grew by 27% in 2024, totaling $39 billion. Public charging received three-quarters of this investment. These chargers reached 5.6 million in number during the first quarter of 2025, increasing by 1.7 million from the end of 2023.

China, along with advanced economies, made up over 95% of the global BEV investment in 2024, remaining largely unchanged during the last five years. Its investment accounted for 49% of the global total.

China’s dominance stems from multiple state initiatives. It also installed 760,000 public fast chargers and one million public slow chargers, more than the rest of the world combined. China made up 60% of the global EV sales in 2022, as a result. It also extended its EV tax incentives in 2023.

Europe made up 23% of the global investment in BEVs in 2024, totaling $97 billion. Its share reduced slightly from 27% in 2022/2023. Growth in BEVs slowed compared to earlier, growing only by 6% since 2022/2023. The U.S. accounted for 19% of BEV investments in 2024, compared to 17% in 2022/2023. Investments rose 35% from $59 billion in 2022/2023 to $ 80 billion in 2024. This was supported by federal incentives, such as tax credits, and by multiple state-level programs. However, many of these investments have since been rolled back.

BEV investments in India and Australia rose by roughly 87% and 33%, respectively, between 2022/2023 and 2024. These investments totaled $8 billion and $4 billion, respectively.

EV Charging

Global governmental investment share in EV charging infrastructure reached 75% in 2024. The remainder was invested by private entities, of which three-quarters was from individuals and households. The remaining investment came from corporations.

Public investments in China with high-density urban living and limited home charger access accounted for 89% of the total EV charging infrastructure funding.

In contrast, in many Western markets, single-family housing enables greater home charging.

In Europe and the U.S., the public sector accounts for 60% and 62% of investments, respectively. U.S. public charging infrastructure investment grew by over 200% from 2022/2023 to 2024, from $1 billion to $3.3 billion. This was driven by programs such as the $5 billion National EV Infrastructure Program.

However, policy changes in early 2025 have disrupted the rollout of further funding by pausing disbursements.

Green Hydrogen

Investments in green hydrogen reduced for the first time in 2024 by 20% compared with 2023. This segment faces considerable economic, policy, and technological challenges. These include high production costs, uncertain demand, and limited transport and storage infrastructure. These hurdles expose projects to multiple risks that have materialised in many high-profile projects, leading to cancellations. Some projects reaching a final close are facing similar challenges.