Europe’s Solar Jobs Rise 5% YoY to 865,000: Report

The European solar market is in a phase of slower expansion and job growth

October 9, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

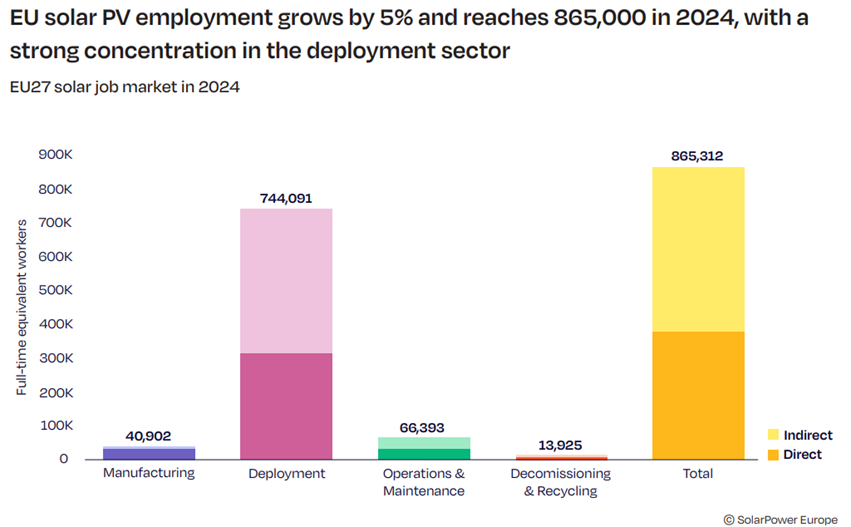

Full-time equivalent (FTE) employment in the European solar sector grew by 5% year-over-year (YoY) to 865,000 in 2024 from 826,000, according to SolarPower Europe’s EU Solar Jobs Report 2025 report. The job growth outperformed a previous forecast of 4.2%.

The report said the European Union’s (EU) job growth in the sector is mirroring market trends.

The solar sector added 65.1 GW of new capacity, achieving a new high and marking the fourth consecutive year of record-setting installations.

The pace of growth, however, reduced considerably compared to the additions in the previous three years, from between 31% and 51% to 3.3%. The report states that the reduction in solar installation growth occurred after the energy crisis triggered by surging electricity prices in 2022 and 2023.

Growth was primarily impacted by the rooftop solar segment, specifically in the residential sector. Households and small and medium enterprises across several major EU member states are delaying investments in new installations, responding to weakened policy support and electricity prices returning to the pre-crisis levels.

The cooling of installation expansion was therefore expected as energy markets stabilized and the temporary drivers fuelling the boom subsided.

Role Segmentation

SolarPower Europe states that direct jobs, such as those in manufacturing, project development, and installations, reached 377,000 FTEs or 44% of the total in 2024.

Indirect jobs, supporting a range of connected activities in the upstream or downstream sectors, comprised the remaining 488,000 FTEs or 66%.

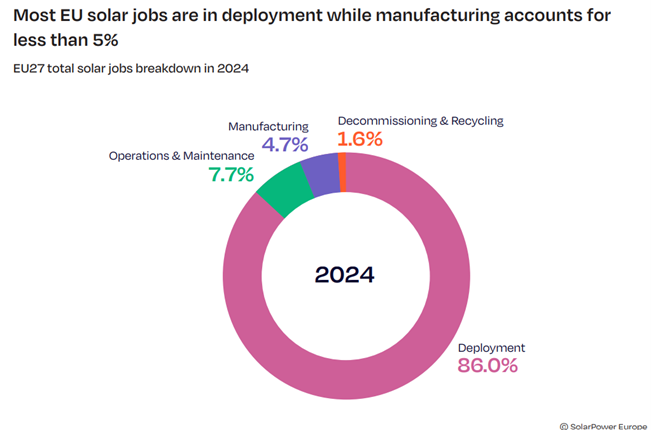

In 2024, solar deployment activities constitute 744,000 FTEs or 86% of the total, reducing slightly from 87% in the previous year. Operation and maintenance activities, which are gaining importance, created 66,000 FTEs or 8% of the total jobs.

The solar manufacturing segment contributed 41,000 FTEs, or 5% of the total. Jobs in this segment declined by 2,000 FTEs from 2023, following a drop of 5,000 FTEs from 2022. The report stated that international competition and supply chain uncertainties pose significant challenges for this segment.

According to SolarPower Europe, the still-emerging decommissioning and recycling segment, which provided approximately 14,000 FTEs, or 1.6% of the total, is a promising avenue for employment as the continent’s solar fleet matures.

It stated that a strong reliance on solar deployment makes the labor market vulnerable to oscillations in deployment volumes. These deployments need to be maintained in a stable and predictable manner through reliable and long-term-oriented policy frameworks.

Leading Performers

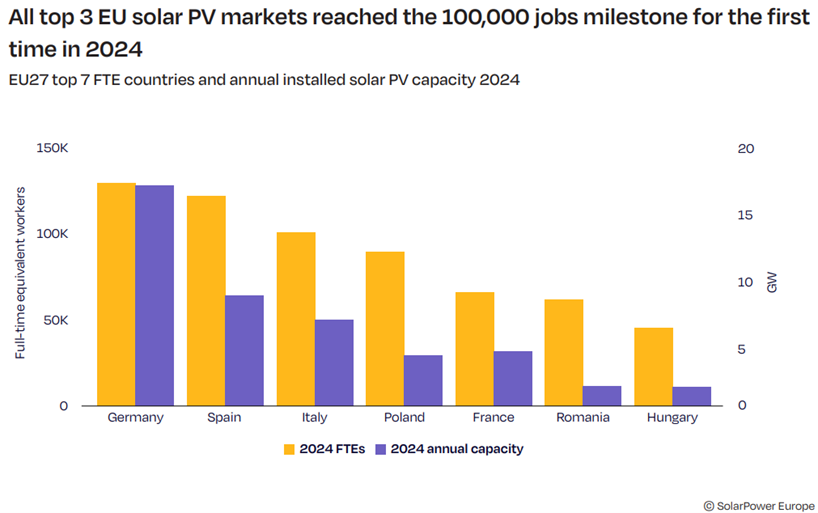

In 2024, Germany retained its lead in employment in the solar sector, accounting for approximately 128,000 direct and indirect FTEs. However, the country experienced a decrease from 154,000 FTEs in the preceding year, despite installations growing from 15.1 GW to 17.2 GW over this period.

A major reason for this development is the bulk of job manufacturing losses occurring in the country, despite Germany hosting the largest industry in this segment. Another reason is the increase in the share of utility-scale projects over the preceding year. Such projects need considerably less labor per MW compared to residential or commercial installations.

SolarPower Europe’s methodology for its employment model also affects Germany’s rankings. Under the methodology, the number of solar installations and the total cost per watt are taken together to calculate the labor cost. This is divided by local wage levels to determine the number of workers needed.

All else being equal, reducing the costs of building solar projects results in fewer jobs per MW. In Germany, the costs of large solar projects reduced by 36% from €0.86 (~$1)/W in 2023 to €0.55 (~$0.64)/W in 2024. This drop was surpassed only in Greece and the Netherlands.

This decline in costs is a key reason why Germany creates fewer jobs than some smaller countries, despite having a much larger market.

Spain created the second most jobs in solar, contributing 122,000 FTEs. It maintained strong employment levels despite a slight decline in installations of 0.9 GW. Utility-scale costs rose 27% YoY from €0.6 (~$0.7)/W to €0.76 (~$0.89)/W, the highest in the EU.

Italy, with more than 100,000 FTEs during the year, was third in the union. This increase mirrored the country’s solar deployment growth from 5.3 GW in 2023 to 6.8 GW in 2024.

Other leading countries included Poland, adding 90,000 FTEs, France, with 66,000 FTEs, Romania, with 62,000 FTEs, and Hungary, with 47,000 FTEs.

The report stated that the largest national solar markets were the primary sources of solar employment in the EU.

Employment Outlook

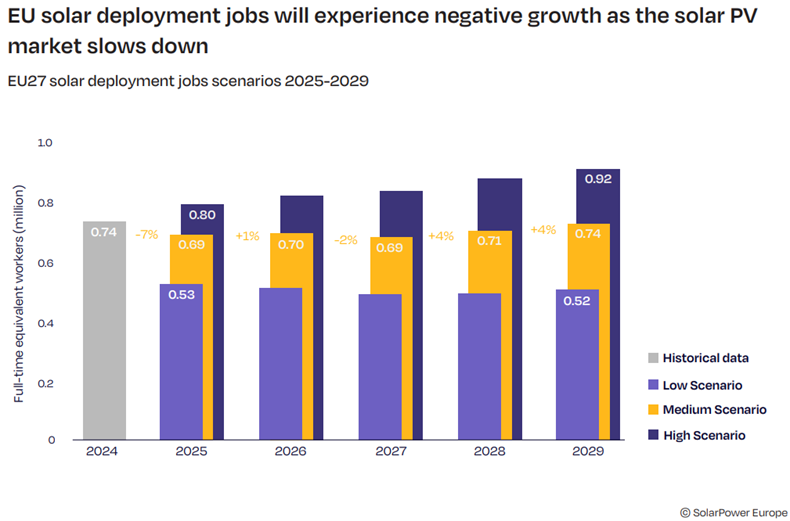

According to the report, a projected 1.4% decrease in installations in 2025 is expected to cause further momentum loss in solar employment creation, resulting in a reduction of 5% to 825,000 FTEs under its medium scenario.

However, the solar installations’ anticipated return to a positive growth rate towards 2029 is expected to help increase employment again to reach 916,000 FTEs in the medium scenario, and up to 1.1 million under the high scenario.

The report cautions that emerging headwinds temper the EU solar industry’s recent significant expansion and employment gains. These headwinds include a slowdown in residential solar, the scaling down of supportive policies, and issues with system flexibility. It said the sector’s ability to adapt to changing market conditions, innovate across the value chain, and secure the required financial and regulatory backing for sustainable growth will impact its continued success.

The European solar market is entering a phase of slower expansion, with growth rates of 3% in 2024, a decline of 1% in 2025, and a range of 4% to 9% in the following years, resulting in a weakening outlook for employment in the deployment segment.

This trend is expected to be reinforced by efficiency gains and learning curve effects, resulting in a reduction in the number of workers required for procurement, construction, and installation.

Going by these trends, deployment jobs are projected to drop to approximately 693,000 FTEs in 2025, decreasing 7% YoY.

Roles in this segmented are forecasted to further reduce to 686,000 FTEs in 2027, under the report’s medium scenario. These roles are expected to achieve a modest growth of approximately 4% in 2028 and 2029.

However, SolarPower Europe said employment in solar deployment could fall to 515,000 FTEs in the low scenario due to the segment’s sensitivity to market fluctuations. This drop would correspond to an annual solar market of 60.1 GW.

Conversely, jobs in the segment could rise to 919,000 FTEs in the high scenario, corresponding to 104 GW of new installations.

In its previous report, SolarPower Europe projected that the deployment segment would grow beyond the one million mark by 2028. This milestone is currently out of reach under the current market conditions.

Skill Shortage

SolarPower Europe stated that skill shortage in the solar sector across Europe remains a significant challenge that needs to be addressed. Companies on the continent report difficulties in hiring electricians, roofers, engineers, and manufacturing specialists with adequate skills. They also report a lack of funds to upskill and reskill their employees.

Technology is evolving quickly at the same time. This requires workers to adapt to new processes, tools, and digital systems.

To address these issues, the European Commission instituted a High-Level Skills Board, a European Skills Intelligence Observatory, and a Skills Portability Initiative. It also strengthened one of the European Skill Agenda’s flagship initiatives, Pact for Skills.

Additionally, the European Solar Academy, which Netherlands-based InnoEnergy launched under the EU’s NetZero Industry Act, aims to train 100,000 workers in the solar sector.

Job growth in clean energy sectors increased by 1.5 million in 2023, bringing total energy employment to 34.8 million jobs, according to the International Energy Agency’s World Energy Employment 2024 report.

Solar photovoltaic jobs constituted 7.1 million new jobs, representing 44% of the world’s total renewable energy workforce in 2023, according to a report by the International Renewable Energy Agency.